Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 1 5 0 pts PROBLEM 1 . ( 2 5 points ) Gryffindor Corporation has 1 0 0 , 0 0 0 shares

Question

pts

PROBLEM points

Gryffindor Corporation has shares of $ par common stock outstanding as of the beginning of Prepare the journal entries for the following transactions for Indicate No Entry" if no journal entry is necessary.

May

Issued additional shares of $ par value common stock for $ per share.

May Repurchased shares of treasury stock for $ per share.

July

Declared a cash dividend of $ per share to all stockholders of record on July

July

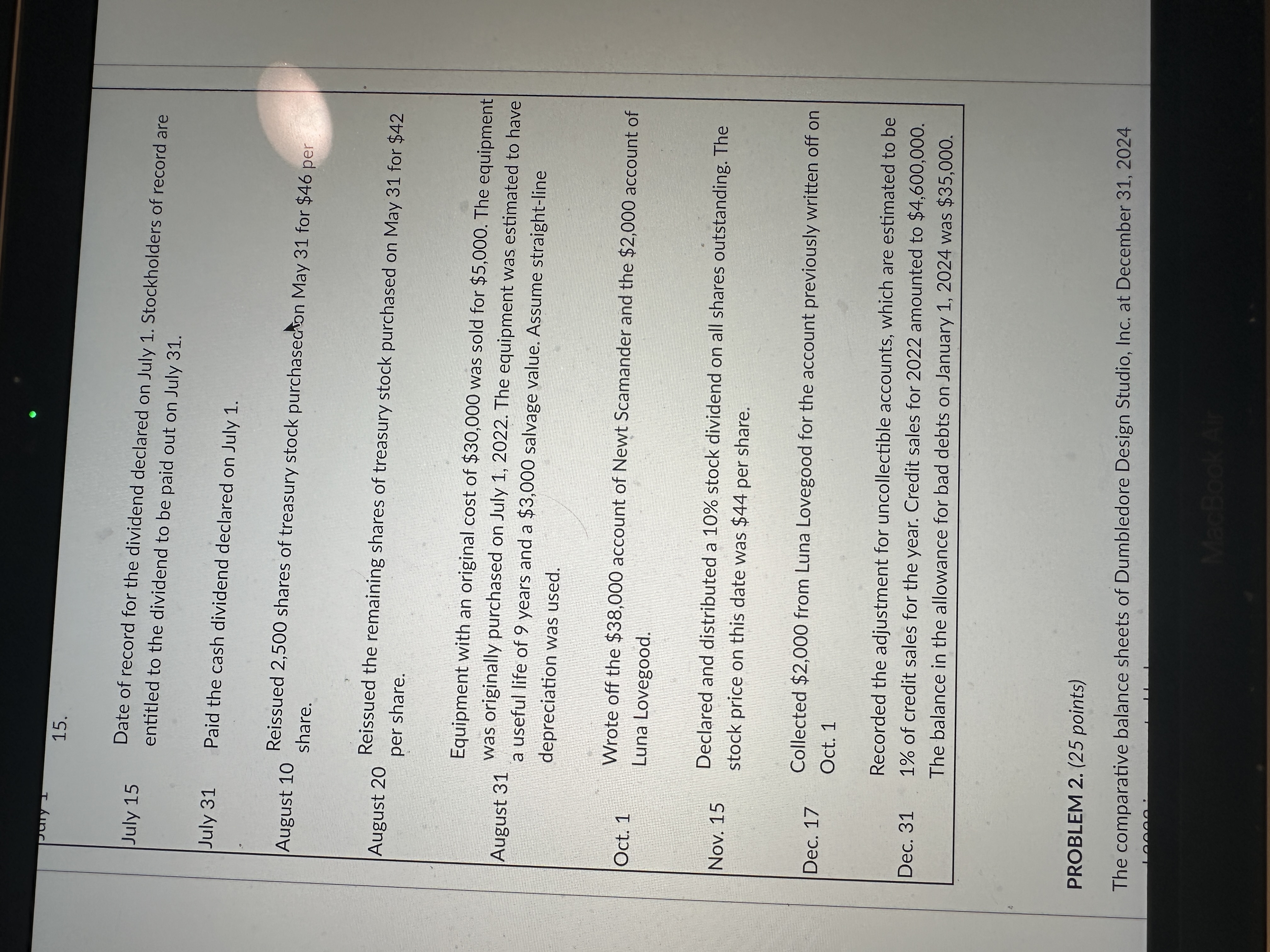

Date of record for the dividend declared on July Stockholders of record are entitled to the dividend to be paid out on July

July Paid the cash dividend declared on July

August

Reissued shares of treasury stock purchased on May for $ per share.

August

Reissued the remaining shares of treasury stock purchased on May for $ per share.

Equipment with an original cost of $ was sold for $ The equipment

August was originally purchased on July The equipment was estimated to have a useful life of years and a $ salvage value. Assume straightline depreciation was used.

Oct.

Wrote off the $ account of Newt Scamander and the $ account of Luna Lovegoo

July

Date of record for the dividend declared on July Stockholders of record are entitled to the dividend to be paid out on July

July Paid the cash dividend declared on July

August

Reissued shares of treasury stock purchasection May for $ per share.

August

Reissued the remaining shares of treasury stock purchased on May for $ per share.

Equipment with an original cost of $ was sold for $ The equipment

August was originally purchased on July The equipment was estimated to have a useful life of years and a $ salvage value. Assume straightline depreciation was used.

Oct.

Wrote off the $ account of Newt Scamander and the $ account of Luna Lovegood.

Nov.

Declared and distributed a stock dividend on all shares outstanding. The stock price on this date was $ per share.

Dec.

Collected $ from Luna Lovegood for the account previously written off on Oct.

Recorded the adjustment for uncollectible accounts, which are estimated to be Dec. of credit sales for the year. Credit sales for amounted to $ The balance in the allowance for bad debts on January was $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started