Answered step by step

Verified Expert Solution

Question

1 Approved Answer

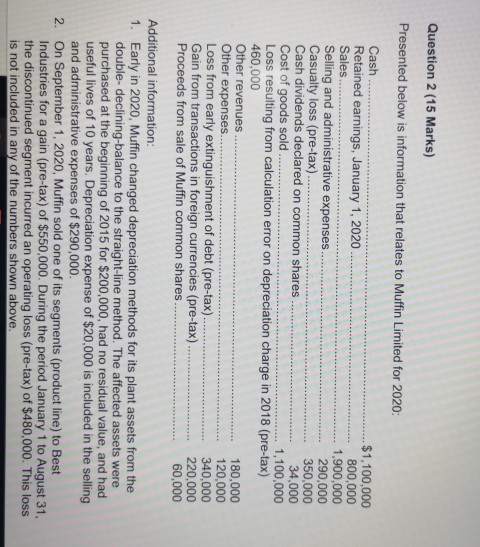

Question 2 (15 Marks) Presented below is information that relates to Muffin Limited for 2020: Cash $1,100,000 Retained earnings, January 1, 2020 800,000 Sales ........

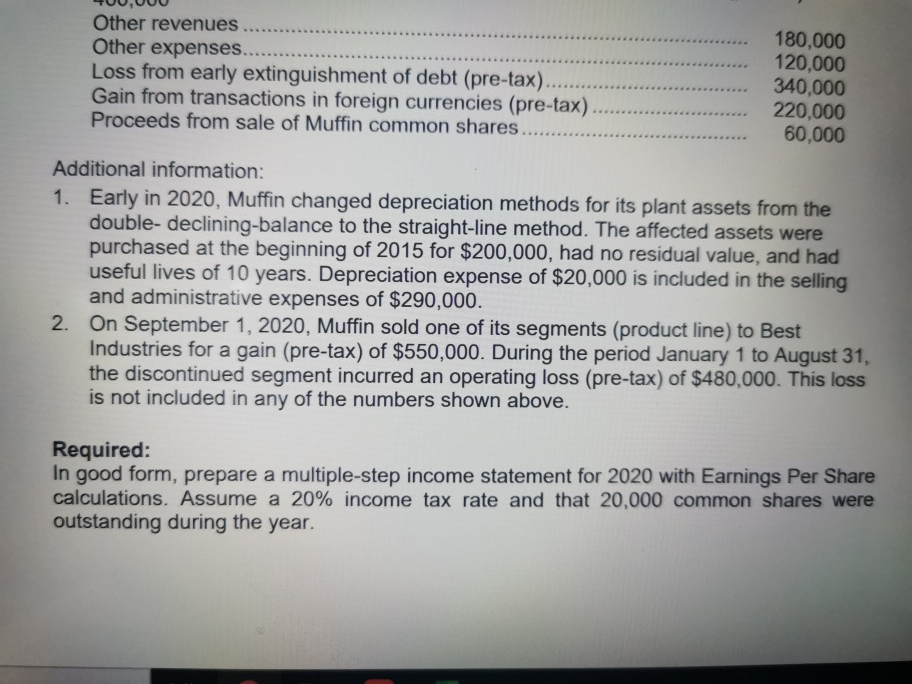

Question 2 (15 Marks) Presented below is information that relates to Muffin Limited for 2020: Cash $1,100,000 Retained earnings, January 1, 2020 800,000 Sales ........ 1,900,000 Selling and administrative expenses 290,000 Casualty loss (pre-tax). 350,000 Cash dividends declared on common shares 34,000 Cost of goods sold 1,100,000 Loss resulting from calculation error on depreciation charge in 2018 (pre-tax) 460,000 Other revenues 180,000 Other expenses 120,000 Loss from early extinguishment of debt (pre-tax). 340,000 Gain from transactions in foreign currencies (pre-tax) 220,000 Proceeds from sale of Muffin common shares 60,000 Additional information: 1. Early in 2020, Muffin changed depreciation methods for its plant assets from the double-declining-balance to the straight-line method. The affected assets were purchased at the beginning of 2015 for $200,000, had no residual value, and had useful lives of 10 years. Depreciation expense of $20,000 is included in the selling and administrative expenses of $290,000 2. On September 1, 2020, Muffin sold one of its segments (product line) to Best Industries for a gain (pre-tax) of $550,000. During the period January 1 to August 31, the discontinued segment incurred an operating loss (pre-tax) of $480,000. This loss is not included in any of the numbers shown above. Other revenues Other expenses... Loss from early extinguishment of debt (pre-tax). Gain from transactions in foreign currencies (pre-tax) Proceeds from sale of Muffin common shares 180,000 120,000 340,000 220,000 60,000 Additional information: 1. Early in 2020, Muffin changed depreciation methods for its plant assets from the double-declining-balance to the straight-line method. The affected assets were purchased at the beginning of 2015 for $200,000, had no residual value, and had useful lives of 10 years. Depreciation expense of $20,000 is included in the selling and administrative expenses of $290,000. 2. On September 1, 2020, Muffin sold one of its segments (product line) to Best Industries for a gain (pre-tax) of $550,000. During the period January 1 to August 31, the discontinued segment incurred an operating loss (pre-tax) of $480,000. This loss is not included in any of the numbers shown above. Required: In good form, prepare a multiple-step income statement for 2020 with Earnings Per Share calculations. Assume a 20% income tax rate and that 20,000 common shares were outstanding during the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started