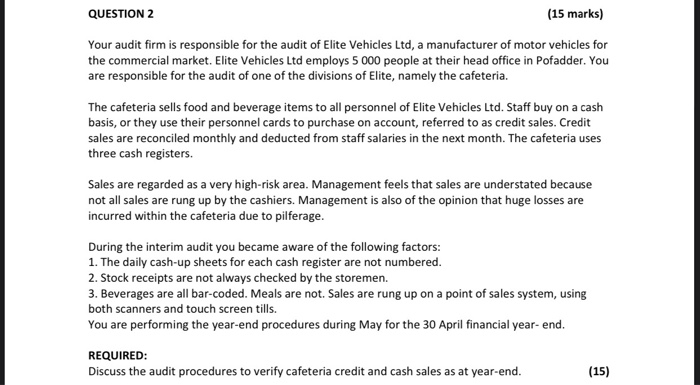

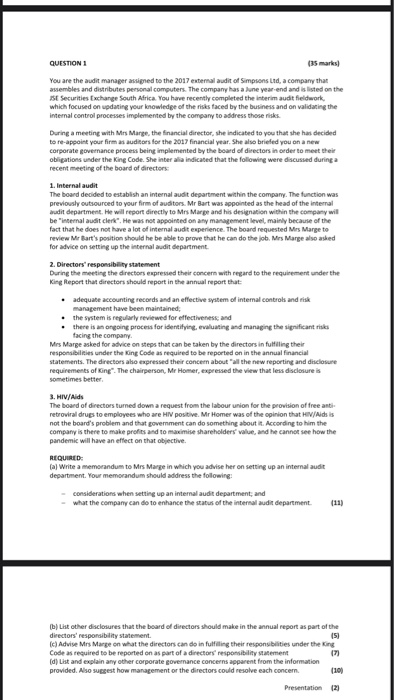

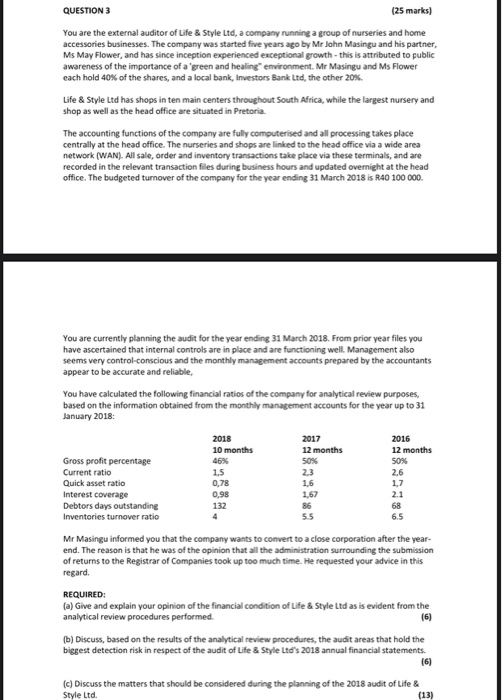

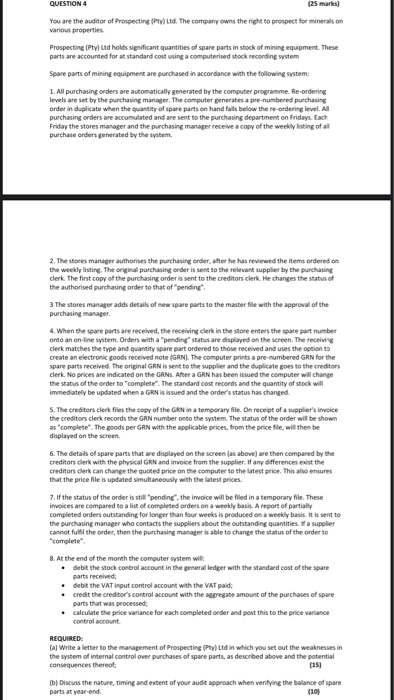

QUESTION 2 (15 marks) Your audit firm is responsible for the audit of Elite Vehicles Ltd, a manufacturer of motor vehicles for the commercial market. Elite Vehicles Ltd employs 5 000 people at their head office in Pofadder. You are responsible for the audit of one of the divisions of Elite, namely the cafeteria. The cafeteria sells food and beverage items to all personnel of Elite Vehicles Ltd. Staff buy on a cash basis, or they use their personnel cards to purchase on account, referred to as credit sales. Credit sales are reconciled monthly and deducted from staff salaries in the next month. The cafeteria uses three cash registers. Sales are regarded as a very high-risk area. Management feels that sales are understated because not all sales are rung up by the cashiers. Management is also of the opinion that huge losses are incurred within the cafeteria due to pilferage. During the interim audit you became aware of the following factors: 1. The daily cash-up sheets for each cash register are not numbered. 2. Stock receipts are not always checked by the storemen. 3. Beverages are all bar-coded. Meals are not. Sales are rung up on a point of sales system, using both scanners and touch screen tills. You are performing the year-end procedures during May for the 30 April financial year-end. REQUIRED: Discuss the audit procedures to verify cafeteria credit and cash sales as at year-end. (15) QUESTION 1 (35 marks) You are the audit manager assigned to the 2017 external audit of Simpsons Ltd, a company that assembles and distributes personal computers. The company has a June year-end and is listed on the SE Securities Exchange South Africa. You have recently completed the interim audit fieldwork which focused on updating your knowledge of the risks faced by the business and on validating the internal control processes implemented by the company to address those risks During a meeting with Mrs Marge, the financial director, she indicated to you that she has decided to re-appoint your firm as auditors for the 2017 financial year. She also briefed you on a new corporate governance process being implemented by the board of directors in order to meet their obligations under the King Code. She inter alia indicated that the following were discussed during a recent meeting of the board of directors 1. Internal audit The board decided to establish an internal audit department within the company. The function was previously outsourced to your firm of auditors. Mr Bart was appointed as the head of the internal audit department. He will report directly to Mrs Marge and his designation within the company wil be "internal audit clerk. He was not appointed on any management level, mainly because of the fact that he does not have a lot of internal audit experience. The board requested Mrs Marge to review Mr Bart's position should he be able to prove that he can do the job. Mrs Marge also asked for advice on setting up the internal audit department 2. Directors' responsibility statement During the meeting the directors expressed their concern with regard to the requirement under the King Report that directors should report in the annual report that adequate accounting records and an effective system of internal controls and risk management have been maintained the system is regularly reviewed for effectiveness and . there is an ongoing process for identifying, evaluating and managing the significant risks facing the company Mrs Marge asked for advice on steps that can be taken by the directors in fulfilling their responsibilities under the King Code as required to be reported on in the annual financial statements. The directors also expressed their concern about all the new reporting and disclosure requirements of King. The chairperson, Mr Homer, expressed the view that less disclosure is sometimes better 3. HIV/Aids The board of directors turned down a request from the labour union for the provision of free anti- retroviral drugs to employees who are HIV positive. Mr Homer was of the opinion that HIV/Aids is not the board's problem and that government can do something about it. According to him the company is there to make profits and to maximise shareholders' value, and he cannot see how the pandemic will have an effect on that objective REQUIRED (aj Write a memorandum to Mrs Marge in which you advise her on setting up an internal audit department. Your memorandum should address the following: considerations when setting up an internal audit department, and what the company can do to enhance the status of the internal audit department. (11) b) List other disclosures that the board of directors should make in the annual report as part of the directors' responsibility statement 151 c) Advise Mrs Marge on what the directors can do in fulfilling their responsibilities under the King Code as required to be reported on as part of a directors responsibility statement (7) (d) List and explain any other corporate governance concerns apparent from the information provided. Also suggest how management or the directors could resolve each concern (10) Presentation (2) QUESTION 3 (25 marks) You are the external auditor of Life & Style Ltd, a company running a group of nurseries and home accessories businesses. The company was started five years ago by Mr John Masingu and his partner, Ms May Flower, and has since inception experienced exceptional growth - this is attributed to public awareness of the importance of a green and healing environment. Mr Masingu and Ms Flower each hold 40% of the shares, and a local bank, Investors Bank Ltd, the other 20%. Life & Style Ltd has shops in ten main centers throughout South Africa, while the largest nursery and shop as well as the head office are situated in Pretoria The accounting functions of the company are fully computerised and all processing takes place centrally at the head office. The nurseries and shops are linked to the head office via a wide area network (WAN). All sale, order and inventory transactions take place via these terminals, and are recorded in the relevant transaction files during business hours and updated overnight at the head office. The budgeted turnover of the company for the year ending 31 March 2018 is R40 100 000 You are currently planning the audit for the year ending 31 March 2018. From prior year files you have ascertained that internal controls are in place and are functioning well. Management also seems very control-conscious and the monthly management accounts prepared by the accountants appear to be accurate and reliable, You have calculated the following financial ratios of the company for analytical review purposes, based on the information obtained from the monthly management accounts for the year up to 31 January 2018: 2017 12 months 50% 2018 10 months 46% 1.5 0,78 0,98 132 Gross profit percentage Current ratio Quick asset ratio Interest coverage Debtors days outstanding Inventories turnover ratio 2.3 1.6 1,67 86 5.5 2016 12 months 50% 2.6 1,7 2.1 68 6.5 Mr Masingu informed you that the company wants to convert to a close corporation after the year- end. The reason is that he was of the opinion that all the administration surrounding the submission of returns to the Registrar of Companies took up too much time. He requested your advice in this regard REQUIRED: (a) Give and explain your opinion of the financial condition of Life & Style Ltd as is evident from the analytical review procedures performed (b) Discuss, based on the results of the analytical review procedures, the audit areas that hold the biggest detection risk in respect of the audit of Life & Style Ltd's 2018 annual financial statements. (6) (c) Discuss the matters that should be considered during the planning of the 2018 audit of Life & Style Ltd. (13) QUESTION 4 (25 marks You are the auditor of Prospecting (Pty) Ltd. The company owns the right to prospect for minerals on various properties Prospecting (Pty) Ltd holds significant quantities of spare parts in stock of mining equipment. These parts are accounted for at standard cost using a computerised stock recording system Spare parts of mining equipment are purchased in accordance with the following system: 1. All purchasing orders are automatically generated by the computer programme. Re-ordering levels are set by the purchasing manager. The computer generates a pre-numbered purchasing order in duplicate when the quantity of spare parts on hand falls below the re-ordering level. Al purchasing orders are accumulated and are sent to the purchasing department on Fridays. Each Friday the stores manager and the purchasing manager receive a copy of the weekly listing of all purchase orders generated by the system. 2. The stores manager authorises the purchasing order, after he has reviewed the items ordered on the weekly listing. The original purchasing order is sent to the relevant supplier by the purchasing clerk. The first copy of the purchasing order is sent to the creditors clerk. He changes the status of the authorised purchasing order to that of "pending 3 The stores manager adds details of new spare parts to the master file with the approval of the purchasing manager 4. When the spare parts are received the receiving clerk in the store enters the spare part number onto an on-line system. Orders with a "pending status are displayed on the screen. The receiving clerk matches the type and quantity spare part ordered to those received and uses the option to Create an electronic goods received note (GRN). The computer prints a pre-numbered GRN for the spare parts received. The original GRN is sent to the supplier and the duplicate goes to the creditors clerk. No prices are indicated on the GRNS. After a GRN has been issued the computer will change the status of the order to complete". The standard cost records and the quantity of stock will immediately be updated when a GRN is issued and the order's status has changed 5. The creditors clerk files the copy of the GRN in a temporary file. On receipt of a supplier's invoice the creditors clerk records the GRN number onto the system. The status of the order will be shown as complete". The goods per GRN with the applicable prices, from the price file, will then be displayed on the screen 6. The details of spare parts that are displayed on the screen as above) are then compared by the creditors clerk with the physical GRN and invoice from the supplier. If any differences exist the creditors clerk can change the quoted price on the computer to the latest price. This also ensures that the price file is updated simultaneously with the latest prices. 7. If the status of the order is still pending", the invoice will be filed in a temporary file. These invoices are compared to a list of completed orders on a weekly basis. A report of partially completed orders outstanding for longer than four weeks is produced on a weekly basis. It is sent to the purchasing manager who contacts the suppliers about the outstanding quantities a supplier cannot fulfil the order, then the purchasing manager is able to change the status of the order to "complete 8. At the end of the month the computer system will . debit the stock control account in the general ledger with the standard cost of the spare parts received debit the VAT input control account with the VAT paid credit the creditor's control account with the agregate amount of the purchases of spare parts that was processed calculate the price variance for each completed order and post this to the price variance control account REQUIRED (a) Write a letter to the management of Prospecting (Pty) Ltd in which you set out the weaknesses in the system of internal control over purchases of spare parts, as described above and the potential consequences thereot b) Discuss the nature, timing and extent of your audit approach when verifying the balance of spare parts at year-end (10) QUESTIONS (30 marks) You are the auditor of Dynamic Clothes Ltd. The company manufactures clothing for the fashion industry. A production manager heads the manufacturing division. He controls the work of 20 foremen and approximately 500 workers. Wages are paid every Friday, based on hours worked during the previous calendar week. New workers are employed by the foremen. At the start of each working week (Monday) each foreman hands a blank clock card to each of his workers. The workers insert their names and employee numbers on the clock cards and then use them for that working week. The clocking device is situated at the entrance to the factory. Workers clock in and out at the entrance to the factory by putting their clock cards in the clocking device. The foremen hand the used clock cards to a wage clerk on Monday mornings. The clock cards are divided alphabetically amongst four wage clerks. Each clerk is always allocated the same section of the alphabet for which he/she is fully responsible. 1. Calculate the total number of hours worked per each clock card and record it on the relevant clock card. 2. Enter the hours worked per individual (by employee number) into the weekly wages file on the computer. After each wage clerk has entered the hours worked into the computer, the computer calculates each worker's gross pay, deductions and net pay by using the wage rates and deductions in accordance with the personnel information kept on a database. The weekly wages report is then printed by the computer. This report is kept in the wages department. One of the wage clerks verbally informs the accountant of the amount needed for the week's net wages. The accountant then prepares a cash cheque for the exact amount of the week's net wages, after which the cheque is cashed by a wage clerk. The computer prints pay envelopes for the workers to be paid, bearing the workers names and employee numbers. Each wage clerk fills the pay envelopes for the letters of the alphabet for which he/she is responsible. After all the pay envelopes are filled, no money should be left. If a discrepancy occurs, the pay envelopes are checked and corrected by the wage clerks. The pay envelopes are then sealed. On Friday afternoons the pay envelopes are handed to the relevant foremen for the weekly pay-out. Each foreman pays out the wages to the workers working for him. Unclaimed wages are given back by the various foremen to a wage clerk. REQUIRED: Identify the weaknesses in the wage system described above and recommend improvement(s) for each weakness identified. (30)