Question 2 (10 points): Consider the following investment problem: you can invest in bonds (B), stocks (Stk) and in savings deposit (SD). Your decisions

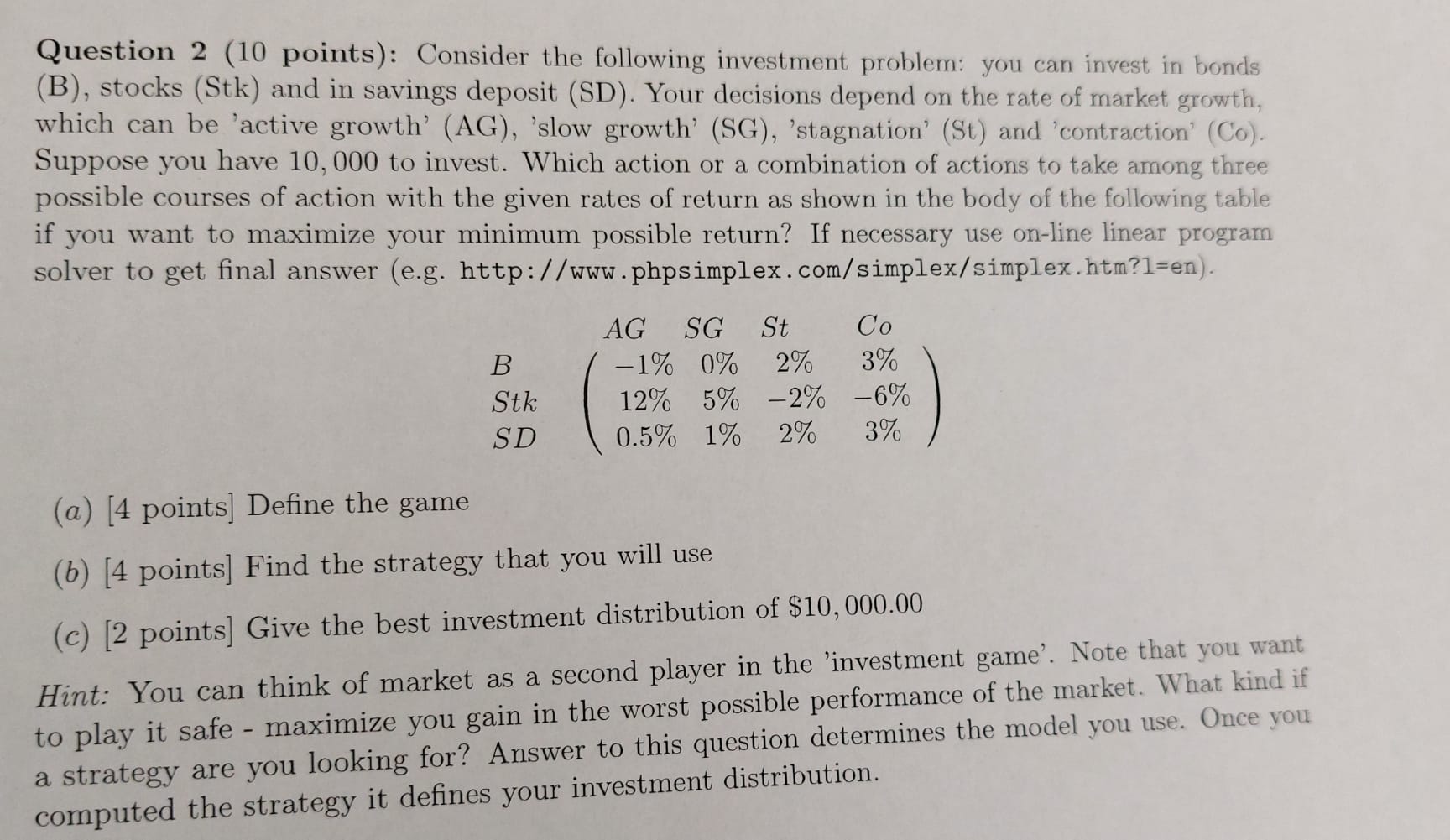

Question 2 (10 points): Consider the following investment problem: you can invest in bonds (B), stocks (Stk) and in savings deposit (SD). Your decisions depend on the rate of market growth, which can be 'active growth' (AG), 'slow growth' (SG), 'stagnation' (St) and 'contraction' (Co). Suppose you have 10,000 to invest. Which action or a combination of actions to take among three possible courses of action with the given rates of return as shown in the body of the following table if you want to maximize your minimum possible return? If necessary use on-line linear program solver to get final answer (e.g. http://www.phpsimplex.com/simplex/simplex.htm?l=en). AG SG St Co B Stk -1% 0% 2% 3% 12% 5% -2% -6% SD 0.5% 1% 2% 3% (a) [4 points] Define the game (b) [4 points] Find the strategy that you will use (c) [2 points] Give the best investment distribution of $10,000.00 Hint: You can think of market as a second player in the 'investment game'. Note that you want to play it safe - maximize you gain in the worst possible performance of the market. What kind if a strategy are you looking for? Answer to this question determines the model you use. Once you computed the strategy it defines your investment distribution.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started