Question

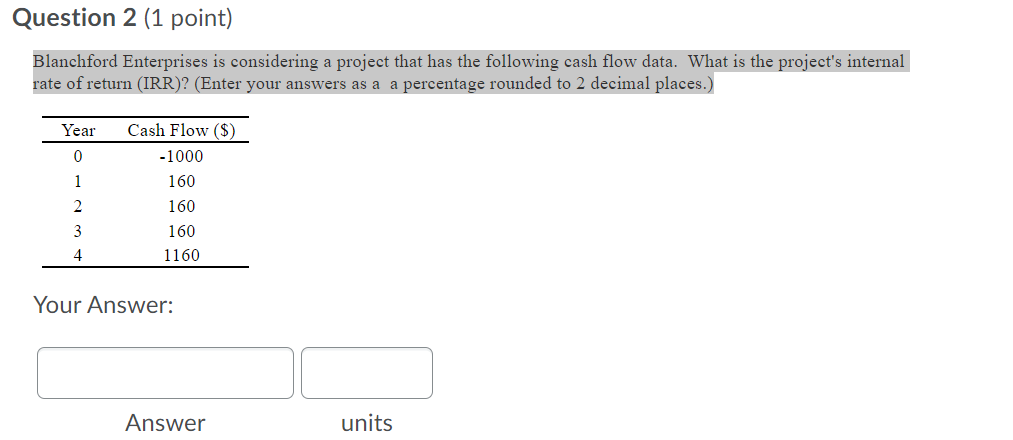

Question 2 (1 point) Blanchford Enterprises is considering a project that has the following cash flow data. What is the project's internal rate of

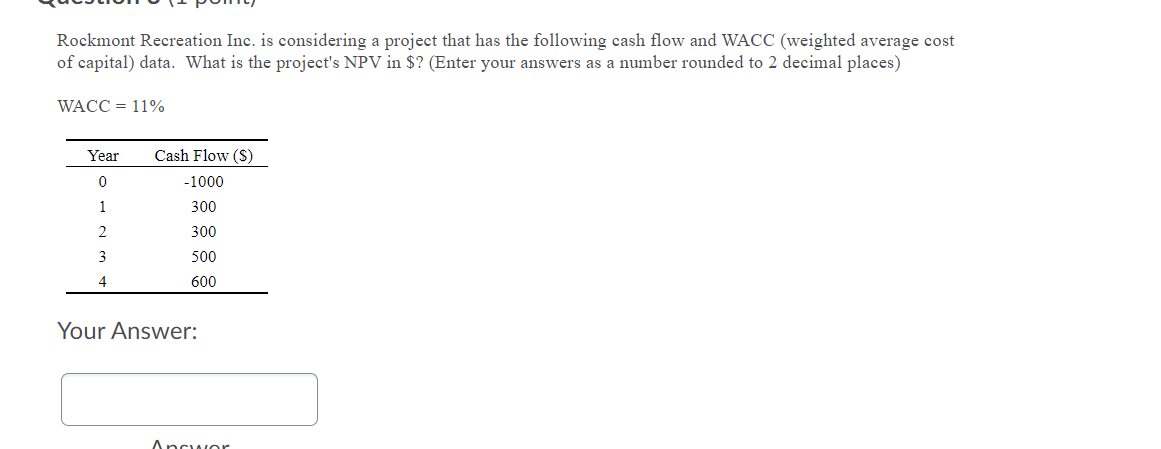

Question 2 (1 point) Blanchford Enterprises is considering a project that has the following cash flow data. What is the project's internal rate of return (IRR)? (Enter your answers as a a percentage rounded to 2 decimal places.) Year Cash Flow ($) -1000 1 160 2 160 3 160 4 1160 Your Answer: Answer units Rockmont Recreation Inc. is considering a project that has the following cash flow and WACC (weighted average cost of capital) data. What is the project's NPV in $? (Enter your answers as a number rounded to 2 decimal places) WACC = 11% Year Cash Flow ($) -1000 1 300 2 300 3 500 4 600 Your Answer: Ancwor

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

IRR16 AT 16 NPV BECOME 0 NP...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Theory and Corporate Policy

Authors: Thomas E. Copeland, J. Fred Weston, Kuldeep Shastri

4th edition

321127218, 978-0321179548, 321179544, 978-0321127211

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App