Answered step by step

Verified Expert Solution

Question

1 Approved Answer

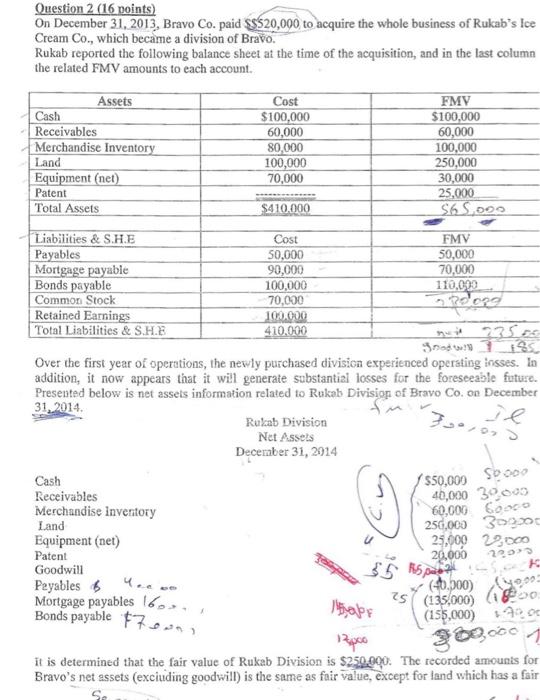

Question 2 (16 points) On December 31, 2013, Bravo Co. paid $520,000 to acquire the whole business of Rukab's Ice Cream Co., which became

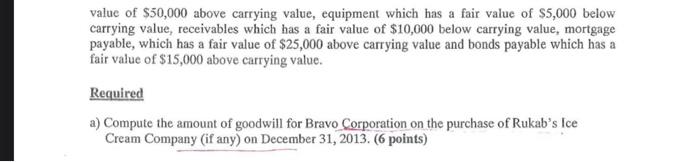

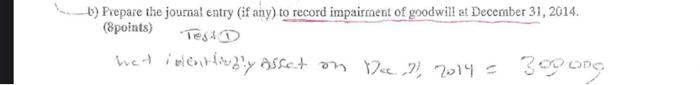

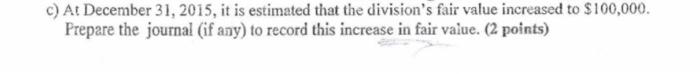

Question 2 (16 points) On December 31, 2013, Bravo Co. paid $520,000 to acquire the whole business of Rukab's Ice Cream Co., which became a division of Bravo. Rukab reported the following balance sheet at the time of the acquisition, and in the last column the related FMV amounts to each account. Assets Cost Cash $100,000 FMV $100,000 Receivables 60,000 60,000 Merchandise Inventory 80,000 100,000 Land 100,000 250,000 Equipment (net) 70,000 30,000 Patent Total Assets $410.000 25,000 $65,000 Liabilities & S.H.E Cost FMV Payables 50,000 50,000 Mortgage payable 90,000 70,000 Bonds payable 100,000 110,090 Common Stock 70,000 Retained Earnings 100.000 Total Liabilities & S.H.E 410.000 23500 Soodwi 185 Over the first year of operations, the newly purchased division experienced operating insses. In addition, it now appears that it will generate substantial losses for the foreseeable future. Presented below is net assets information related to Rukab Division of Bravo Co. on December 31, 2014. Cash Receivables Merchandise inventory Land Equipment (net) Patent Goodwill Peyables Mortgage payables 160. Bonds payable Rukab Division Net Assets December 31, 2014 je $50,000 50,000 40,000 30,000 60,000 60000 250,000 30000 25,000 22,000 20,000 22073 $5 R5 sack 1450F 12,000 (0.000) 25(135,000) (200 (155,000) on 3000001 It is determined that the fair value of Rukab Division is $250,000. The recorded amounts for Bravo's net assets (excluding goodwill) is the same as fair value, except for land which has a fair Se

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started