Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 (10 marks) Vukani Limited maintains a debt-equity ratio of 0.40 and follows a residual dividend policy. The company has profit before tax

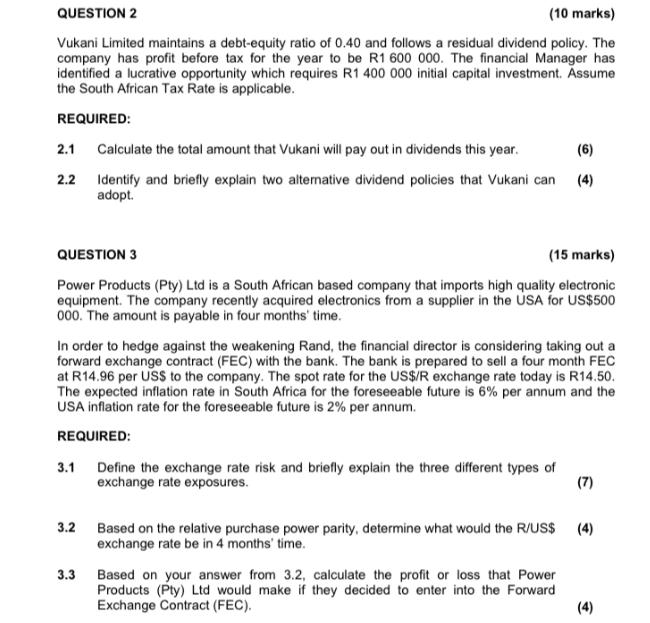

QUESTION 2 (10 marks) Vukani Limited maintains a debt-equity ratio of 0.40 and follows a residual dividend policy. The company has profit before tax for the year to be R1 600 000. The financial Manager has identified a lucrative opportunity which requires R1 400 000 initial capital investment. Assume the South African Tax Rate is applicable. REQUIRED: 2.1 Calculate the total amount that Vukani will pay out in dividends this year. (6) 2.2 Identify and briefly explain two alternative dividend policies that Vukani can (4) adopt. QUESTION 3 (15 marks) Power Products (Pty) Ltd is a South African based company that imports high quality electronic equipment. The company recently acquired electronics from a supplier in the USA for US$500 000. The amount is payable in four months' time. In order to hedge against the weakening Rand, the financial director is considering taking out a forward exchange contract (FEC) with the bank. The bank is prepared to sell a four month FEC at R14.96 per US$ to the company. The spot rate for the US$/R exchange rate today is R14.50. The expected inflation rate in South Africa for the foreseeable future is 6% per annum and the USA inflation rate for the foreseeable future is 2% per annum. REQUIRED: 3.1 Define the exchange rate risk and briefly explain the three different types of exchange rate exposures. 3.2 (7) Based on the relative purchase power parity, determine what would the R/US$ (4) exchange rate be in 4 months' time. 3.3 Based on your answer from 3.2, calculate the profit or loss that Power Products (Pty) Ltd would make if they decided to enter into the Forward Exchange Contract (FEC). (4)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started