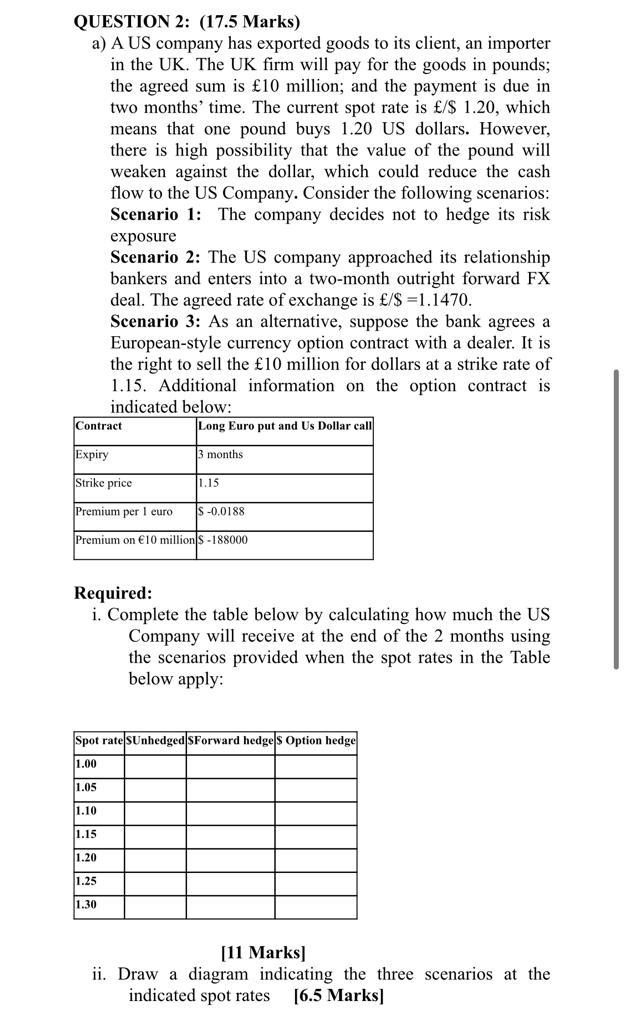

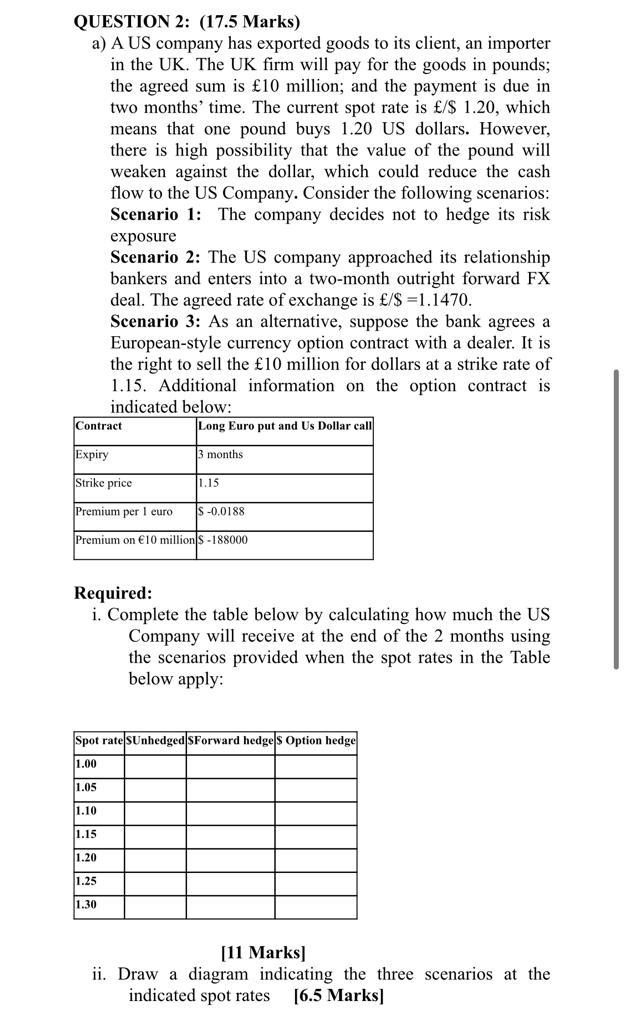

QUESTION 2: (17.5 Marks) a) A US company has exported goods to its client, an importer in the UK. The UK firm will pay for the goods in pounds; the agreed sum is 10 million; and the payment is due in two months' time. The current spot rate is /$ 1.20, which means that one pound buys 1.20 US dollars. However, there is high possibility that the value of the pound will weaken against the dollar, which could reduce the cash flow to the US Company. Consider the following scenarios: Scenario 1: The company decides not to hedge its risk exposure Scenario 2: The US company approached its relationship bankers and enters into a two-month outright forward FX deal. The agreed rate of exchange is /$ =1.1470. Scenario 3: As an alternative, suppose the bank agrees a European-style currency option contract with a dealer. It is the right to sell the 10 million for dollars at a strike rate of 1.15. Additional information on the option contract is indicated below: Long Euro put and Us Dollar call Contract Expiry 3 months Strike price 1.15 Premium per 1 euro IS -0.0188 Premium on 10 millions - 188000 Required: i. Complete the table below by calculating how much the US Company will receive at the end of the 2 months using the scenarios provided when the spot rates in the Table below apply: Spot rateSUnhedged Forward hedges Option hedge 1.00 1.05 1.10 (1.15 1.20 1.25 1.30 [11 Marks) ii. Draw a diagram indicating the three scenarios at the indicated spot rates [6.5 Marks) QUESTION 2: (17.5 Marks) a) A US company has exported goods to its client, an importer in the UK. The UK firm will pay for the goods in pounds; the agreed sum is 10 million; and the payment is due in two months' time. The current spot rate is /$ 1.20, which means that one pound buys 1.20 US dollars. However, there is high possibility that the value of the pound will weaken against the dollar, which could reduce the cash flow to the US Company. Consider the following scenarios: Scenario 1: The company decides not to hedge its risk exposure Scenario 2: The US company approached its relationship bankers and enters into a two-month outright forward FX deal. The agreed rate of exchange is /$ =1.1470. Scenario 3: As an alternative, suppose the bank agrees a European-style currency option contract with a dealer. It is the right to sell the 10 million for dollars at a strike rate of 1.15. Additional information on the option contract is indicated below: Long Euro put and Us Dollar call Contract Expiry 3 months Strike price 1.15 Premium per 1 euro IS -0.0188 Premium on 10 millions - 188000 Required: i. Complete the table below by calculating how much the US Company will receive at the end of the 2 months using the scenarios provided when the spot rates in the Table below apply: Spot rateSUnhedged Forward hedges Option hedge 1.00 1.05 1.10 (1.15 1.20 1.25 1.30 [11 Marks) ii. Draw a diagram indicating the three scenarios at the indicated spot rates [6.5 Marks)