Question

Question 1Vanda Capital is an investment fund with an AUM of $500m. Its current portfolio is expected to yield an 8% return and has a

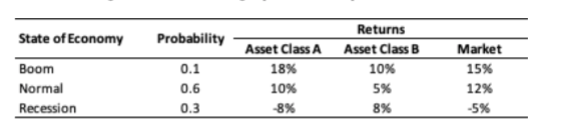

Question 1Vanda Capital is an investment fund with an AUM of $500m. Its current portfolio is expected to yield an 8% return and has a beta of 1.20. The fund is considering changing its portfolio composition to be composed of two asset classes and has generated the following capital market expectations:

The risk-free rate is 2%.The chief investment officer of Vanda Capital proposes a new portfolio that invests $300m in Asset Class A and the rest of the investable funds in Asset Class B.You have been tasked to assess the risk-return tradeoff of the proposed portfolio using the Treynor measure and, hence, recommend whether Vanda Capital should make the change.To make the assessment, you are to take the following steps:

(a)Calculate the proposed portfolio return for each state of the economy and, hence, the expected portfolio return.

(b)Calculate the covariance between the proposed portfolio returns and the market portfolio returns.

(c) Using your result from part (b), calculate the beta of the proposed portfolio. You cannot assume that the Capital Asset Pricing Model holds true.

State of Economy Boom Normal Recession Probability 0.1 0.6 0.3 Asset Class A 18% 10% -8% Returns Asset Class B 10% 5% 8% Market 15% 12% -5%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started