Question 19 a. The current yield curve for risk-free zero-coupon bonds is given below: Years to maturity Interest rate (%, p.a) 1 2 3

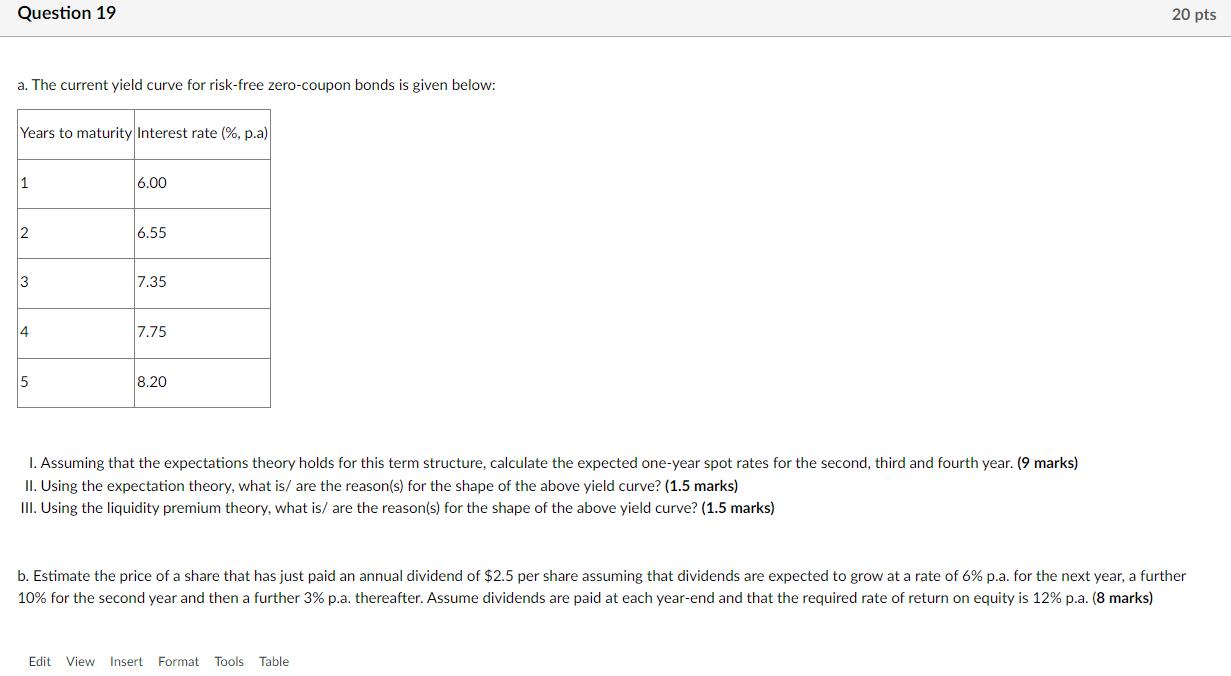

Question 19 a. The current yield curve for risk-free zero-coupon bonds is given below: Years to maturity Interest rate (%, p.a) 1 2 3 4 5 6.00 6.55 7.35 7.75 8.20 1. Assuming that the expectations theory holds for this term structure, calculate the expected one-year spot rates for the second, third and fourth year. (9 marks) II. Using the expectation theory, what is/are the reason(s) for the shape of the above yield curve? (1.5 marks) III. Using the liquidity premium theory, what is/ are the reason(s) for the shape of the above yield curve? (1.5 marks) 20 pts b. Estimate the price of a share that has just paid an annual dividend of $2.5 per share assuming that dividends are expected to grow at a rate of 6% p.a. for the next year, a further 10% for the second year and then a further 3% p.a. thereafter. Assume dividends are paid at each year-end and that the required rate of return on equity is 12% p.a. (8 marks) Edit View Insert Format Tools Format Tools Table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a 1 To calculate the expected oneyear spot rates using the expectations theory we can use the formul...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started