Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (17 marks) (a) Peter owns a company and he needs money for paying his suppliers before the deadline. The performance of his

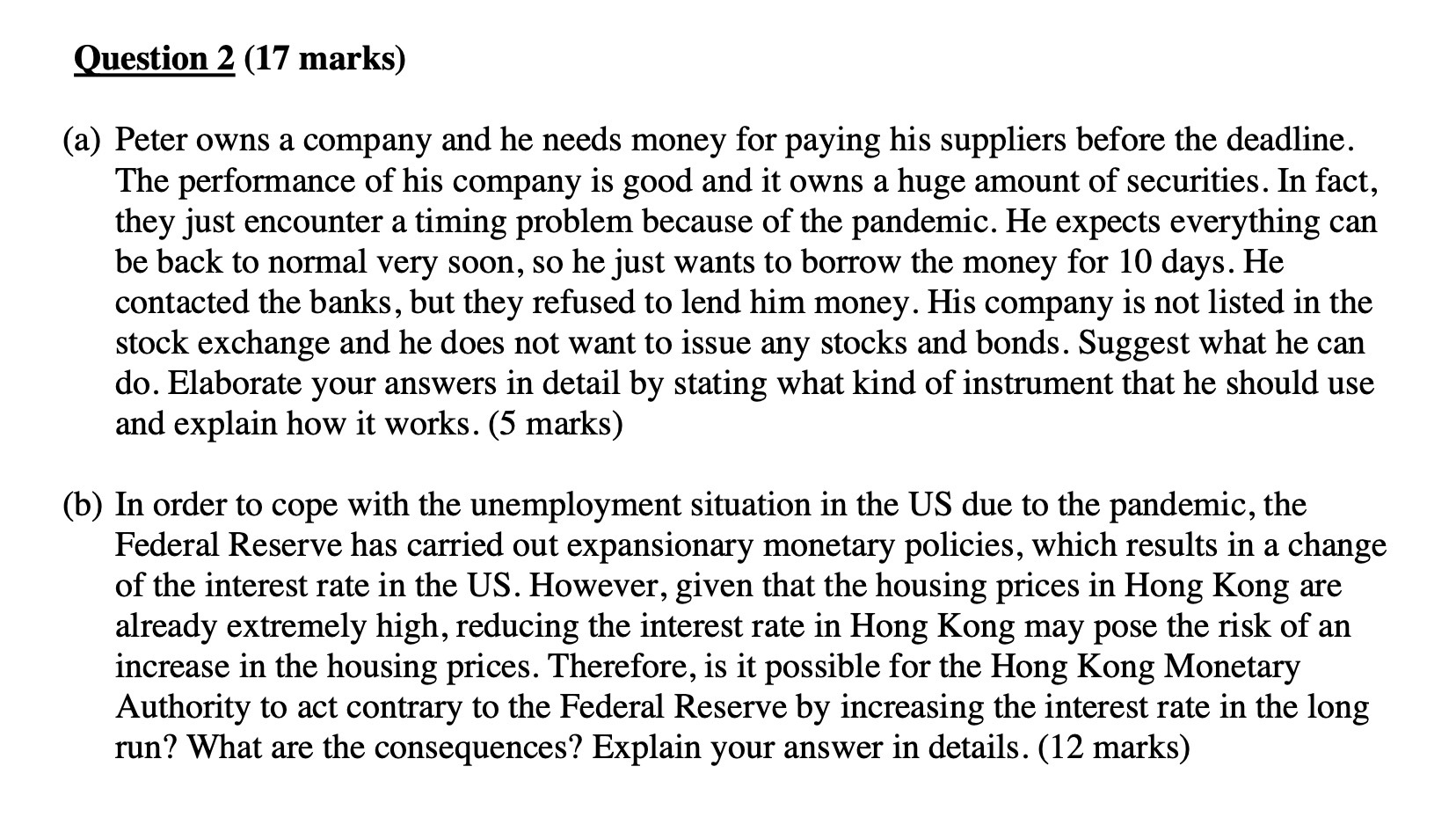

Question 2 (17 marks) (a) Peter owns a company and he needs money for paying his suppliers before the deadline. The performance of his company is good and it owns a huge amount of securities. In fact, they just encounter a timing problem because of the pandemic. He expects everything can be back to normal very soon, so he just wants to borrow the money for 10 days. He contacted the banks, but they refused to lend him money. His company is not listed in the stock exchange and he does not want to issue any stocks and bonds. Suggest what he can do. Elaborate your answers in detail by stating what kind of instrument that he should use and explain how it works. (5 marks) (b) In order to cope with the unemployment situation in the US due to the pandemic, the Federal Reserve has carried out expansionary monetary policies, which results in a change of the interest rate in the US. However, given that the housing prices in Hong Kong are already extremely high, reducing the interest rate in Hong Kong may pose the risk of an increase in the housing prices. Therefore, is it possible for the Hong Kong Monetary Authority to act contrary to the Federal Reserve by increasing the interest rate in the long run? What are the consequences? Explain your answer in details. (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Since Peters company is not listed on the stock exchange and he doesnt want to issue stocks or bonds he can consider using shortterm financing instruments such as commercial paper or a line of credi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started