Answered step by step

Verified Expert Solution

Question

1 Approved Answer

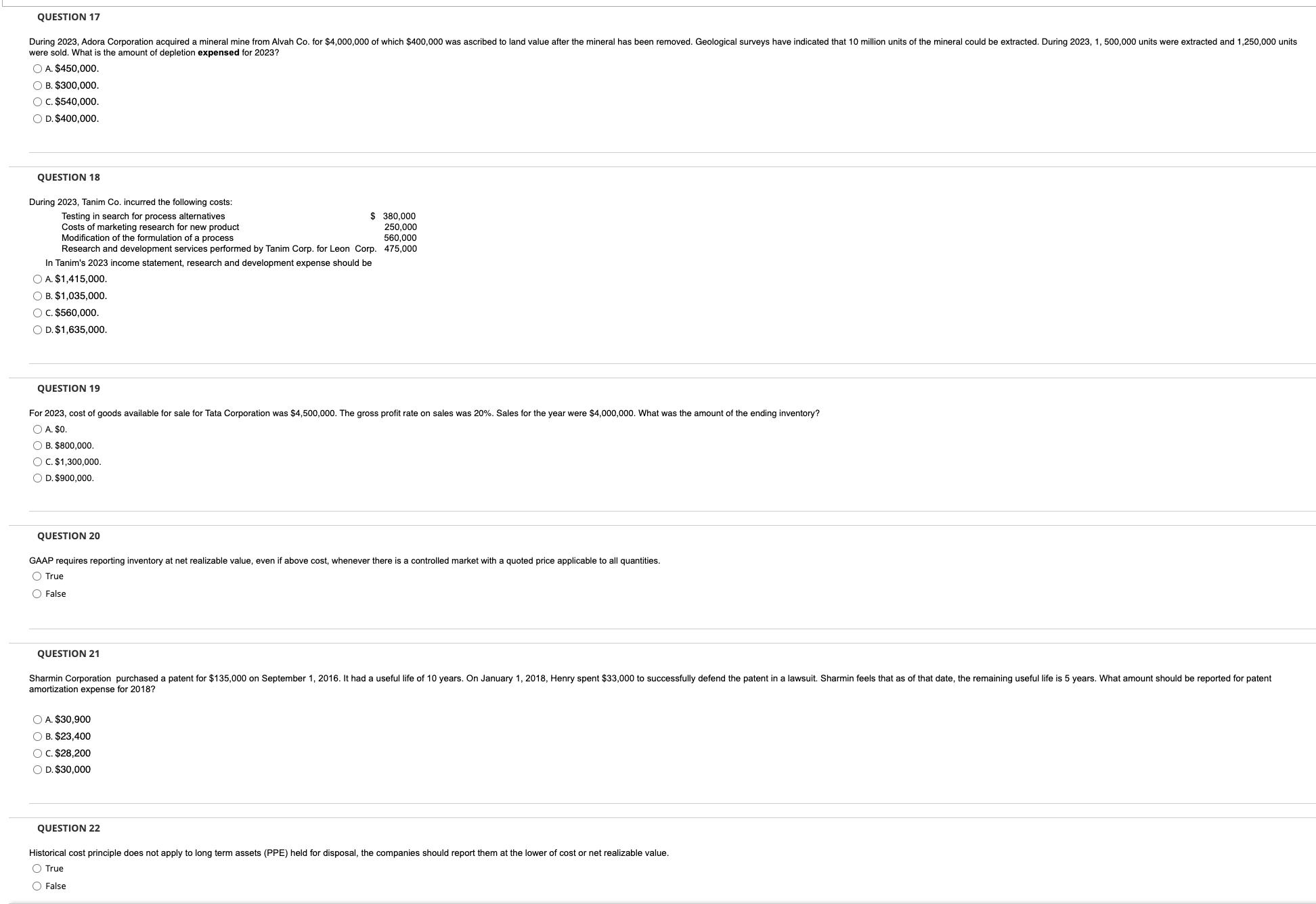

QUESTION 17 were sold. What is the amount of depletion expensed for 2023 ? A. $450,000. B. $300,000. C. $540,000. D. $400,000. QUESTION 18 During

QUESTION 17 were sold. What is the amount of depletion expensed for 2023 ? A. $450,000. B. $300,000. C. $540,000. D. $400,000. QUESTION 18 During 2023, Tanim Co. incurred the following costs: Testing in search for process alternatives Costs of marketing research for new product Modification of the formulation of a process 250,000 560,000 475,000 In Tanim's 2023 income statement, research and development expense should be A. $1,415,000. B. $1,035,000. C. $560,000. D. $1,635,000. QUESTION 19 A. $0. B. $800,000. C. $1,300,000 D. $900,000. QUESTION 20 GAAP requires reporting inventory at net realizable value, even if above cost, whenever there is a controlled market with a quoted price applicable to all quantities. True False QUESTION 21 amortization expense for 2018 ? A. $30,900 B. $23,400 C. $28,200 D. $30,000 QUESTION 22 Historical cost principle does not apply to long term assets (PPE) held for disposal, the companies should report them at the lower of cost or net realizable value. True False

QUESTION 17 were sold. What is the amount of depletion expensed for 2023 ? A. $450,000. B. $300,000. C. $540,000. D. $400,000. QUESTION 18 During 2023, Tanim Co. incurred the following costs: Testing in search for process alternatives Costs of marketing research for new product Modification of the formulation of a process 250,000 560,000 475,000 In Tanim's 2023 income statement, research and development expense should be A. $1,415,000. B. $1,035,000. C. $560,000. D. $1,635,000. QUESTION 19 A. $0. B. $800,000. C. $1,300,000 D. $900,000. QUESTION 20 GAAP requires reporting inventory at net realizable value, even if above cost, whenever there is a controlled market with a quoted price applicable to all quantities. True False QUESTION 21 amortization expense for 2018 ? A. $30,900 B. $23,400 C. $28,200 D. $30,000 QUESTION 22 Historical cost principle does not apply to long term assets (PPE) held for disposal, the companies should report them at the lower of cost or net realizable value. True False Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started