Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (17 marks) Question a Grey Ltd plans to buy a new machine at the beginning of the year, to meet expected demand for

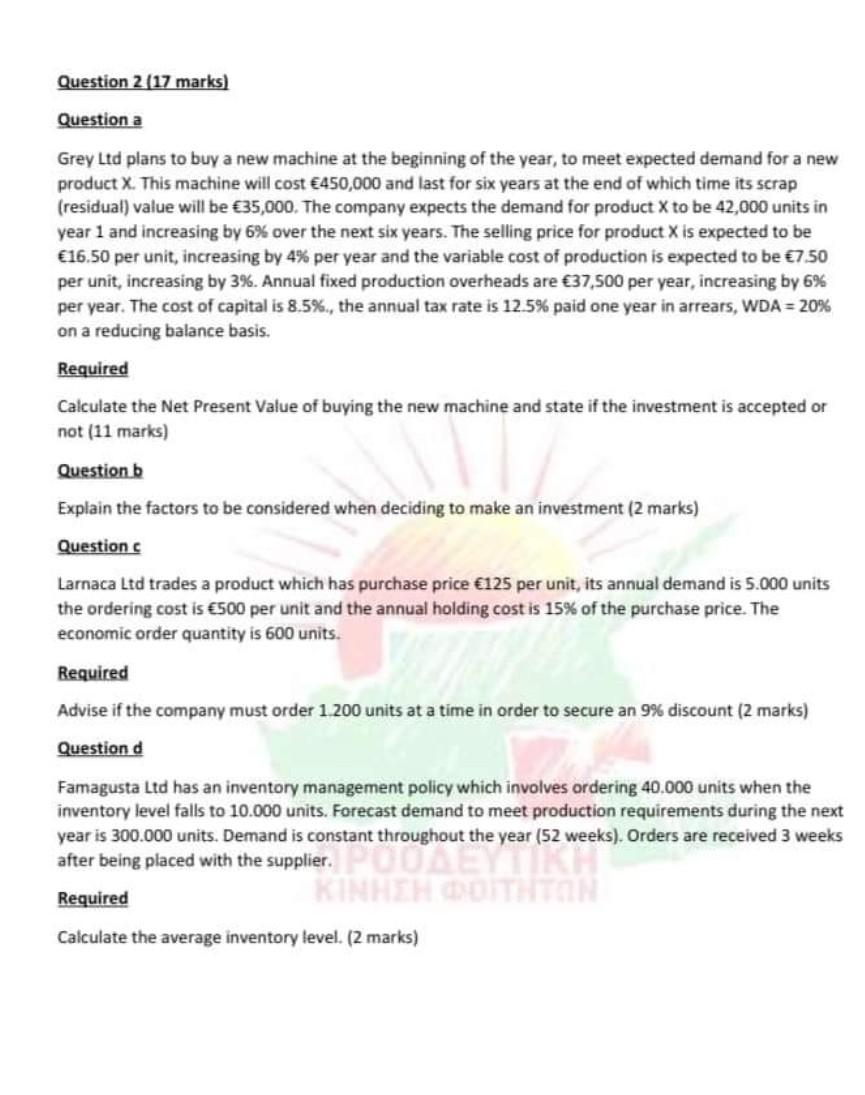

Question 2 (17 marks) Question a Grey Ltd plans to buy a new machine at the beginning of the year, to meet expected demand for a new product X. This machine will cost 450,000 and last for six years at the end of which time its scrap (residual) value will be 35,000. The company expects the demand for product X to be 42,000 units in year 1 and increasing by 6% over the next six years. The selling price for product X is expected to be 16.50 per unit, increasing by 4% per year and the variable cost of production is expected to be 7.50 per unit, increasing by 3%. Annual fixed production overheads are 37,500 per year, increasing by 6% per year. The cost of capital is 8.5%., the annual tax rate is 12.5% paid one year in arrears, WDA = 20% on a reducing balance basis. Required Calculate the Net Present Value of buying the new machine and state if the investment is accepted or not (11 marks) Question b Explain the factors to be considered when deciding to make an investment (2 marks) Question c Larnaca Ltd trades a product which has purchase price 125 per unit, its annual demand is 5.000 units the ordering cost is 500 per unit and the annual holding cost is 15% of the purchase price. The economic order quantity is 600 units. Required Advise if the company must order 1.200 units at a time in order to secure an 9% discount (2 marks) Question d Famagusta Ltd has an inventory management policy which involves ordering 40.000 units when the inventory level falls to 10.000 units. Forecast demand to meet production requirements during the next year is 300.000 units. Demand is constant throughout the year (52 weeks). Orders are received 3 weeks after being placed with the supplier. PODAEYTIKH KINHEN DOITHTON Required Calculate the average inventory level. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started