Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 0 Simple Tech Inc is an Australian company operating in a pure imputation tax system. It is currently financed entirely ( 1 0

Question

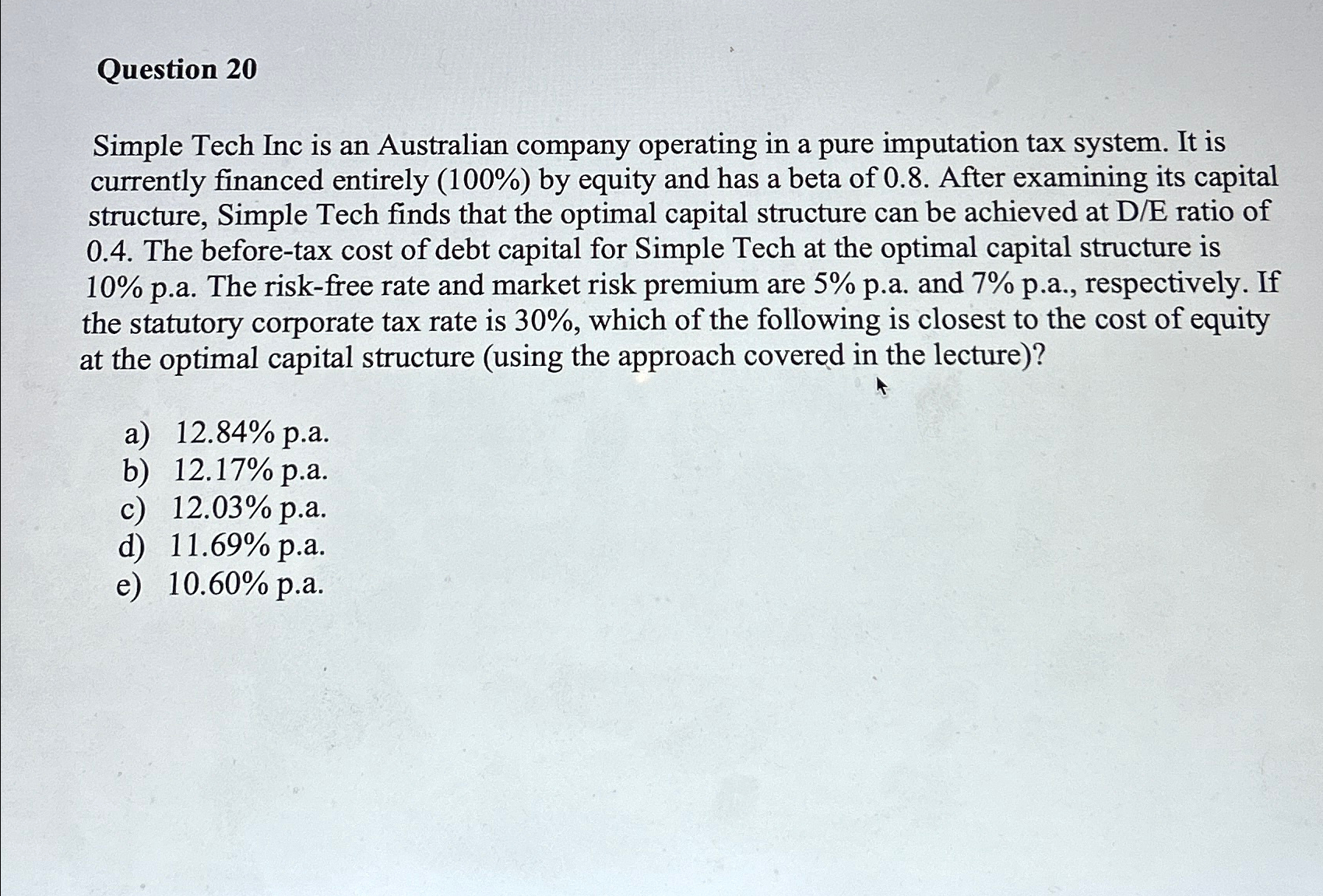

Simple Tech Inc is an Australian company operating in a pure imputation tax system. It is currently financed entirely by equity and has a beta of After examining its capital structure, Simple Tech finds that the optimal capital structure can be achieved at DE ratio of The beforetax cost of debt capital for Simple Tech at the optimal capital structure is pa The riskfree rate and market risk premium are pa and pa respectively. If the statutory corporate tax rate is which of the following is closest to the cost of equity at the optimal capital structure using the approach covered in the lecture

a pa

b pa

c pa

d pa

e pa

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started