Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 2 pts Clooney Inc. common stock paid $ 5 in dividends last year. Dividends are expected to grow at a 9 % annual

Question

pts

Clooney Inc. common stock paid $ in dividends last year. Dividends are expected to grow at a annual rate forever. If your required rate of return is how much should you pay for this stock? Reminder: Be careful with Dfuture versus DO past The formula wants D If you have D you will need to solve for D

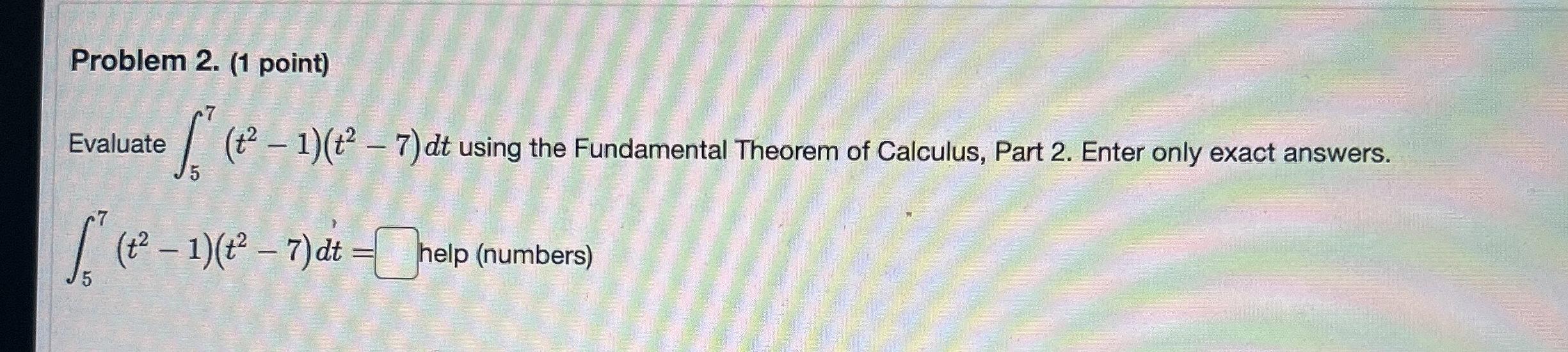

Problem point

Evaluate using the Fundamental Theorem of Calculus, Part Enter only exact answers. elp numbers

Problem point

Evaluate using the Fundamental Theorem of Calculus, Part Enter only exact answers. elp numbers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started