Answered step by step

Verified Expert Solution

Question

1 Approved Answer

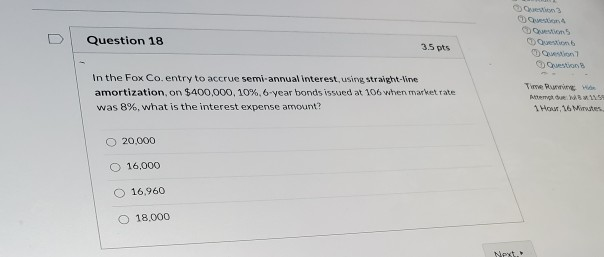

Question 18 3.5 pts Ob 1 Gestion In the Fox Co. entry to accrue semi-annualInterest, using straight-Vine amortization, on $400,000, 10%, 6-year bonds issued at

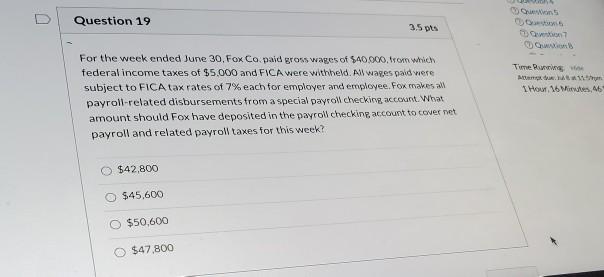

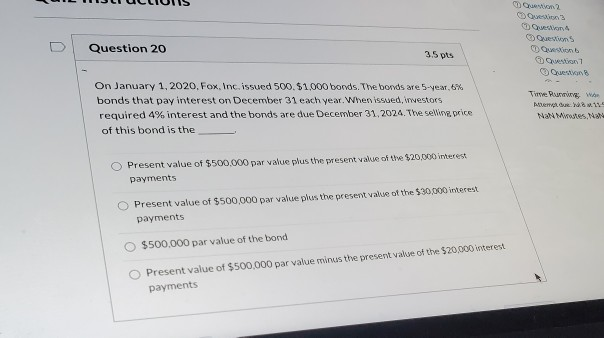

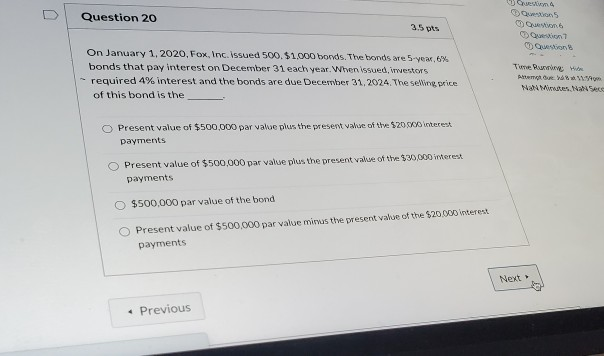

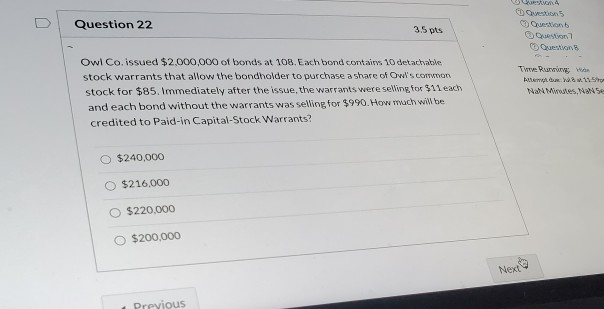

Question 18 3.5 pts Ob 1 Gestion In the Fox Co. entry to accrue semi-annualInterest, using straight-Vine amortization, on $400,000, 10%, 6-year bonds issued at 106 when market rate was 8%, what is the interest expense avont? Menu 1 Hour 16 Minutes O 20.000 16,000 16.960 O 18.000 Next Question 19 35 pts usons DO an Tun Running A125 1 Hout. 16 Murwes, For the week ended June 30, Fox Co. paid gross wages of $40.000, from which federal income taxes of $5.000 and FICA were withheld. All wages paid were subject to FICA tax rates of 7% each for employer and employee. Fox makes all payroll-related disbursements from a special payroll checking, account. What amount should Fox have deposited in the payroll checking account to cover net payroll and related payroll taxes for this week? $42,800 O $45,600 $50.600 $47.800 Oto 2 Ons von 4 Oms Dan on 1 westron Question 20 3.5 pts On January 1, 2020, Fox, Inc. issued 500.$1,000 bonds. The bonds are 5-year 6% bonds that pay interest on December 31 each year. When issued, westors required 4% interest and the bords are due December 31,2024. The selle price of this bond is the The Run Aben:981 Na Mwases, Present value of $500.000 par value plus the present value of the $20,000 interest payments O Present value of $500,000 par value plus the present value of the $30,000 interest payments $500.000 par value of the bond O Present value of $500,000 par value minus the present value of the $20,000 interest payments em U Question 20 3.5 pts Olen Questions On January 1, 2020, Fox, Inc. Issued 500.$1.000 bords. The bonds are 5-year 6% bonds that pay interest on December 31 each year. When issued, wwestors required 4% interest and the bonds are due December 31, 2024. The selling price of this bond is the Tune Range Am 12:19 Nes NASALE Present value of $500,000 par value plus the wesent value of the $20 interest payments O Present value of $500,000 par value plus the present value of the $30,000 interest payments O $500.000 par value of the bond Present value of $500.000 par value miras tive present value of the $20.000 interest payments Next Previous em Question 22 35 pts Ob Other 7 Question Owl Co. issued $2,000,000 of bonds at 108. Each bond contains 10 detachable stock warrants that allow the bondholder to purchase a share of Owl's.com stock for $85. Immediately after the issue, the warrants were selling for $11 each and each bond without the warrants was selling for $990. How twach will be credited to Paid-in Capital-Stock Warrants? Twee Run W. Stro Na Mwostes. No se O $240,000 O $216,000 O $220.000 0 $200,000 Next Previous

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started