Answered step by step

Verified Expert Solution

Question

1 Approved Answer

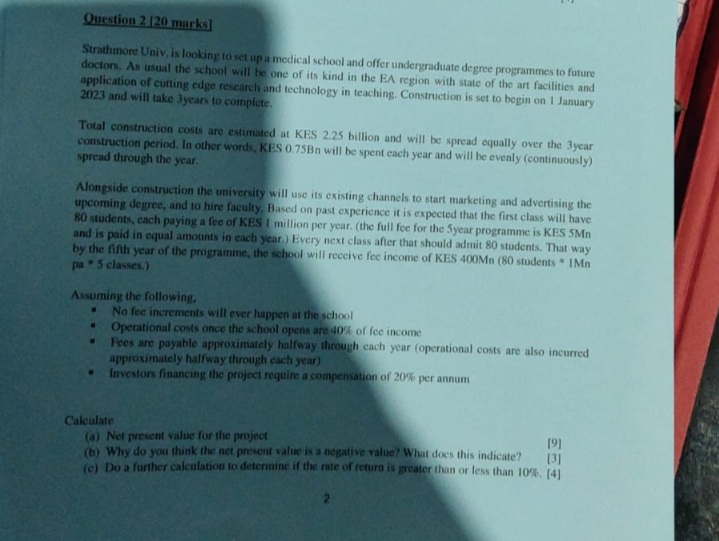

Question 2 120 marks] Strathmore Univ, is looking to set up a medical school and offer undergraduate degree programmes to future doctors. As usual

Question 2 120 marks] Strathmore Univ, is looking to set up a medical school and offer undergraduate degree programmes to future doctors. As usual the school will be one of its kind in the EA region with state of the art facilities and application of cutting edge research and technology in teaching. Construction is set to begin on 1 January 2023 and will take 3years to complete. Total construction costs are estimated at KES 2.25 billion and will be spread equally over the 3year construction period. In other words, KES 0.75Bn will be spent each year and will be evenly (continuously) spread through the year. Alongside construction the university will use its existing channels to start marketing and advertising the upcoming degree, and to hire faculty. Based on past experience it is expected that the first class will have 80 students, each paying a fee of KES 1 million per year. (the full fee for the Syear programme is KES 5Mn and is paid in equal amounts in each year.) Every next class after that should admit 80 students. That way by the fifth year of the programme, the school will receive fee income of KES 400Mn (80 students IMn pa 5 classes.) 4 Assuming the following, Calculate No fee increments will ever happen at the school Operational costs once the school opens are 40% of fee income Fees are payable approximately halfway through each year (operational costs are also incurred approximately halfway through each year) Investors financing the project require a compensation of 20% per annum (a) Net present value for the project [9] [3] (b) Why do you think the net present value is a negative value? What does this indicate? (c) Do a further calculation to determine if the rate of return is greater than or less than 10%. [4] 2 (d) Would you invest in this project? Explain why or why not. Suppose the full fees for new students were increased at a rate of 5% per annum. (e) What impact would this have on the NPV and IRR? [2] 11 [2]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started