Answered step by step

Verified Expert Solution

Question

1 Approved Answer

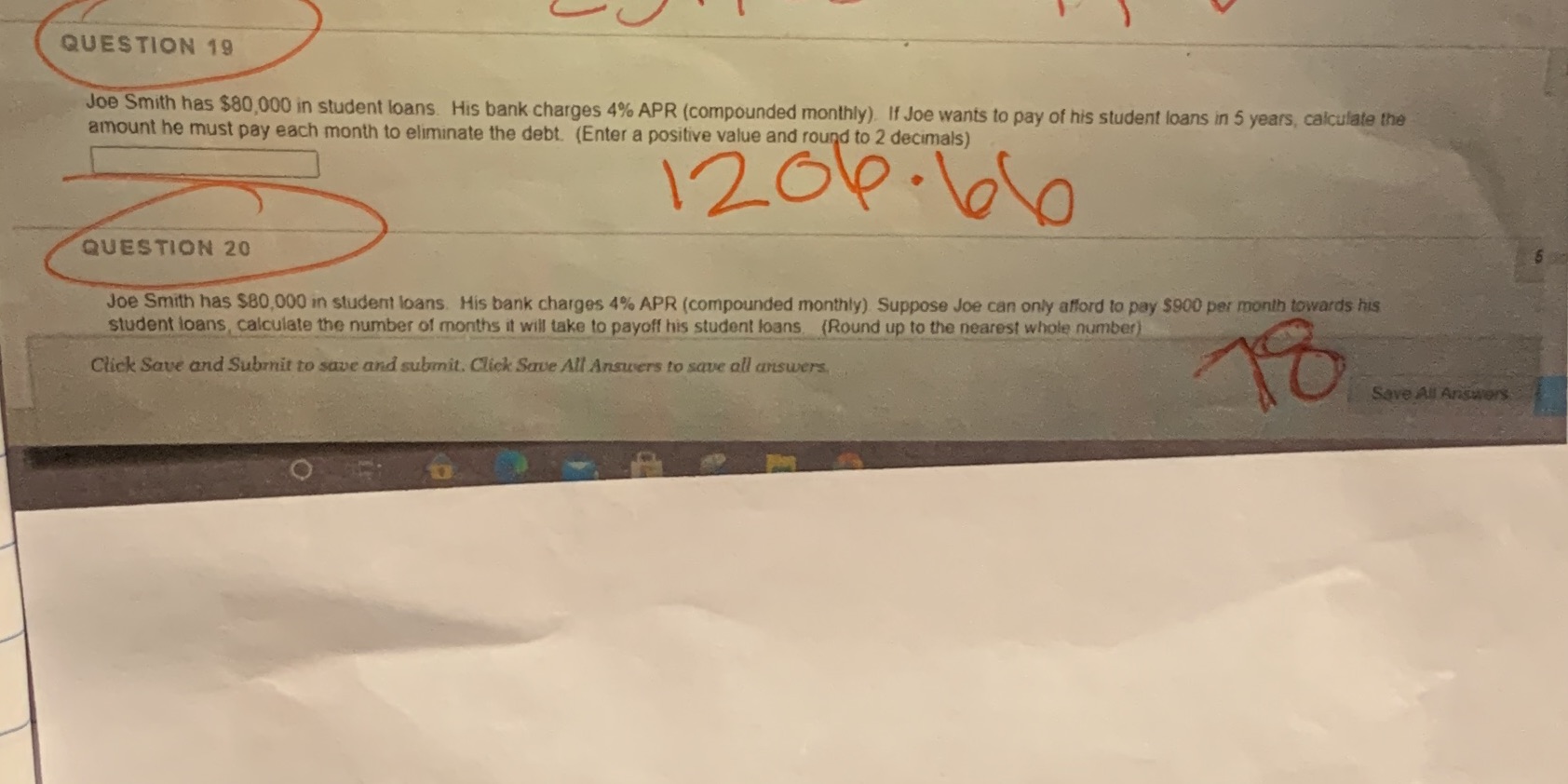

QUESTION 19 Joe Smith has $80,000 in student loans. His bank charges 4% APR (compounded monthly). If Joe wants to pay of his student

QUESTION 19 Joe Smith has $80,000 in student loans. His bank charges 4% APR (compounded monthly). If Joe wants to pay of his student loans in 5 years, calculate the amount he must pay each month to eliminate the debt. (Enter a positive value and round to 2 decimals) 1206.66 QUESTION 20 Joe Smith has $80,000 in student loans. His bank charges 4% APR (compounded monthly). Suppose Joe can only afford to pay $900 per month towards his student loans, calculate the number of months it will take to payoff his student loans (Round up to the nearest whole number) Click Save and Submit to save and submit. Click Save All Answers to save all answers. 18 Save All Answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

CertainlyI can help you with those student loan calculations Question 19 Monthly Payment to Payoff i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started