Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question #2 (10 Points): John wishes to buy a $500,000 home using Loan 1 [mortgage rate: 7.00%, maturity: 30 years, Discount Points, %: X

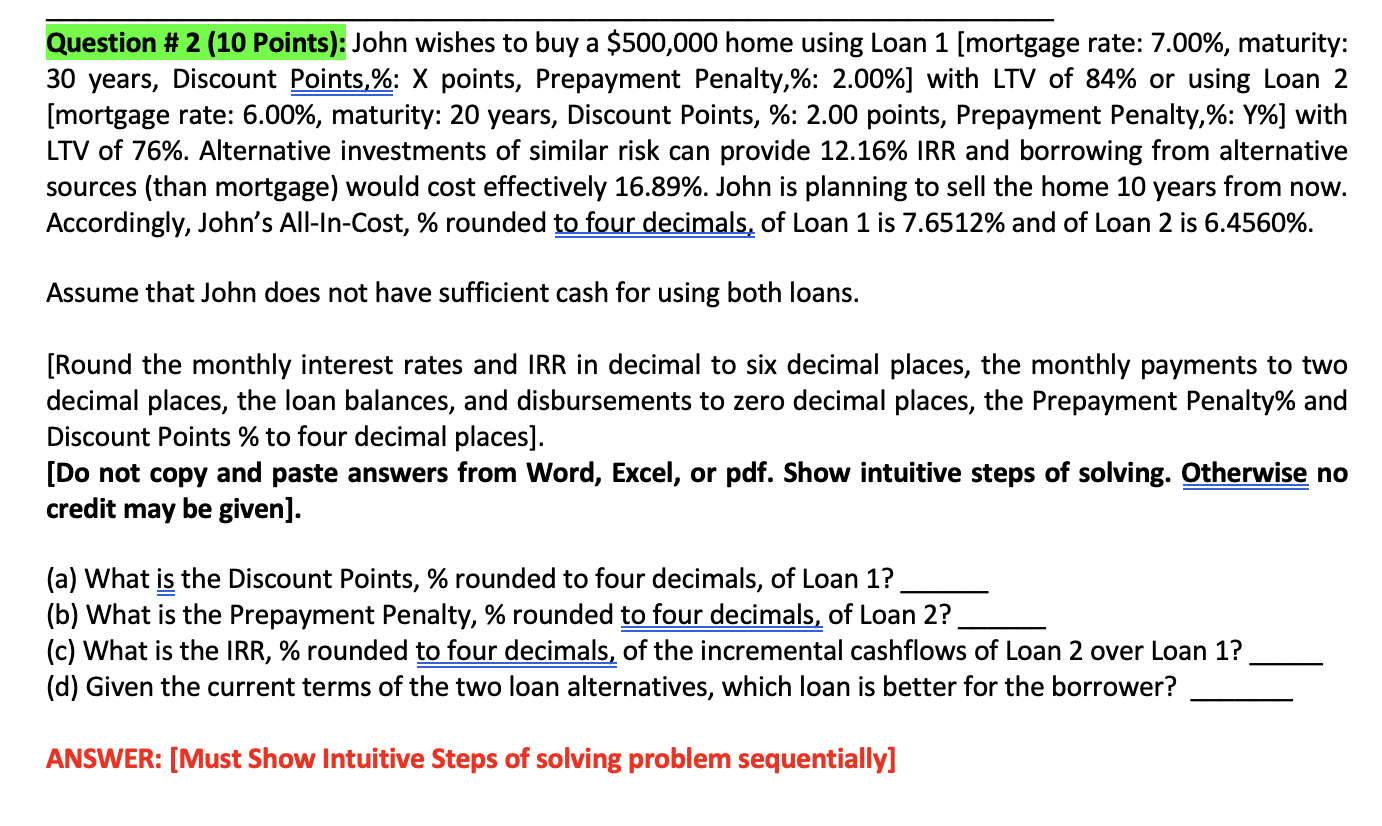

Question #2 (10 Points): John wishes to buy a $500,000 home using Loan 1 [mortgage rate: 7.00%, maturity: 30 years, Discount Points, %: X points, Prepayment Penalty,%: 2.00%] with LTV of 84% or using Loan 2 [mortgage rate: 6.00%, maturity: 20 years, Discount Points, %: 2.00 points, Prepayment Penalty,%: Y%] with LTV of 76%. Alternative investments of similar risk can provide 12.16% IRR and borrowing from alternative sources (than mortgage) would cost effectively 16.89%. John is planning to sell the home 10 years from now. Accordingly, John's All-In-Cost, % rounded to four decimals, of Loan 1 is 7.6512% and of Loan 2 is 6.4560%. Assume that John does not have sufficient cash for using both loans. [Round the monthly interest rates and IRR in decimal to six decimal places, the monthly payments to two decimal places, the loan balances, and disbursements to zero decimal places, the Prepayment Penalty% and Discount Points % to four decimal places]. [Do not copy and paste answers from Word, Excel, or pdf. Show intuitive steps of solving. Otherwise no credit may be given]. (a) What is the Discount Points, % rounded to four decimals, of Loan 1? (b) What is the Prepayment Penalty, % rounded to four decimals, of Loan 2? (c) What is the IRR, % rounded to four decimals, of the incremental cashflows of Loan 2 over Loan 1? (d) Given the current terms of the two loan alternatives, which loan is better for the borrower? ANSWER: [Must Show Intuitive Steps of solving problem sequentially]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started