Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 [ 1 0 MARKS ] Danny Zuma operates a security business in Inanda, Kwazulu - Natal. He seeks advice on whether the following

QUESTION

MARKS

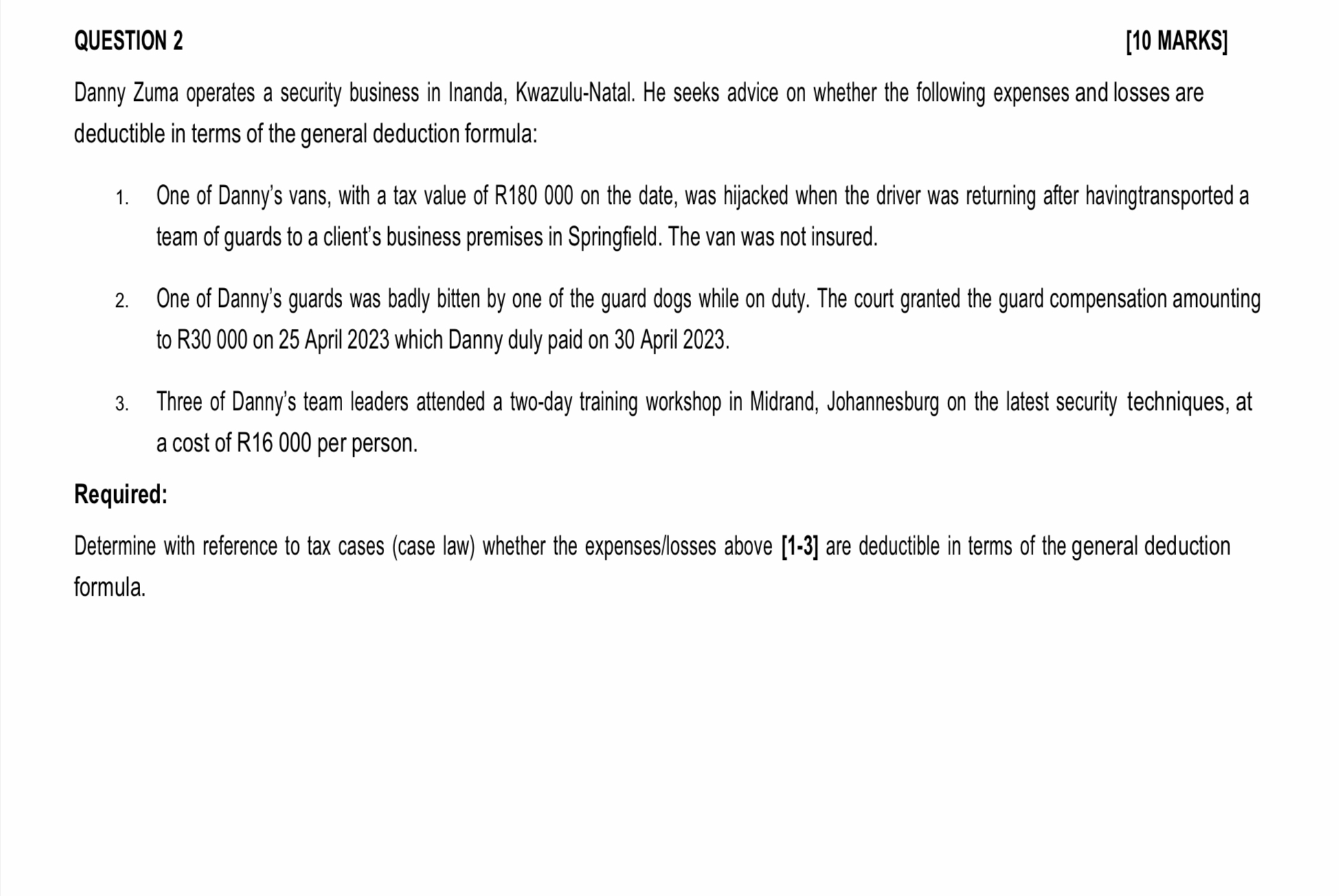

Danny Zuma operates a security business in Inanda, KwazuluNatal. He seeks advice on whether the following expenses and losses are deductible in terms of the general deduction formula:

One of Danny's vans, with a tax value of R on the date, was hijacked when the driver was returning after havingtransported a team of guards to a client's business premises in Springfield. The van was not insured.

One of Danny's guards was badly bitten by one of the guard dogs while on duty. The court granted the guard compensation amounting to R on April which Danny duly paid on April

Three of Danny's team leaders attended a twoday training workshop in Midrand, Johannesburg on the latest security techniques, at a cost of R per person.

Required:

Determine with reference to tax cases case law whether the expensesllosses above are deductible in terms of the general deduction formula.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started