Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 0 of 1 0 0 . The maximum a 4 8 - year - old taxpayer with $ 5 , 0 0 0

Question of

The maximum a yearold taxpayer with $ in wages is allowed to contribute to a traditional IRA in is

$

$

$

$

Mark for follow up

Question of

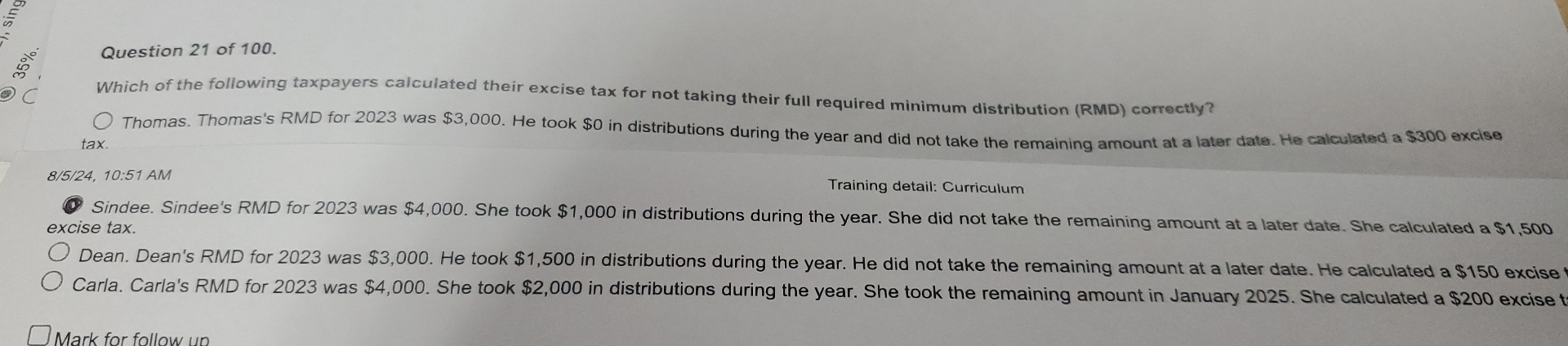

Which of the following taxpayers calculated their excise tax for not taking their full required minimum distribution RMD correctly? tax. Thomas. Thomas's RMD for was $ He took $ in distributions during the year and did not take the remaining amount at a later date. He calculated a $ excise

: AM

Training detail: Curriculum

Sindee. Sindee's RMD for was $ She took $ in distributions during the year. She did not take the remaining amount at a later date. She calculated a $ excise tax.

Dean. Dean's RMD for was $ He took $ in distributions during the year. He did not take the remaining amount at a later date. He calculated a $ excise Carla. Carla's RMD for was $ She took $ in distributions during the year. She took the remaining amount in January She calculated a $ excise

Mark for follow un

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started