Answered step by step

Verified Expert Solution

Question

1 Approved Answer

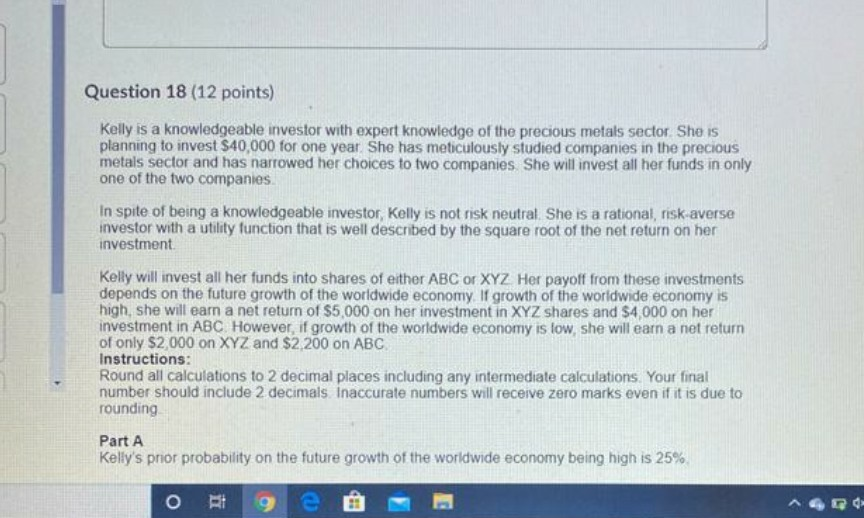

Question 18 (12 points) Kelly is a knowledgeable investor with expert knowledge of the precious metals sector. She is planning to invest $40,000 for one

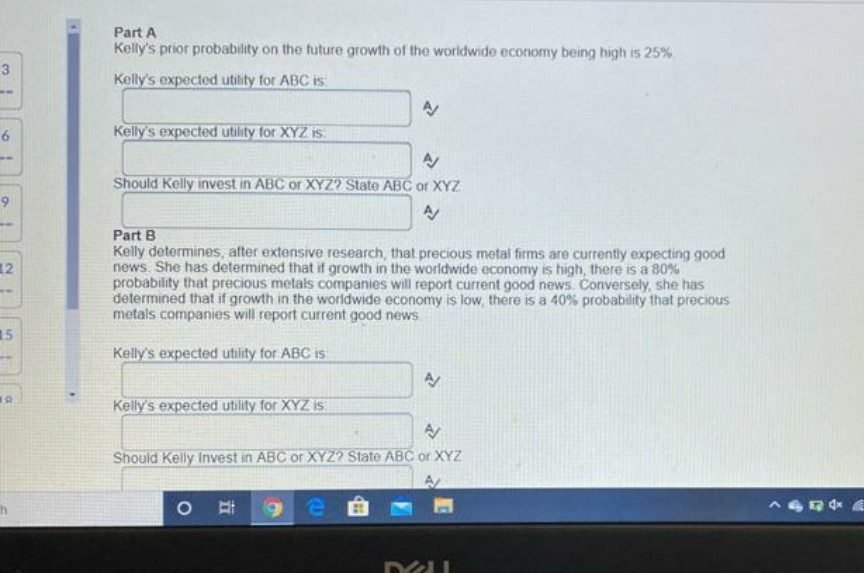

Question 18 (12 points) Kelly is a knowledgeable investor with expert knowledge of the precious metals sector. She is planning to invest $40,000 for one year She has meticulously studied companies in the precious metals sector and has narrowed her choices to two companies She will invest all her funds in only one of the two companies In spite of being a knowledgeable investor, Kelly is not risk neutral. She is a rational, risk-averse investor with a utility function that is well described by the square root of the net return on her investment Kelly will invest all her funds into shares of either ABC or XYZ Her payoff from these investments depends on the future growth of the worldwide economy. If growth of the worldwide economy is high, she will earn a net return of $5,000 on her investment in XYZ shares and $4,000 on her investment in ABC However, if growth of the worldwide economy is low, she will earn a net return of only $2,000 on XYZ and $2,200 on ABC Instructions: Round all calculations to 2 decimal places including any intermediate calculations. Your final number should include 2 decimals. Inaccurate numbers will receive zero marks even if it is due to rounding Part A Kelly's prior probability on the future growth of the worldwide economy being high is 25% o RE Part A Kelly's prior probability on the future growth of the worldwide economy being high is 25% Kelly's expected utility for ABC is 3 A 6 9 Kelly's expected utility for XYZ is A Should Kelly invest in ABC OR XYZ? State ABC or XYZ A/ Part B Kelly determines, after extensive research, that precious metal forms are currently expecting good news. She has determined that if growth in the worldwide economy is high, there is a 80% probability that precious metals companies will report current good news Conversely, she has determined that if growth in the worldwide economy is low there is a 40% probability that precious metals companies will report current good news 12 15 Kelly's expected utility for ABC is Kelly's expected utility for XYZ IS Should Kelly Invest in ABC or XYZ? State ABC or XYZ AZ e DI 6 Time Left:1:40:12 Sukhjinder kaur. CL: Attempt 1 A/ Kelly's expected utility for XYZ IS. A/ Should Kelly Invest in ABC or XYZ? State ABC or XYZ A/ Question 19 (6 points) On September 13, 2019, the shares of LMN fell $15.14 to $45 22 on the New York Stock Fxchange a decline of 12 49 The dolino follo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started