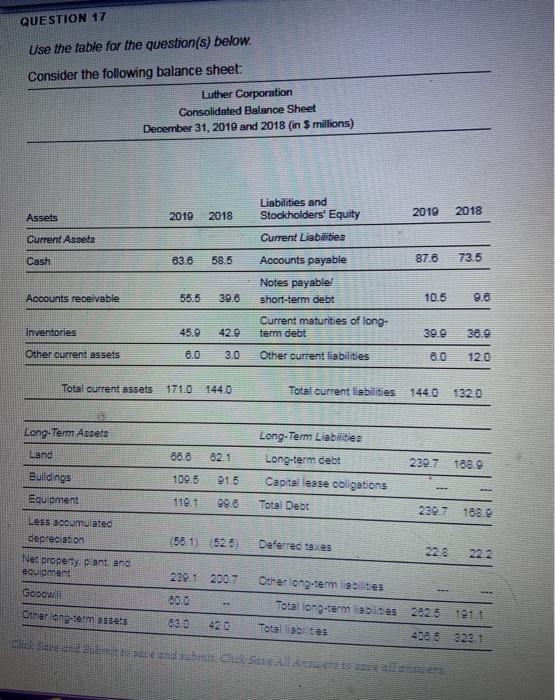

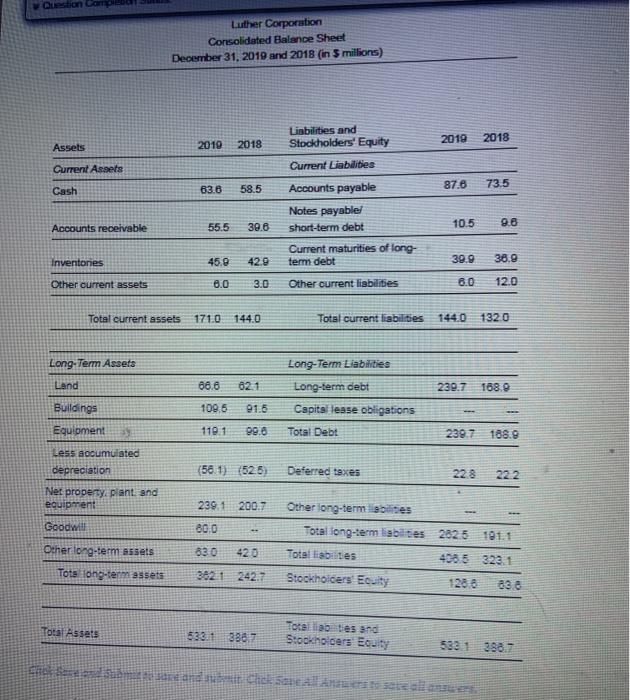

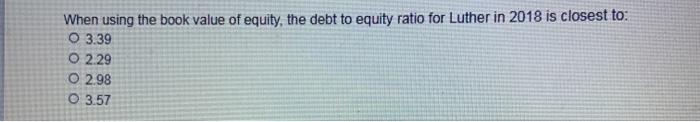

QUESTION 17 Use the table for the question(s) below. Consider the following balance sheet: Luther Corporation Consolidated Balance Sheet December 31, 2019 and 2018 (in 5 millions) Liabilities and Stockholders' Equity Assets 2018 2010 2018 2019 Current Assets Current Liabarbes Cash 83.6 58.5 87.6 73.5 Accounts receivable 55.5 30.6 Accounts payable Notes payable! short-term debt Current maturities of long- term debt 10.5 98 Inventories 45.9 42.0 39.9 38.9 Other current assets 6.0 3.0 Other current liabilities 6.0 12.0 Total current assets 171.0 144.0 Total current liabilities 144.0 1320 Long-Term Assets Land Long-Term Liabilities Long-term cebt 86.6 621 2307 188.0 109.5 015 Buildings Equipment Capital lease obligations 1191 99.6 Total Debt 239.7 188.0 Less socumulated depreciabon (581) 526 Deferred taxes 228 Ne property, pant and equipment 239.1 Beogw Other long-termites Total long-term labies 80.0 Other one 154 42.0 Totes 4083 and burchak Scene Question com Luther Corporation Consolidated Balance Sheet December 31, 2019 and 2018 (in 5 millions) 2019 2018 Assets 2019 2018 Liabilities and Stockholders' Equity Current Liabilities Current Assets 63.8 Cash 58.5 87.6 73.5 9.8 55.5 Accounts receivable Accounts payable Notes payable/ short-term debt Current maturities of long- term debt 39.8 10.5 Inventories 45.9 42.9 39.9 38.9 Other current assets 0.0 3.0 Other current liabilities 12.0 Total current assets 171.0 144.0 Total current liabilities 144.0 1320 Long-Term Assets Long-Term Liabilities Long-term debt Land 68.6 621 239.7 168.9 109,5 Capital lease obligations Buildings Equipment 110.1 99.0 Total Debt 239.7 188.9 Less accumulated depreciation (56 1) (526) Deferred taxes 228 22.2 Ner property, plant and equipment 2391 2007 Goodwill 800 Other long-term bilities Total long-term liabilities 2825 191.1 Total listes 408,5 323.1 Stockholders Edit 1288 838 Other long-term assets 830 420 Tots long-term assets 3621 242.7 Total Assets 388.7 Total 30 tes and Stockholders Eowy 5331 388.2 Chere are the beast When using the book value of equity, the debt to equity ratio for Luther in 2018 is closest to: O 3.39 O 2.29 O 2.98 O 3.57