Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (13 marks) Working as a senior manager at a fast-growing technology company, Gold Standard Ltd (GST), you hold 5,000 shares of Gold Standard

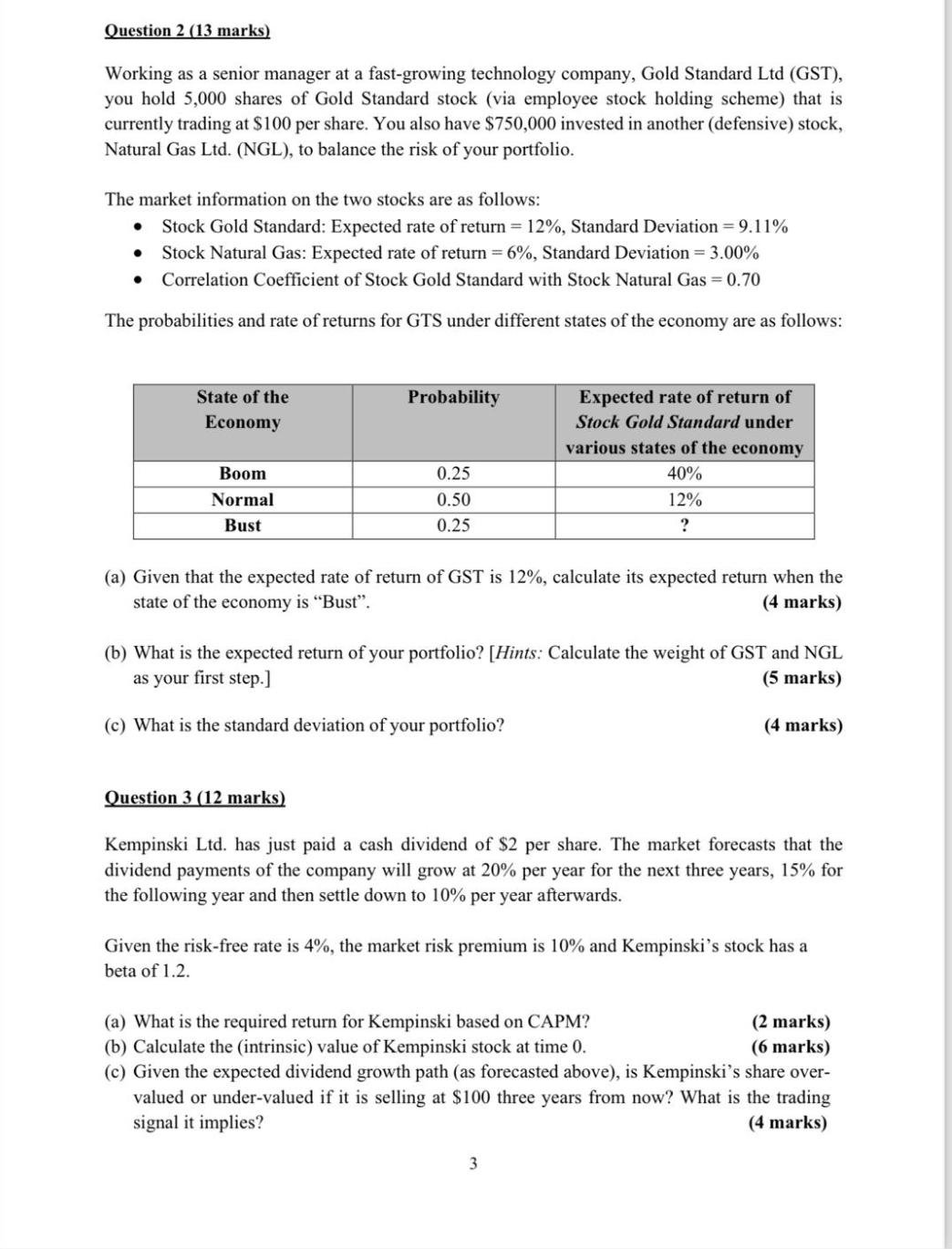

Question 2 (13 marks) Working as a senior manager at a fast-growing technology company, Gold Standard Ltd (GST), you hold 5,000 shares of Gold Standard stock (via employee stock holding scheme) that is currently trading at $100 per share. You also have $750,000 invested in another (defensive) stock, Natural Gas Ltd. (NGL), to balance the risk of your portfolio. The market information on the two stocks are as follows: - Stock Gold Standard: Expected rate of return =12%, Standard Deviation =9.11% - Stock Natural Gas: Expected rate of return =6%, Standard Deviation =3.00% - Correlation Coefficient of Stock Gold Standard with Stock Natural Gas =0.70 The probabilities and rate of returns for GTS under different states of the economy are as follows: (a) Given that the expected rate of return of GST is 12%, calculate its expected return when the state of the economy is "Bust". (4 marks) (b) What is the expected return of your portfolio? [Hints: Calculate the weight of GST and NGL as your first step.] (5 marks) (c) What is the standard deviation of your portfolio? (4 marks) Question 3 (12 marks) Kempinski Ltd. has just paid a cash dividend of \$2 per share. The market forecasts that the dividend payments of the company will grow at 20% per year for the next three years, 15% for the following year and then settle down to 10% per year afterwards. Given the risk-free rate is 4%, the market risk premium is 10% and Kempinski's stock has a beta of 1.2 . (a) What is the required return for Kempinski based on CAPM? (2 marks) (b) Calculate the (intrinsic) value of Kempinski stock at time 0 . (6 marks) (c) Given the expected dividend growth path (as forecasted above), is Kempinski's share overvalued or under-valued if it is selling at $100 three years from now? What is the trading signal it implies? (4 marks) Question 2 (13 marks) Working as a senior manager at a fast-growing technology company, Gold Standard Ltd (GST), you hold 5,000 shares of Gold Standard stock (via employee stock holding scheme) that is currently trading at $100 per share. You also have $750,000 invested in another (defensive) stock, Natural Gas Ltd. (NGL), to balance the risk of your portfolio. The market information on the two stocks are as follows: - Stock Gold Standard: Expected rate of return =12%, Standard Deviation =9.11% - Stock Natural Gas: Expected rate of return =6%, Standard Deviation =3.00% - Correlation Coefficient of Stock Gold Standard with Stock Natural Gas =0.70 The probabilities and rate of returns for GTS under different states of the economy are as follows: (a) Given that the expected rate of return of GST is 12%, calculate its expected return when the state of the economy is "Bust". (4 marks) (b) What is the expected return of your portfolio? [Hints: Calculate the weight of GST and NGL as your first step.] (5 marks) (c) What is the standard deviation of your portfolio? (4 marks) Question 3 (12 marks) Kempinski Ltd. has just paid a cash dividend of \$2 per share. The market forecasts that the dividend payments of the company will grow at 20% per year for the next three years, 15% for the following year and then settle down to 10% per year afterwards. Given the risk-free rate is 4%, the market risk premium is 10% and Kempinski's stock has a beta of 1.2 . (a) What is the required return for Kempinski based on CAPM? (2 marks) (b) Calculate the (intrinsic) value of Kempinski stock at time 0 . (6 marks) (c) Given the expected dividend growth path (as forecasted above), is Kempinski's share overvalued or under-valued if it is selling at $100 three years from now? What is the trading signal it implies? (4 marks)

Question 2 (13 marks) Working as a senior manager at a fast-growing technology company, Gold Standard Ltd (GST), you hold 5,000 shares of Gold Standard stock (via employee stock holding scheme) that is currently trading at $100 per share. You also have $750,000 invested in another (defensive) stock, Natural Gas Ltd. (NGL), to balance the risk of your portfolio. The market information on the two stocks are as follows: - Stock Gold Standard: Expected rate of return =12%, Standard Deviation =9.11% - Stock Natural Gas: Expected rate of return =6%, Standard Deviation =3.00% - Correlation Coefficient of Stock Gold Standard with Stock Natural Gas =0.70 The probabilities and rate of returns for GTS under different states of the economy are as follows: (a) Given that the expected rate of return of GST is 12%, calculate its expected return when the state of the economy is "Bust". (4 marks) (b) What is the expected return of your portfolio? [Hints: Calculate the weight of GST and NGL as your first step.] (5 marks) (c) What is the standard deviation of your portfolio? (4 marks) Question 3 (12 marks) Kempinski Ltd. has just paid a cash dividend of \$2 per share. The market forecasts that the dividend payments of the company will grow at 20% per year for the next three years, 15% for the following year and then settle down to 10% per year afterwards. Given the risk-free rate is 4%, the market risk premium is 10% and Kempinski's stock has a beta of 1.2 . (a) What is the required return for Kempinski based on CAPM? (2 marks) (b) Calculate the (intrinsic) value of Kempinski stock at time 0 . (6 marks) (c) Given the expected dividend growth path (as forecasted above), is Kempinski's share overvalued or under-valued if it is selling at $100 three years from now? What is the trading signal it implies? (4 marks) Question 2 (13 marks) Working as a senior manager at a fast-growing technology company, Gold Standard Ltd (GST), you hold 5,000 shares of Gold Standard stock (via employee stock holding scheme) that is currently trading at $100 per share. You also have $750,000 invested in another (defensive) stock, Natural Gas Ltd. (NGL), to balance the risk of your portfolio. The market information on the two stocks are as follows: - Stock Gold Standard: Expected rate of return =12%, Standard Deviation =9.11% - Stock Natural Gas: Expected rate of return =6%, Standard Deviation =3.00% - Correlation Coefficient of Stock Gold Standard with Stock Natural Gas =0.70 The probabilities and rate of returns for GTS under different states of the economy are as follows: (a) Given that the expected rate of return of GST is 12%, calculate its expected return when the state of the economy is "Bust". (4 marks) (b) What is the expected return of your portfolio? [Hints: Calculate the weight of GST and NGL as your first step.] (5 marks) (c) What is the standard deviation of your portfolio? (4 marks) Question 3 (12 marks) Kempinski Ltd. has just paid a cash dividend of \$2 per share. The market forecasts that the dividend payments of the company will grow at 20% per year for the next three years, 15% for the following year and then settle down to 10% per year afterwards. Given the risk-free rate is 4%, the market risk premium is 10% and Kempinski's stock has a beta of 1.2 . (a) What is the required return for Kempinski based on CAPM? (2 marks) (b) Calculate the (intrinsic) value of Kempinski stock at time 0 . (6 marks) (c) Given the expected dividend growth path (as forecasted above), is Kempinski's share overvalued or under-valued if it is selling at $100 three years from now? What is the trading signal it implies? (4 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started