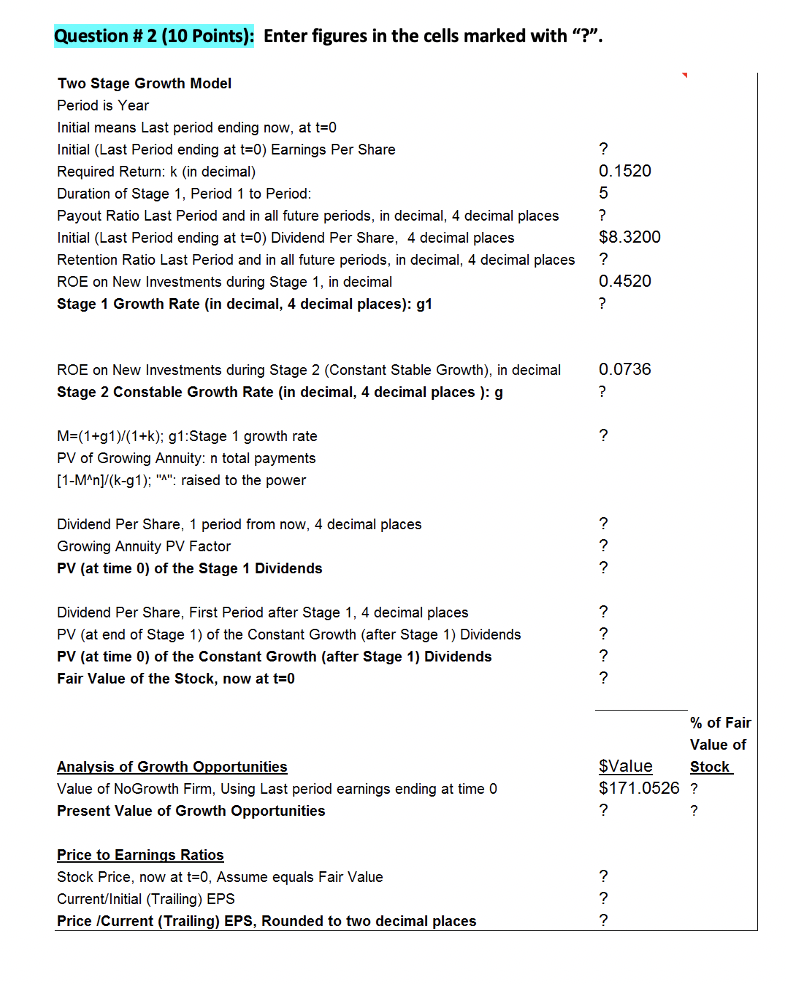

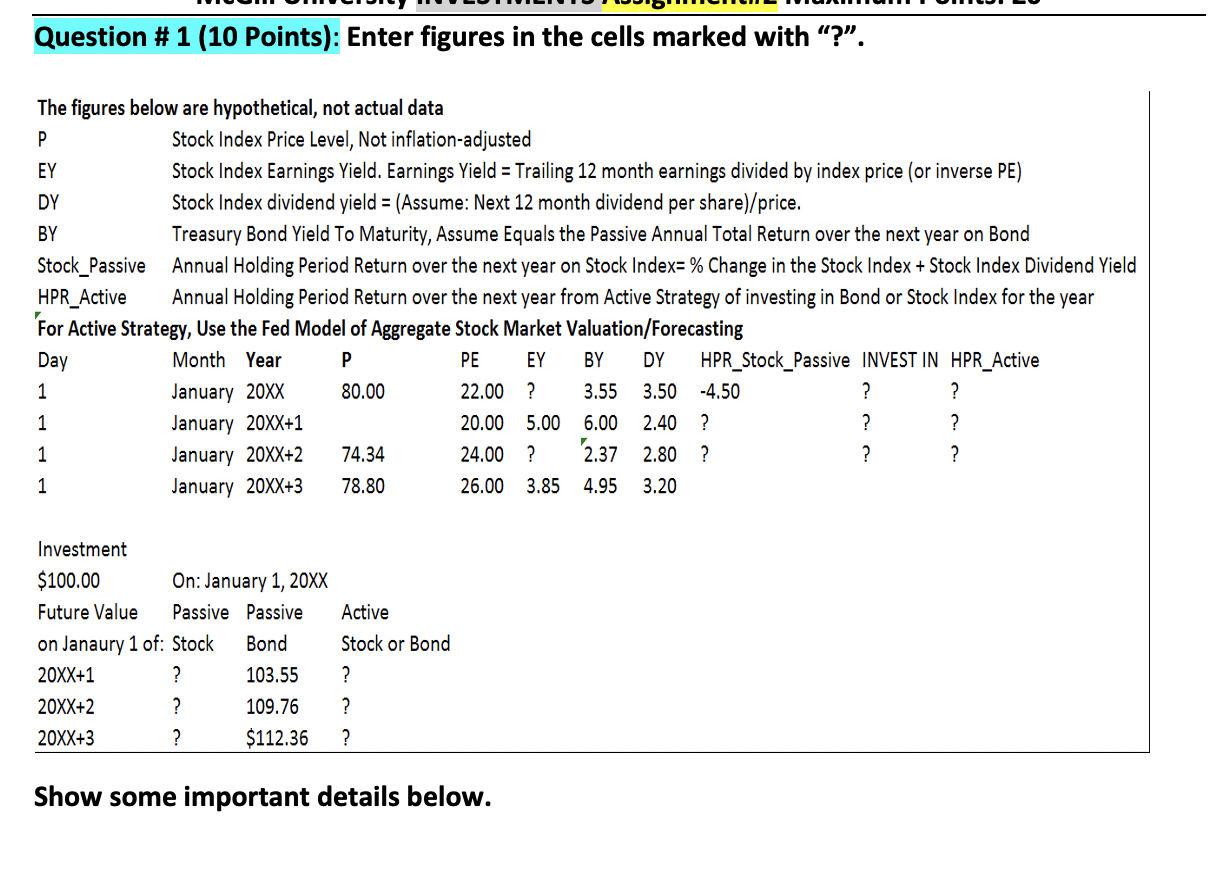

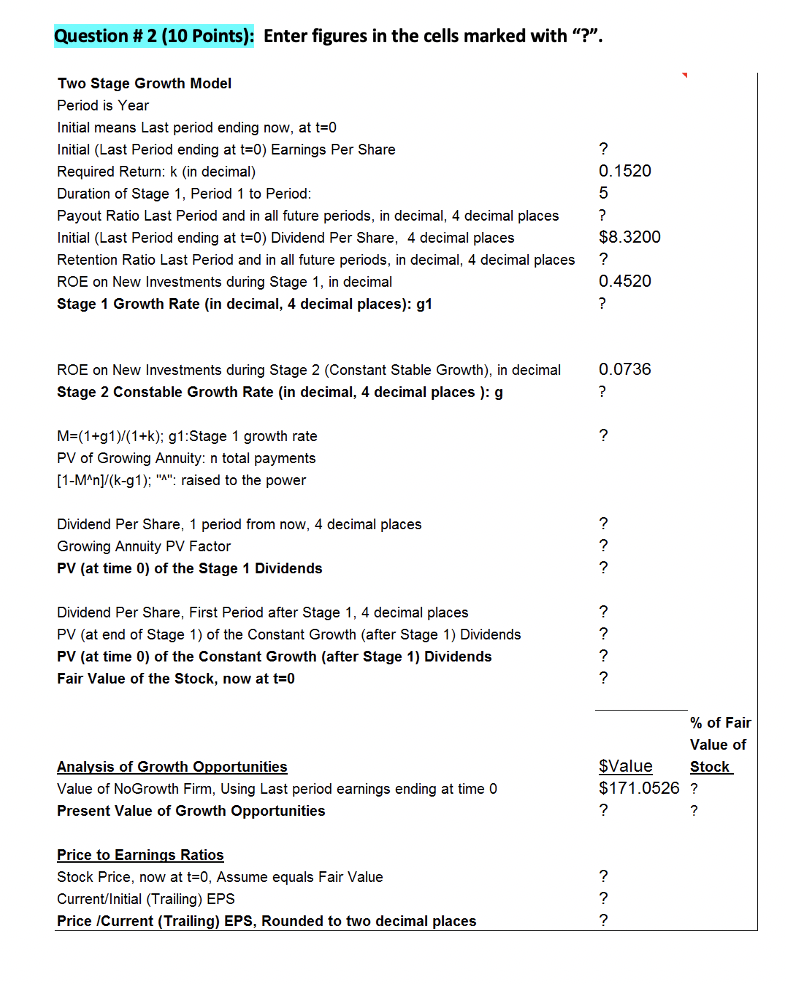

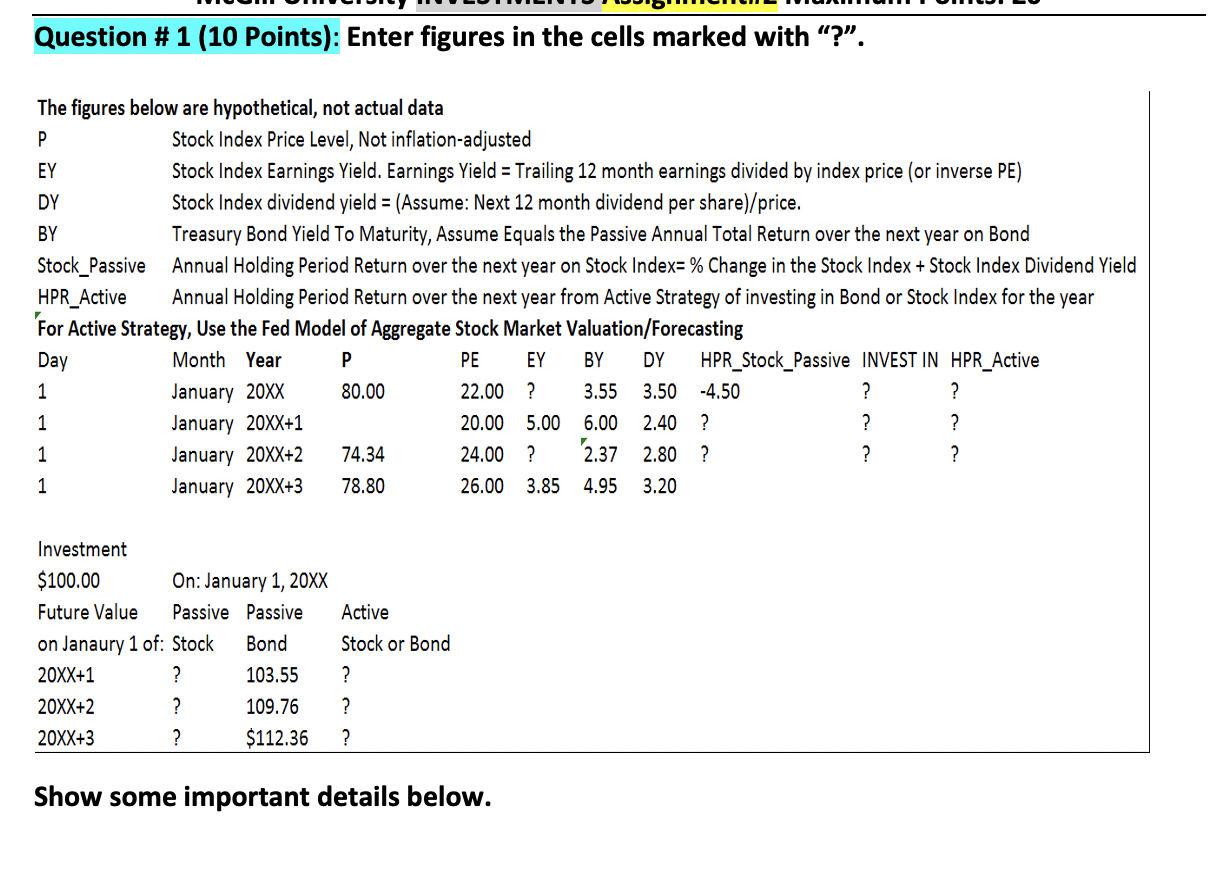

Question #2 (10 Points): Enter figures in the cells marked with "?". Two Stage Growth Model Period is Year Initial means Last period ending now, at t=0 Initial (Last Period ending at t=0) Earnings Per Share Required Return: k (in decimal) Duration of Stage 1, Period 1 to Period: Payout Ratio Last Period and in all future periods, in decimal, 4 decimal places Initial (Last Period ending at t=0) Dividend Per Share, 4 decimal places Retention Ratio Last Period and in all future periods, in decimal, 4 decimal places ROE on New Investments during Stage 1, in decimal Stage 1 Growth Rate (in decimal, 4 decimal places): g1 ? 0.1520 5 ? $8.3200 ? 0.4520 ? ROE on New Investments during Stage 2 (Constant Stable Growth), in decimal Stage 2 Constable Growth Rate (in decimal, 4 decimal places ): g 0.0736 ? ? M=(1+1)/(1+k); g1:Stage 1 growth rate PV of Growing Annuity: n total payments [1-M^n]/(k-g1); "": raised to the power Dividend Per Share, 1 period from now, 4 decimal places Growing Annuity PV Factor PV (at time 0) of the Stage 1 Dividends ? ? ? Dividend Per Share, First Period after Stage 1, 4 decimal places PV (at end of Stage 1) of the Constant Growth (after Stage 1) Dividends PV (at time 0) of the Constant Growth (after Stage 1) Dividends Fair Value of the Stock, now at t=0 ? ? ? ? Analysis of Growth Opportunities Value of NoGrowth Firm, Using Last period earnings ending at time 0 Present Value of Growth Opportunities % of Fair Value of $Value Stock $171.0526 ? ? ? Price to Earnings Ratios Stock Price, now at t=0, Assume equals Fair Value Current/Initial (Trailing) EPS Price /Current (Trailing) EPS, Rounded to two decimal places ? ? ? Question # 1 (10 Points): Enter figures in the cells marked with "?". The figures below are hypothetical, not actual data P Stock Index Price Level, Not inflation-adjusted EY Stock Index Earnings Yield. Earnings Yield = Trailing 12 month earnings divided by index price (or inverse PE) DY Stock Index dividend yield = (Assume: Next 12 month dividend per share)/price. BY Treasury Bond Yield To Maturity, Assume Equals the Passive Annual Total Return over the next year on Bond Stock_Passive Annual Holding Period Return over the next year on Stock Index=% Change in the Stock Index + Stock Index Dividend Yield HPR_Active Annual Holding Period Return over the next year from Active Strategy of investing in Bond or Stock Index for the year For Active Strategy, Use the Fed Model of Aggregate Stock Market Valuation/Forecasting Month Year P PE EY BY DY HPR_Stock_Passive INVEST IN HPR_Active 1 January 20xx 80.00 22.00 ? 3.55 3.50 -4.50 ? ? 1 January 20XX+1 20.00 5.00 6.00 2.40 ? ? ? 1 January 20XX+2 74.34 24.00 ? 2.37 2.80 ? ? ? 1 January 20XX+3 78.80 26.00 3.85 4.95 Day 3.20 Investment $100.00 On: January 1, 20XX Future Value Passive Passive on Janaury 1 of: Stock Bond 20XX+1 ? 103.55 20XX+2 ? 109.76 20XX+3 ? $112.36 Active Stock or Bond ? ? ? Show some important details below. Question #2 (10 Points): Enter figures in the cells marked with "?". Two Stage Growth Model Period is Year Initial means Last period ending now, at t=0 Initial (Last Period ending at t=0) Earnings Per Share Required Return: k (in decimal) Duration of Stage 1, Period 1 to Period: Payout Ratio Last Period and in all future periods, in decimal, 4 decimal places Initial (Last Period ending at t=0) Dividend Per Share, 4 decimal places Retention Ratio Last Period and in all future periods, in decimal, 4 decimal places ROE on New Investments during Stage 1, in decimal Stage 1 Growth Rate (in decimal, 4 decimal places): g1 ? 0.1520 5 ? $8.3200 ? 0.4520 ? ROE on New Investments during Stage 2 (Constant Stable Growth), in decimal Stage 2 Constable Growth Rate (in decimal, 4 decimal places ): g 0.0736 ? ? M=(1+1)/(1+k); g1:Stage 1 growth rate PV of Growing Annuity: n total payments [1-M^n]/(k-g1); "": raised to the power Dividend Per Share, 1 period from now, 4 decimal places Growing Annuity PV Factor PV (at time 0) of the Stage 1 Dividends ? ? ? Dividend Per Share, First Period after Stage 1, 4 decimal places PV (at end of Stage 1) of the Constant Growth (after Stage 1) Dividends PV (at time 0) of the Constant Growth (after Stage 1) Dividends Fair Value of the Stock, now at t=0 ? ? ? ? Analysis of Growth Opportunities Value of NoGrowth Firm, Using Last period earnings ending at time 0 Present Value of Growth Opportunities % of Fair Value of $Value Stock $171.0526 ? ? ? Price to Earnings Ratios Stock Price, now at t=0, Assume equals Fair Value Current/Initial (Trailing) EPS Price /Current (Trailing) EPS, Rounded to two decimal places ? ? ? Question # 1 (10 Points): Enter figures in the cells marked with "?". The figures below are hypothetical, not actual data P Stock Index Price Level, Not inflation-adjusted EY Stock Index Earnings Yield. Earnings Yield = Trailing 12 month earnings divided by index price (or inverse PE) DY Stock Index dividend yield = (Assume: Next 12 month dividend per share)/price. BY Treasury Bond Yield To Maturity, Assume Equals the Passive Annual Total Return over the next year on Bond Stock_Passive Annual Holding Period Return over the next year on Stock Index=% Change in the Stock Index + Stock Index Dividend Yield HPR_Active Annual Holding Period Return over the next year from Active Strategy of investing in Bond or Stock Index for the year For Active Strategy, Use the Fed Model of Aggregate Stock Market Valuation/Forecasting Month Year P PE EY BY DY HPR_Stock_Passive INVEST IN HPR_Active 1 January 20xx 80.00 22.00 ? 3.55 3.50 -4.50 ? ? 1 January 20XX+1 20.00 5.00 6.00 2.40 ? ? ? 1 January 20XX+2 74.34 24.00 ? 2.37 2.80 ? ? ? 1 January 20XX+3 78.80 26.00 3.85 4.95 Day 3.20 Investment $100.00 On: January 1, 20XX Future Value Passive Passive on Janaury 1 of: Stock Bond 20XX+1 ? 103.55 20XX+2 ? 109.76 20XX+3 ? $112.36 Active Stock or Bond ? ? ? Show some important details below