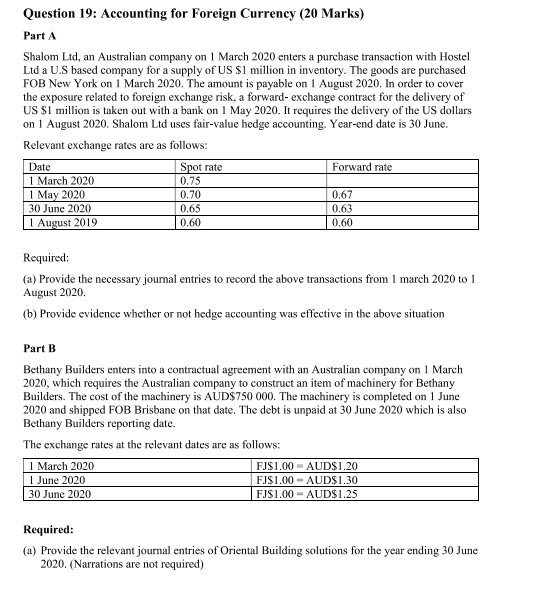

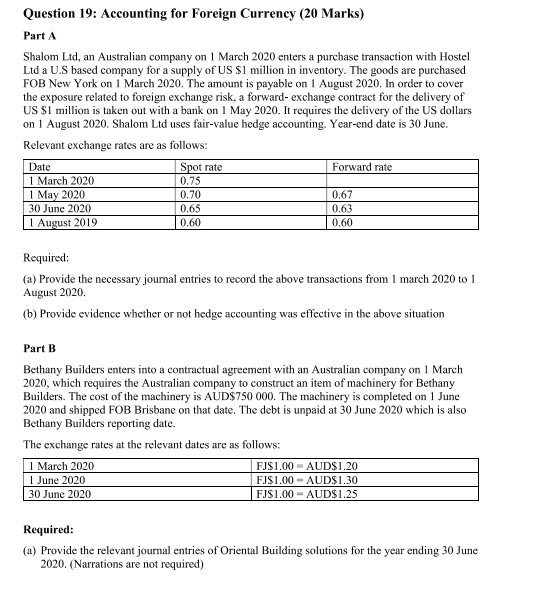

Question 19: Accounting for Foreign Currency (20 Marks) Part A Shalom Ltd, an Australian company on 1 March 2020 enters a purchase transaction with Hostel Ltd a U.S based company for a supply of US $1 million in inventory. The goods are purchased FOB New York on 1 March 2020. The amount is payable on 1 August 2020. In order to cover the exposure related to foreign exchange risk, a forward- exchange contract for the delivery of US $1 million is taken out with a bank on 1 May 2020. It requires the delivery of the US dollars on 1 August 2020. Shalom Ltd uses fair-value hedge accounting. Year-end date is 30 June. Relevant exchange rates are as follows: Spot rate Forward rate 1 March 2020 0.75 1 May 2020 0.67 30 June 2020 0.65 0.63 1 August 2019 0.60 Date 0.70 0.60 Required: (a) Provide the necessary journal entries to record the above transactions from 1 march 2020 to 1 August 2020 (b) Provide evidence whether or not hedge accounting was effective in the above situation Part B Bethany Builders enters into a contractual agreement with an Australian company on 1 March 2020, which requires the Australian company to construct an item of machinery for Bethany Builders. The cost of the machinery is AUD$750 000. The machinery is completed on 1 June 2020 and shipped FOB Brisbane on that date. The debt is unpaid at 30 June 2020 which is also Bethany Builders reporting date. The exchange rates at the relevant dates are as follows: 1 March 2020 FJ$1.00 - AUD$ 1.20 1 June 2020 FJ$1.00 - AUD$1.30 30 June 2020 FJ$1.00 - AUD$1.25 Required: (a) Provide the relevant journal entries of Oriental Building solutions for the year ending 30 June 2020. (Narrations are not required) Question 19: Accounting for Foreign Currency (20 Marks) Part A Shalom Ltd, an Australian company on 1 March 2020 enters a purchase transaction with Hostel Ltd a U.S based company for a supply of US $1 million in inventory. The goods are purchased FOB New York on 1 March 2020. The amount is payable on 1 August 2020. In order to cover the exposure related to foreign exchange risk, a forward- exchange contract for the delivery of US $1 million is taken out with a bank on 1 May 2020. It requires the delivery of the US dollars on 1 August 2020. Shalom Ltd uses fair-value hedge accounting. Year-end date is 30 June. Relevant exchange rates are as follows: Spot rate Forward rate 1 March 2020 0.75 1 May 2020 0.67 30 June 2020 0.65 0.63 1 August 2019 0.60 Date 0.70 0.60 Required: (a) Provide the necessary journal entries to record the above transactions from 1 march 2020 to 1 August 2020 (b) Provide evidence whether or not hedge accounting was effective in the above situation Part B Bethany Builders enters into a contractual agreement with an Australian company on 1 March 2020, which requires the Australian company to construct an item of machinery for Bethany Builders. The cost of the machinery is AUD$750 000. The machinery is completed on 1 June 2020 and shipped FOB Brisbane on that date. The debt is unpaid at 30 June 2020 which is also Bethany Builders reporting date. The exchange rates at the relevant dates are as follows: 1 March 2020 FJ$1.00 - AUD$ 1.20 1 June 2020 FJ$1.00 - AUD$1.30 30 June 2020 FJ$1.00 - AUD$1.25 Required: (a) Provide the relevant journal entries of Oriental Building solutions for the year ending 30 June 2020. (Narrations are not required)