Answered step by step

Verified Expert Solution

Question

1 Approved Answer

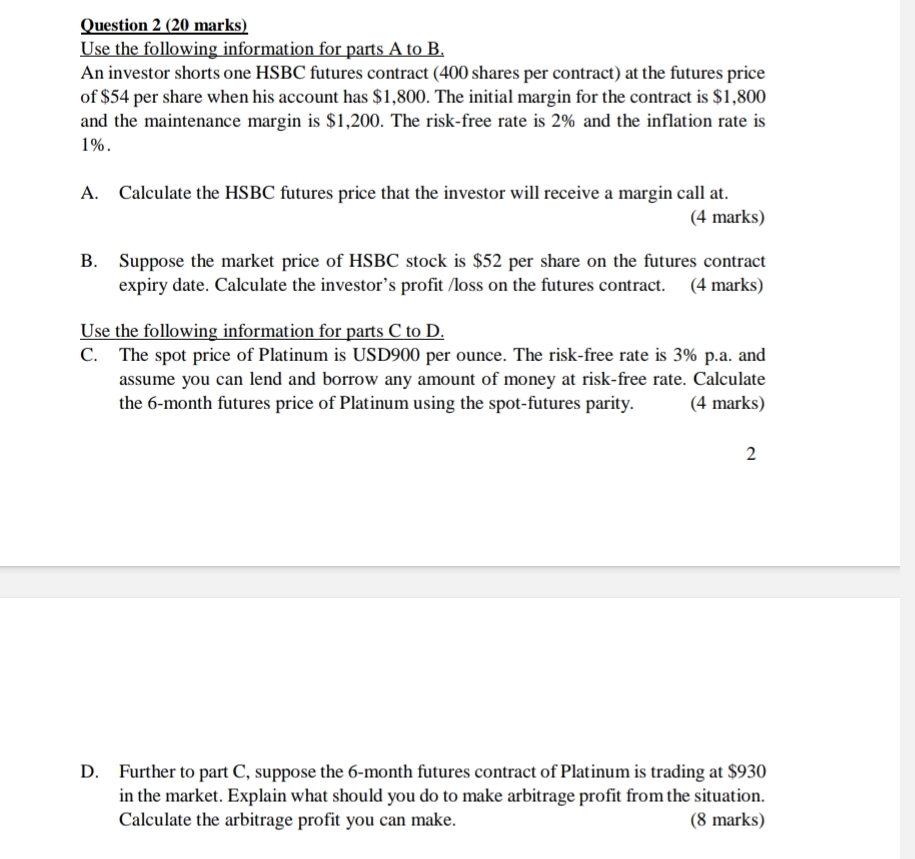

Question 2 ( 2 0 marks ) Use the following information for parts A to B . An investor shorts one HSBC futures contract (

Question marks

Use the following information for parts A to B

An investor shorts one HSBC futures contract shares per contract at the futures price of $ per share when his account has $ The initial margin for the contract is $ and the maintenance margin is $ The riskfree rate is and the inflation rate is

A Calculate the HSBC futures price that the investor will receive a margin call at

marks

B Suppose the market price of HSBC stock is $ per share on the futures contract expiry date. Calculate the investor's profitloss on the futures contract. marks

Use the following information for parts to

C The spot price of Platinum is USD per ounce. The riskfree rate is pa and assume you can lend and borrow any amount of money at riskfree rate. Calculate the month futures price of Platinum using the spotfutures parity.

marks

D Further to part C suppose the month futures contract of Platinum is trading at $ in the market. Explain what should you do to make arbitrage profit from the situation. Calculate the arbitrage profit you can make.

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started