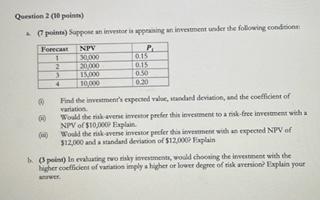

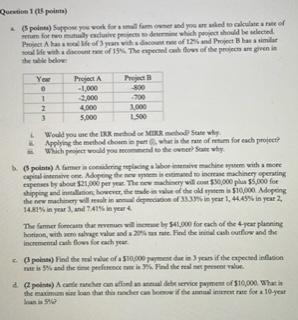

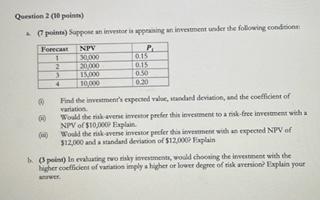

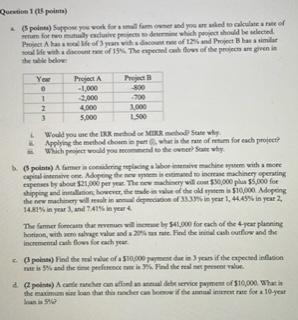

Question 2 (18 points) pointe) Suppose an investor uppring an investment under the following condition Forecast NPV P QUES 0.000 015 18.00 030 1000 0:30 Find the investmen's expected standard deviation, and the coefficient of wanation Would the riven investor prefer this movement to a risk-free with NPV of $100 aplain Would the riverse torpedier this time with an expand NPV of 312,000 and standard deviation of 512.000 Fxplain point) is evaluating to say men, would choosing the terment with the higher coeficient of artis imply higher or lower degree of risk version Explain your Durati) point) work forum und you to all of pala healinal Phase of them oleh discount of The hos of the goeie heb You PA 1 2.000 700 2 4.000 2.000 5.000 1500 Would you need some why Applying the method choomiputerom for each project? Which would you to the owner See why pont) A fumegbochine with more capitalisme Adam en med to increase machinery operating expenses about $20.000 per. They wil.com $90,000 $5,000 for shipping and into however, de voleo the old tem $10,000 Meene the new machinery will de 33% in year 1.443 in year 2 14.81% in year and 715 in your The fumer focus will now by S4,300 for each of the year planning hation, with relevald 20 Find the churflow and the incrementachows for each year po) Find the role of a 50.000 de oas if the expected inflation rates and completa 2 pointe) Acuerno Video 510,000 What is so that there where for 10 year Question 2 (18 points) pointe) Suppose an investor uppring an investment under the following condition Forecast NPV P QUES 0.000 015 18.00 030 1000 0:30 Find the investmen's expected standard deviation, and the coefficient of wanation Would the riven investor prefer this movement to a risk-free with NPV of $100 aplain Would the riverse torpedier this time with an expand NPV of 312,000 and standard deviation of 512.000 Fxplain point) is evaluating to say men, would choosing the terment with the higher coeficient of artis imply higher or lower degree of risk version Explain your Durati) point) work forum und you to all of pala healinal Phase of them oleh discount of The hos of the goeie heb You PA 1 2.000 700 2 4.000 2.000 5.000 1500 Would you need some why Applying the method choomiputerom for each project? Which would you to the owner See why pont) A fumegbochine with more capitalisme Adam en med to increase machinery operating expenses about $20.000 per. They wil.com $90,000 $5,000 for shipping and into however, de voleo the old tem $10,000 Meene the new machinery will de 33% in year 1.443 in year 2 14.81% in year and 715 in your The fumer focus will now by S4,300 for each of the year planning hation, with relevald 20 Find the churflow and the incrementachows for each year po) Find the role of a 50.000 de oas if the expected inflation rates and completa 2 pointe) Acuerno Video 510,000 What is so that there where for 10 year