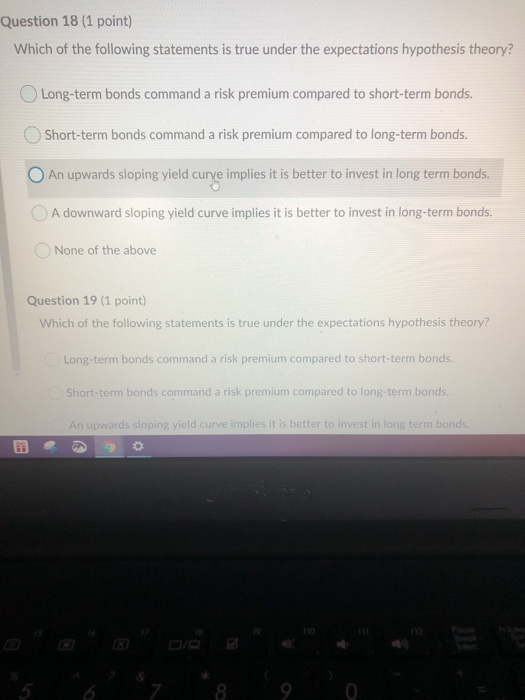

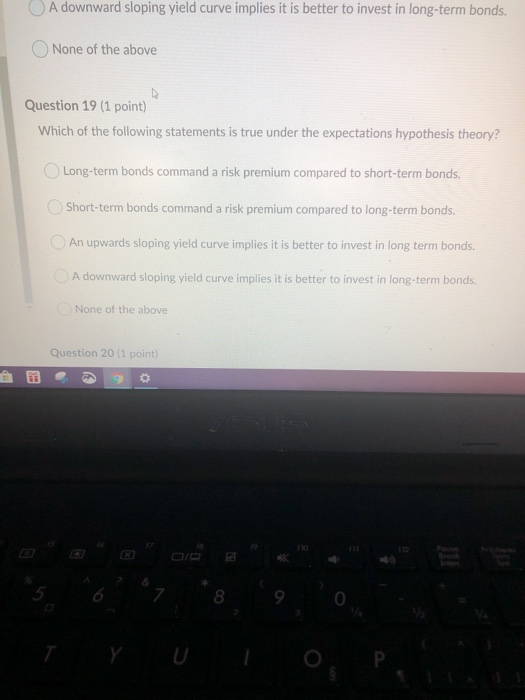

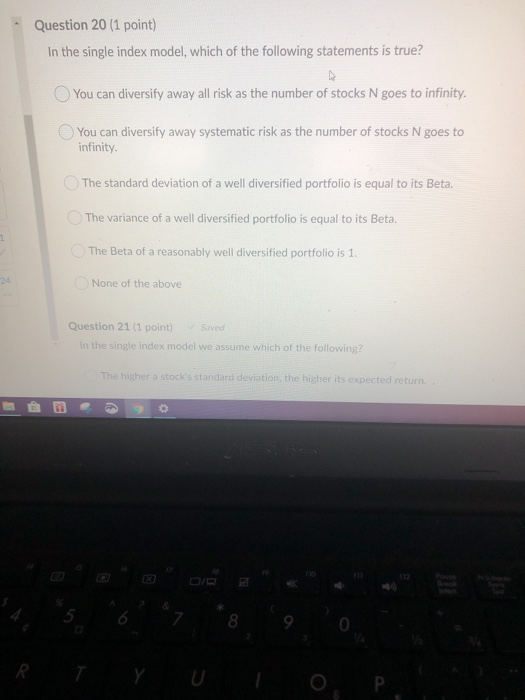

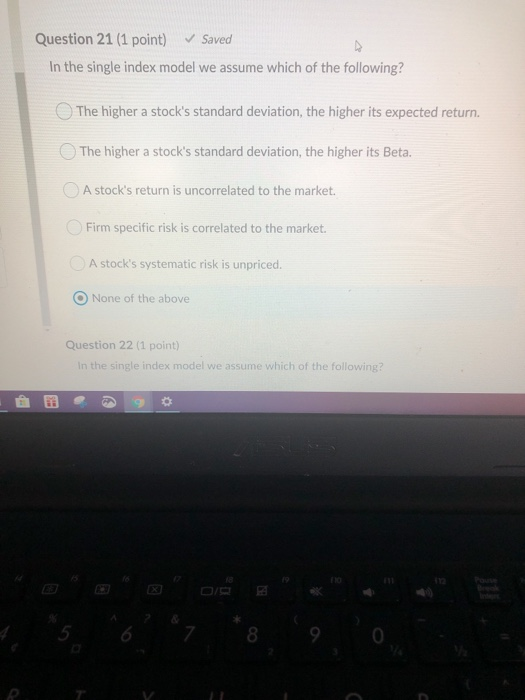

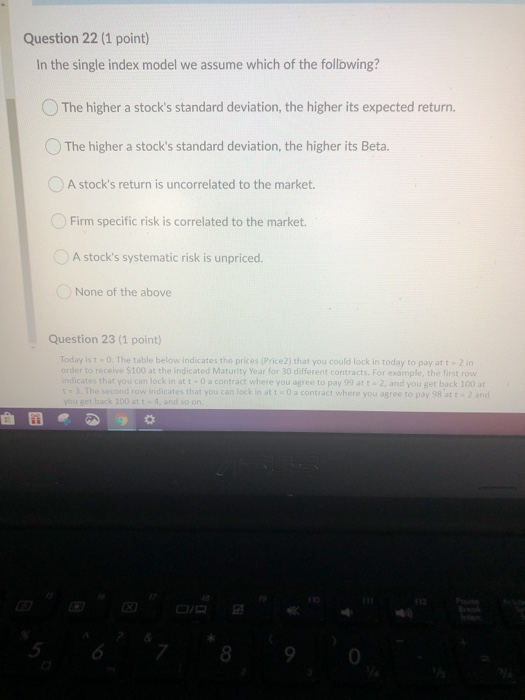

Question 18 (1 point) Which of the following statements is true under the expectations hypothesis theory? Long-term bonds command a risk premium compared to short-term bonds. Short-term bonds command a risk premium compared to long-term bonds. An upwards sloping yield curye implies it is better to invest in long term bonds. A downward sloping yield curve implies it is better to invest in long-term bonds. None of the above Question 19 (1 point) Which of the following statements is true under the expectations hypothesis theory? Long-term bonds command a risk premium compared to short-term bonds. Short-term bonds command a risk premium compared to long-term bonds. An upwards sloping yield curve implies it is better to invest in long term bonds. . 3 0 7 8 0 A downward sloping yield curve implies it is better to invest in long-term bonds. None of the above Question 19 (1 point) Which of the following statements is true under the expectations hypothesis theory? Long-term bonds command a risk premium compared to short-term bonds. Short-term bonds command a risk premium compared to long-term bonds. An upwards sloping yield curve implies it is better to invest in long term bonds. A downward sloping yield curve implies it is better to invest in long-term bonds. None of the above Question 20 (1 point) 8 P Question 20 (1 point) In the single index model, which of the following statements is true? You can diversify away all risk as the number of stocks N goes to infinity You can diversify away systematic risk as the number of stocks N goes to infinity The standard deviation of a well diversified portfolio is equal to its Beta, The variance of a well diversified portfolio is equal to its Beta. 1 The Beta of a reasonably well diversified portfolio is 1. None of the above Question 21 (1 point) In the single index model we assume which of the following? The higher a stock's standard deviation the higher its expected return 5 7 8 P Saved Question 21 (1 point) In the single index model we assume which of the following? The higher a stock's standard deviation, the higher its expected return. The higher a stock's standard deviation, the higher its Beta. A stock's return is uncorrelated to the market. Firm specific risk is correlated to the market. A stock's systematic risk is unpriced. None of the above Question 22 (1 point) In the single index model we assume which of the following? 5 8 Question 22 (1 point) In the single index model we assume which of the following? The higher a stock's standard deviation, the higher its expected return. The higher a stock's standard deviation, the higher its Beta. A stock's return is uncorrelated to the market. Firm specific risk is correlated to the market. A stock's systematic risk is unpriced. None of the above Question 23 (1 point) Today is t-0. The table below indicates the prices (Price2) that you could lock in today to pay att 2 in order to receive $100 at the indicated Maturity Year for 30 different contracts. For example, the first row Indicates that you can lock in atto a contract where you agree to pay 99 at t = 2, and you get back 100 at 13. The second row indicates that you can lock in atto a contract where you agree to pay 98 att and you get back 100 att 4, and so on P 9 9 8