Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1c [15 Marks] Suppose a borrower knows at time t = 0 that it will have available at time t = 1 an

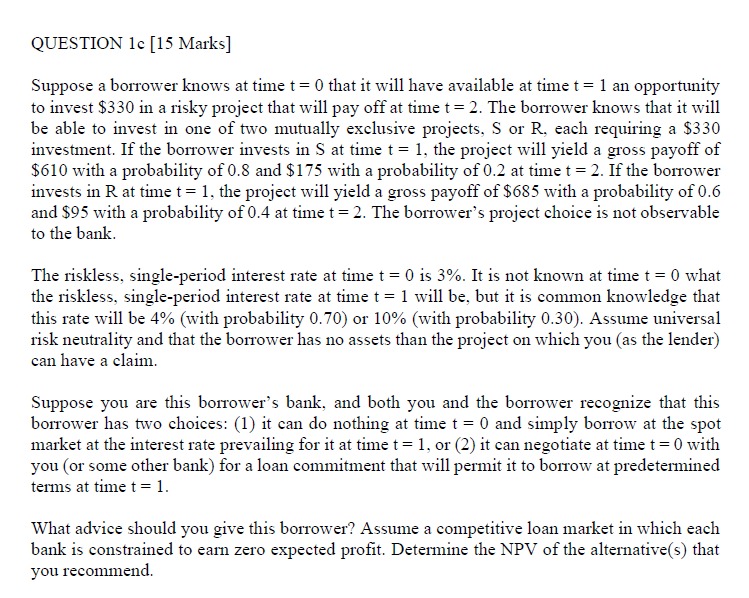

QUESTION 1c [15 Marks] Suppose a borrower knows at time t = 0 that it will have available at time t = 1 an opportunity to invest $330 in a risky project that will pay off at time t = 2. The borrower knows that it will be able to invest in one of two mutually exclusive projects, S or R, each requiring a $330 investment. If the borrower invests in S at time t = 1, the project will yield a gross payoff of $610 with a probability of 0.8 and $175 with a probability of 0.2 at time t = 2. If the borrower invests in R at time t = 1, the project will yield a gross payoff of $685 with a probability of 0.6 and $95 with a probability of 0.4 at time t = 2. The borrower's project choice is not observable to the bank. The riskless, single-period interest rate at time t = 0 is 3%. It is not known at time t = 0 what the riskless, single-period interest rate at time t = 1 will be, but it is common knowledge that this rate will be 4% (with probability 0.70) or 10% (with probability 0.30). Assume universal risk neutrality and that the borrower has no assets than the project on which you (as the lender) can have a claim. Suppose you are this borrower's bank, and both you and the borrower recognize that this borrower has two choices: (1) it can do nothing at time t = 0 and simply borrow at the spot market at the interest rate prevailing for it at time t = 1, or (2) it can negotiate at time t = 0 with you (or some other bank) for a loan commitment that will permit it to borrow at predetermined terms at time t = 1. What advice should you give this borrower? Assume a competitive loan market in which each bank is constrained to earn zero expected profit. Determine the NPV of the alternative(s) that you recommend.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started