Answered step by step

Verified Expert Solution

Question

1 Approved Answer

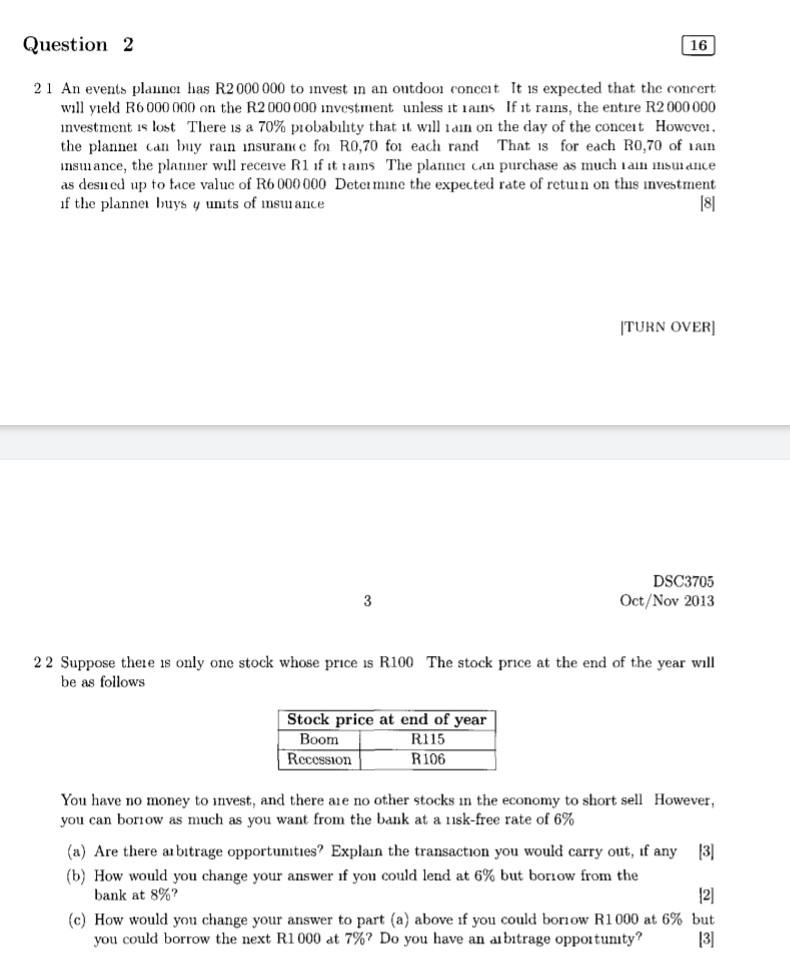

Question 2 16 21 An events planner has R2 000 000 to invest in an ontdoor concet It is expected that the concert will yield

Question 2 16 21 An events planner has R2 000 000 to invest in an ontdoor concet It is expected that the concert will yield R6 000 000 on the R2 000 000 investment unless it rains If it rains, the entire R2 000 000 investment is lost There is a 70% probability that it will lain on the day of the concert However, the planner can buy rain insurance for R0,70 for each rand That is for each R0,70 of lain instance, the planner will receive Rl of trans The plannc can purchase as much an insurance as desned up to face value of R6 000 000 Determine the expected rate of return on this investment of the planner buys y units of msu ance 181 TURN OVER] DSC3705 Oct/Nov 2013 3 22 Suppose there is only one stock whose price is R100 The stock price at the end of the year will be as follows Stock price at end of year Boom R115 Recossion R 106 You have no money to invest, and there are no other stocks in the economy to short sell However, you can borrow as much as you want from the bank at a nisk-free rate of 6% (a) Are there arbitrage opportunities? Explain the transaction you would carry out, if any 3] (b) How would you change your answer if you could lend at 6% but boriow from the bank at 8%? 12] (c) How would you change your answer to part (a) above if you could boriow R1000 at 6% but you could borrow the next R1 000 at 7%? Do you have an al bitrage opportunity? 13] Question 2 16 21 An events planner has R2 000 000 to invest in an ontdoor concet It is expected that the concert will yield R6 000 000 on the R2 000 000 investment unless it rains If it rains, the entire R2 000 000 investment is lost There is a 70% probability that it will lain on the day of the concert However, the planner can buy rain insurance for R0,70 for each rand That is for each R0,70 of lain instance, the planner will receive Rl of trans The plannc can purchase as much an insurance as desned up to face value of R6 000 000 Determine the expected rate of return on this investment of the planner buys y units of msu ance 181 TURN OVER] DSC3705 Oct/Nov 2013 3 22 Suppose there is only one stock whose price is R100 The stock price at the end of the year will be as follows Stock price at end of year Boom R115 Recossion R 106 You have no money to invest, and there are no other stocks in the economy to short sell However, you can borrow as much as you want from the bank at a nisk-free rate of 6% (a) Are there arbitrage opportunities? Explain the transaction you would carry out, if any 3] (b) How would you change your answer if you could lend at 6% but boriow from the bank at 8%? 12] (c) How would you change your answer to part (a) above if you could boriow R1000 at 6% but you could borrow the next R1 000 at 7%? Do you have an al bitrage opportunity? 13]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started