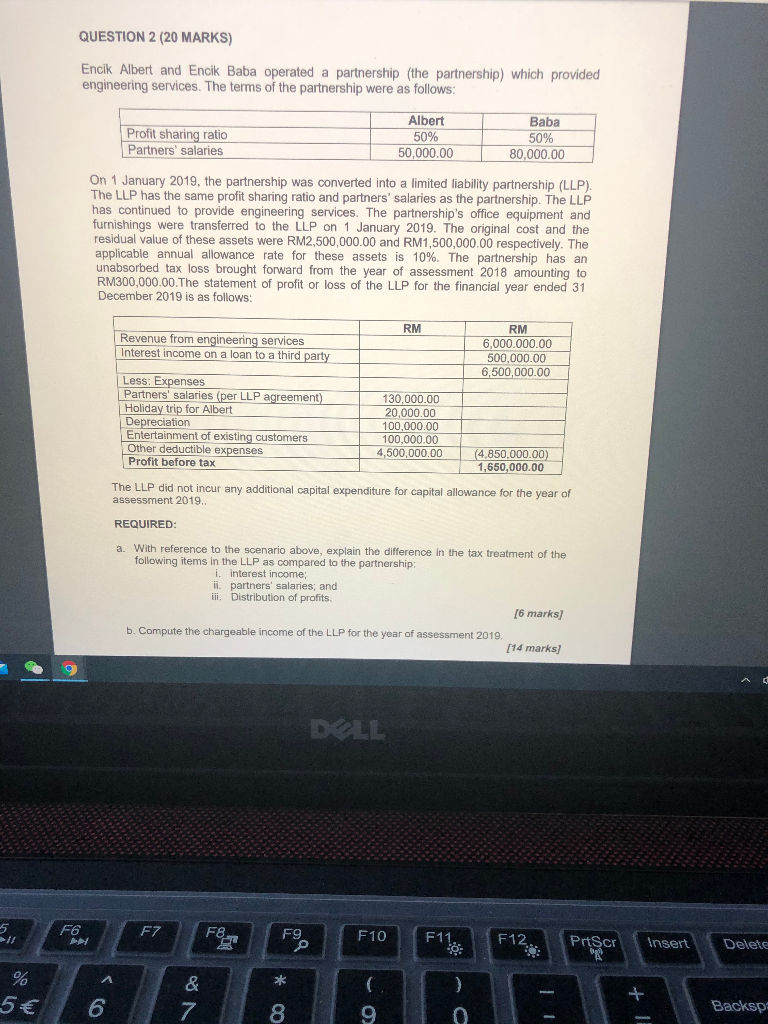

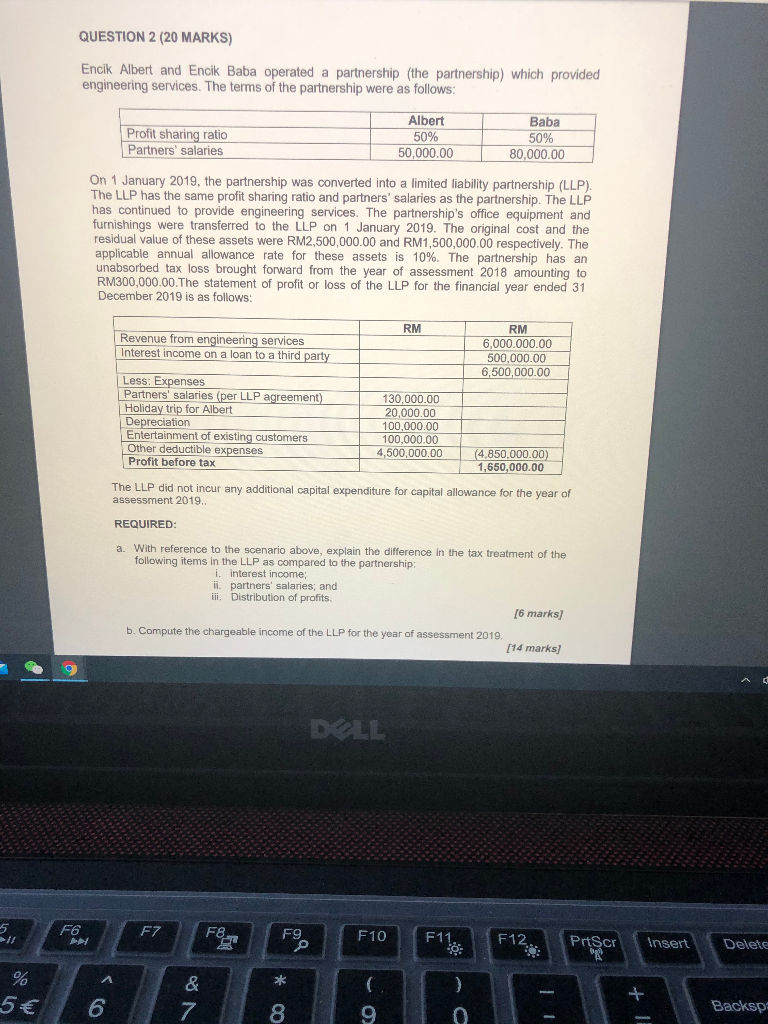

QUESTION 2 (20 MARKS) Encik Albert and Encik Baba operated a partnership (the partnership) which provided engineering services. The terms of the partnership were as follows: Profit sharing ratio Partners' salaries Albert 50% 50,000.00 Baba 50% 80,000.00 On 1 January 2019, the partnership was converted into a limited liability partnership (LLP). The LLP has the same profit sharing ratio and partners' salaries as the partnership. The LLP has continued to provide engineering services. The partnership's office equipment and furnishings were transferred to the LLP on 1 January 2019. The original cost and the residual value of these assets were RM2,500,000.00 and RM1,500,000.00 respectively. The applicable annual allowance rate for these assets is 10%. The partnership has an unabsorbed tax loss brought forward from the year of assessment 2018 amounting to RM300,000.00. The statement of profit or loss of the LLP for the financial year ended 31 December 2019 is as follows: RM Revenue from engineering services Interest income on a loan to a third party RM 6,000.000.00 500,000.00 6,500,000.00 Less: Expenses Partners' salaries (per LLP agreement) Holiday trip for Albert Depreciation Entertainment of existing customers Other deductible expenses Profit before tax 130,000.00 20,000.00 100,000.00 100,000.00 4,500,000.00 (4.850.000.00) 1,650,000.00 The LLP did not incur any additional capital expenditure for capital allowance for the year of assessment 2019, REQUIRED: a. With reference to the scenario above, explain the difference in the tax treatment of the following items in the LLP as compared to the partnership: i interest income ii. partners' salaries; and ii. Distribution of profits. [6 marks] b. Compute the chargeable income of the LLP for the year of assessment 2019. [14 marks] DOLL 5 FO F7 F8 FG F10 F11. F12. PetScr insert Delete % 5 6 & 7 * 00 9 0 Backsph 11 QUESTION 2 (20 MARKS) Encik Albert and Encik Baba operated a partnership (the partnership) which provided engineering services. The terms of the partnership were as follows: Profit sharing ratio Partners' salaries Albert 50% 50,000.00 Baba 50% 80,000.00 On 1 January 2019, the partnership was converted into a limited liability partnership (LLP). The LLP has the same profit sharing ratio and partners' salaries as the partnership. The LLP has continued to provide engineering services. The partnership's office equipment and furnishings were transferred to the LLP on 1 January 2019. The original cost and the residual value of these assets were RM2,500,000.00 and RM1,500,000.00 respectively. The applicable annual allowance rate for these assets is 10%. The partnership has an unabsorbed tax loss brought forward from the year of assessment 2018 amounting to RM300,000.00. The statement of profit or loss of the LLP for the financial year ended 31 December 2019 is as follows: RM Revenue from engineering services Interest income on a loan to a third party RM 6,000.000.00 500,000.00 6,500,000.00 Less: Expenses Partners' salaries (per LLP agreement) Holiday trip for Albert Depreciation Entertainment of existing customers Other deductible expenses Profit before tax 130,000.00 20,000.00 100,000.00 100,000.00 4,500,000.00 (4.850.000.00) 1,650,000.00 The LLP did not incur any additional capital expenditure for capital allowance for the year of assessment 2019, REQUIRED: a. With reference to the scenario above, explain the difference in the tax treatment of the following items in the LLP as compared to the partnership: i interest income ii. partners' salaries; and ii. Distribution of profits. [6 marks] b. Compute the chargeable income of the LLP for the year of assessment 2019. [14 marks] DOLL 5 FO F7 F8 FG F10 F11. F12. PetScr insert Delete % 5 6 & 7 * 00 9 0 Backsph 11