Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1c 2018: c) d) Assume that the current date is 10 January 2018. Calculate the accrued interest for the cheapest-to-deliver note in the table

Question 1c 2018:

c)

d) Assume that the current date is 10 January 2018. Calculate the accrued interest for the cheapest-to-deliver note in the table in part (c), which pays interest semi-annually on 15 April and 15 October. Show your workings.

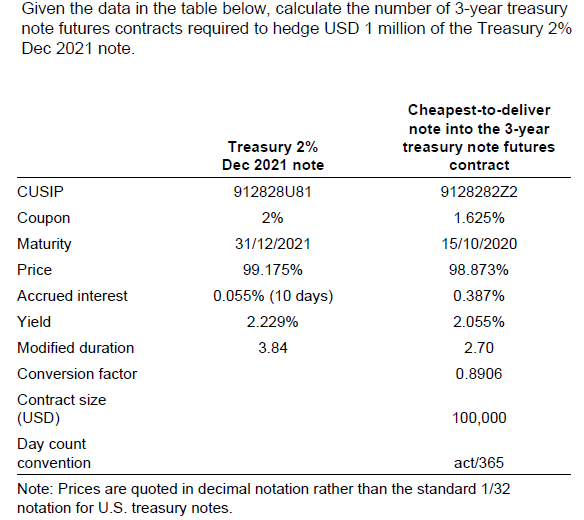

Given the data in the table below, calculate the number of 3-year treasury note futures contracts required to hedge USD 1 million of the Treasury 2% Dec 2021 note. Cheapest-to-deliver note into the 3-year Treasury 2% treasury note futures Dec 2021 note contract CUSIP 912828U81 912828222 Coupon 2% 1.625% Maturity 31/12/2021 15/10/2020 Price 99.175% 98.873% Accrued interest 0.055% (10 days) 0.387% Yield 2.229% 2.055% Modified duration 3.84 2.70 Conversion factor 0.8906 Contract size (USD) 100,000 Day count convention act/365 Note: Prices are quoted in decimal notation rather than the standard 1/32 notation for U.S. treasury notesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started