Answered step by step

Verified Expert Solution

Question

1 Approved Answer

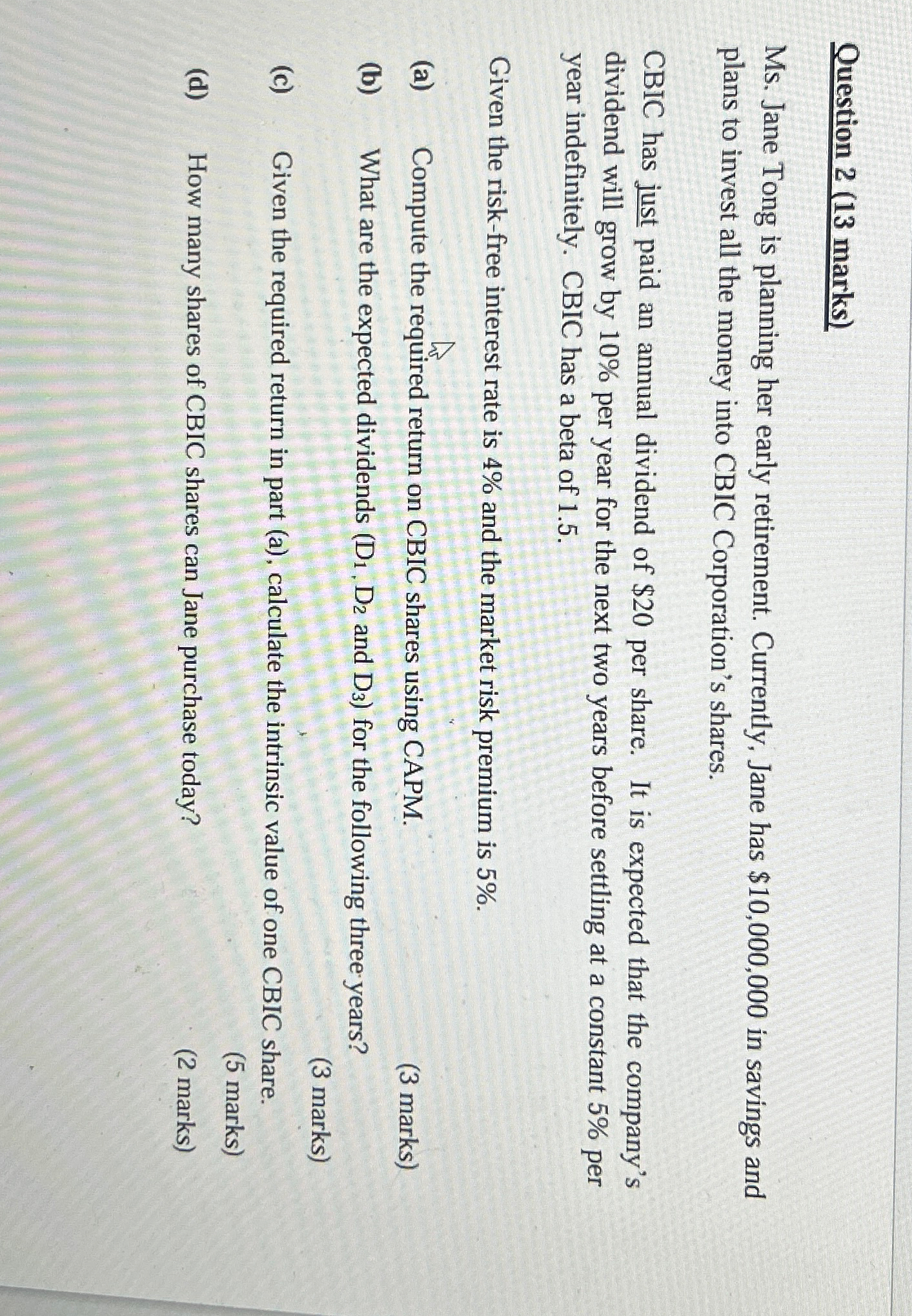

Question 2 (13 marks) Ms. Jane Tong is planning her early retirement. Currently, Jane has $10,000,000 in savings and plans to invest all the

Question 2 (13 marks) Ms. Jane Tong is planning her early retirement. Currently, Jane has $10,000,000 in savings and plans to invest all the money into CBIC Corporation's shares. CBIC has just paid an annual dividend of $20 per share. It is expected that the company's dividend will grow by 10% per year for the next two years before settling at a constant 5% per year indefinitely. CBIC has a beta of 1.5. Given the risk-free interest rate is 4% and the market risk premium is 5%. (a) Compute the required return on CBIC shares using CAPM. (3 marks) (b) What are the expected dividends (D1, D2 and D3) for the following three years? (3 marks) (c) Given the required return in part (a), calculate the intrinsic value of one CBIC share. (5 marks) (d) How many shares of CBIC shares can Jane purchase today? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started