Answered step by step

Verified Expert Solution

Question

1 Approved Answer

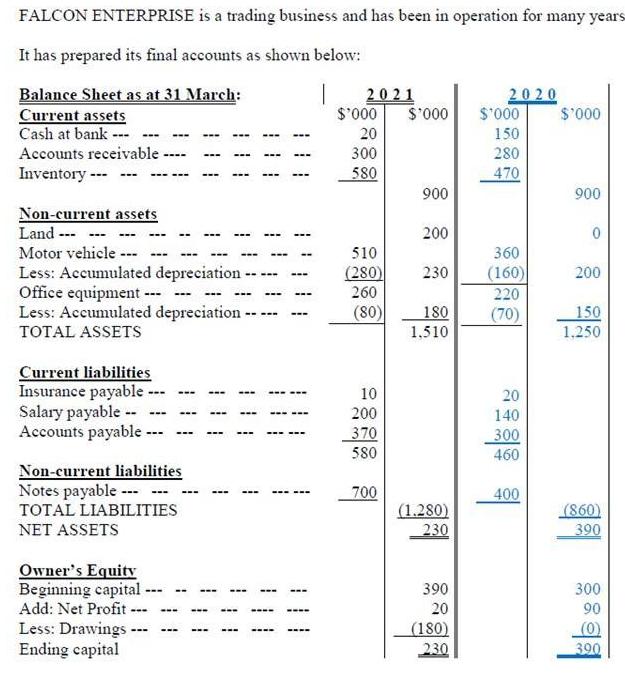

FALCON ENTERPRISE is a trading business and has been in operation for many years It has prepared its final accounts as shown below: Balance

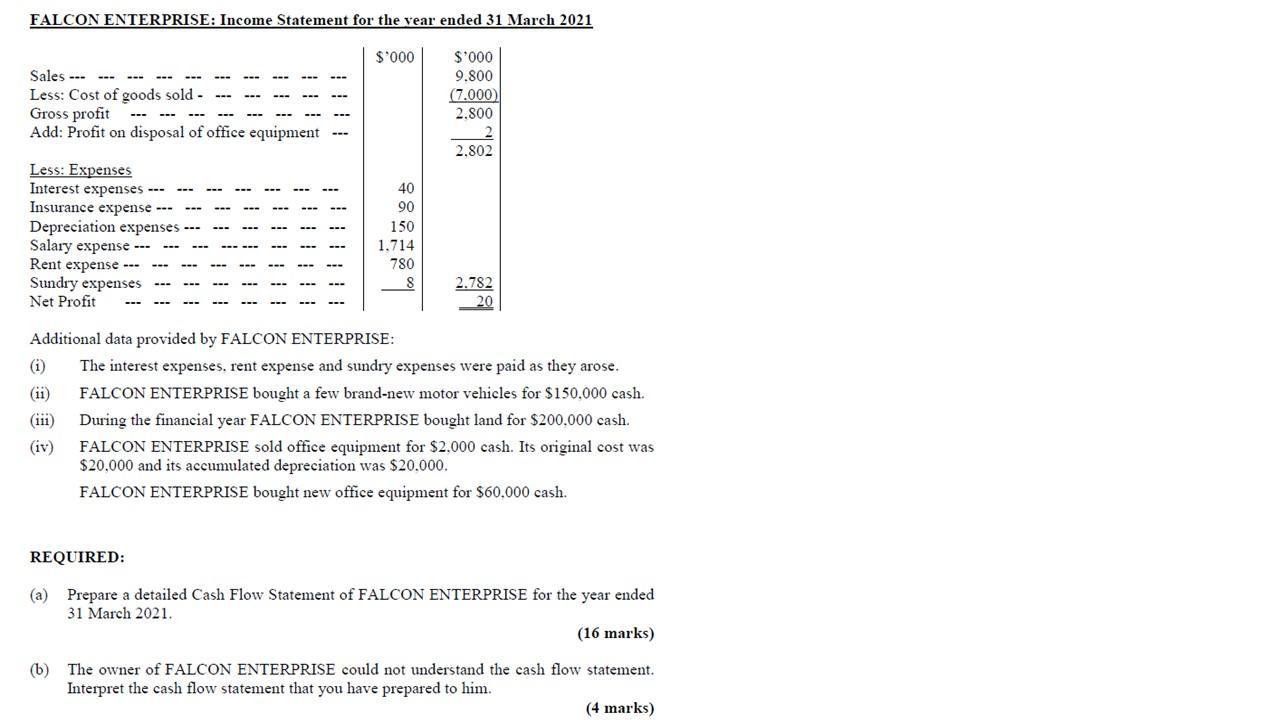

FALCON ENTERPRISE is a trading business and has been in operation for many years It has prepared its final accounts as shown below: Balance Sheet as at 31 March: Current assets Cash at bank - 2021 000.$ S'000 2020 $'000 $'000 20 150 Accounts receivable ---- 300 280 Inventory --- 580 470 900 900 Non-current assets Land --- Motor vehicle -.. 200 --- --- 510 360 (280) (160) Less: Accumulated depreciation Office equipment --- Less: Accumulated depreciation 230 200 260 220 --- (80) 180 (70) 150 1,250 TOTAL ASSETS 1,510 Current liabilities Insurance payable- Salary payable -- Accounts payable - 10 20 --- --- 200 140 --- 370 300 460 --- --- 580 Non-current liabilities Notes payable --- TOTAL LIABILITIES 700 400 (1.280) 230 (860) 390 NET ASSETS Owner's Equity Beginning capital --- Add: Net Profit --- Less: Drawings -- Ending capital 390 300 - -- 20 90 --- (180) 230 390 FALCON ENTERPRISE: Income Statement for the vear ended 31 March 2021 000.$ s'000 Sales --- --- 9.800 Less: Cost of goods sold - Gross profit --- Add: Profit on disposal of office equipment (7.000) 2,800 --- 2,802 Less: Expenses Interest expenses Insurance expense --- Depreciation expenses --- Salary expense --- Rent expense --- Sundry expenses --- Net Profit 40 --- --- --- --- 90 150 --- --- --- 1,714 --- --- -- --- --- --- 780 ... --- 2.782 20 --- --- --- ----- --- --- --- Additional data provided by FALCON ENTERPRISE: (i) The interest expenses, rent expense and sundry expenses were paid as they arose. (ii) FALCON ENTERPRISE bought a few brand-new motor vehicles for $150,000 cash. (ii) During the financial year FALCON ENTERPRISE bought land for $200,000 cash. (iv) FALCON ENTERPRISE sold office equipment for $2,000 cash. Its original cost was $20,000 and its accumulated depreciation was $20,000. FALCON ENTERPRISE bought new office equipment for $60,000 cash. REQUIRED: (a) Prepare a detailed Cash Flow Statement of FALCON ENTERPRISE for the year ended 31 March 2021. (16 marks) (b) The owner of FALCON ENTERPRISE could not understand the cash flow statement. Interpret the cash flow statement that you have prepared to him. (4 marks)

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

solution of both the parts is given below CASH FLOW STATEMENT YEAR ENDING MARCH 2021 CASH FLOW FROM ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6098c28b5e916_206864.pdf

180 KBs PDF File

6098c28b5e916_206864.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started