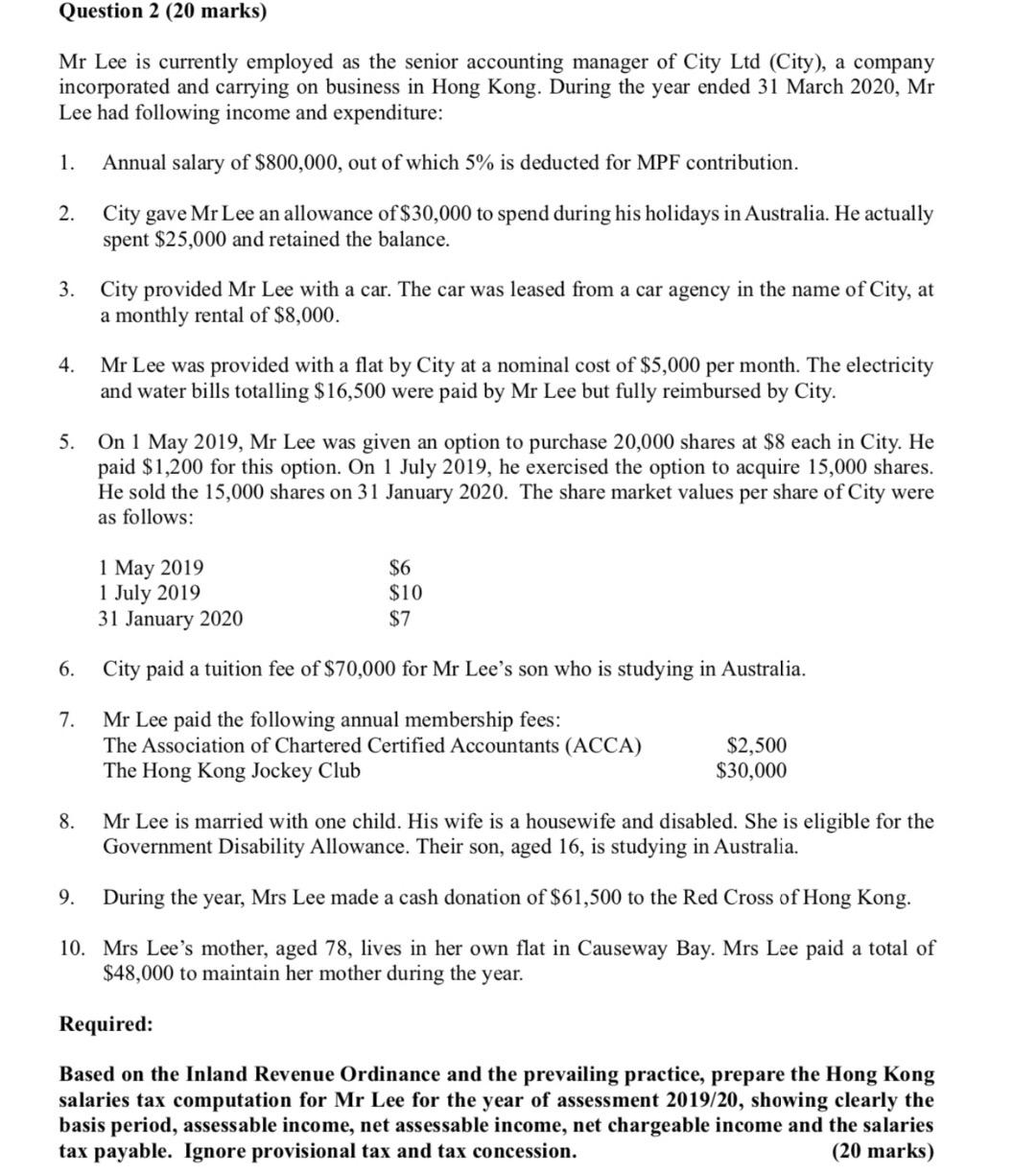

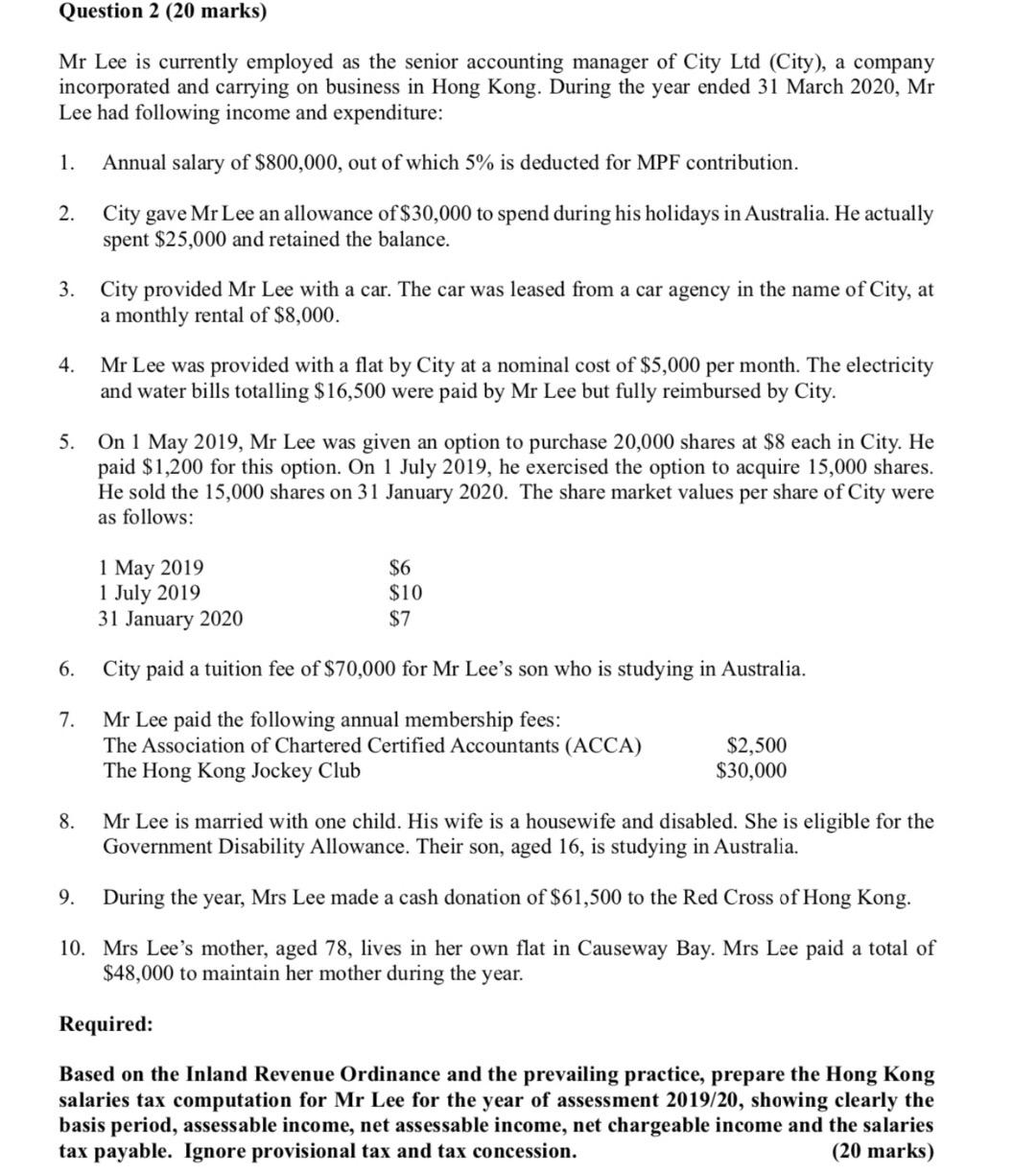

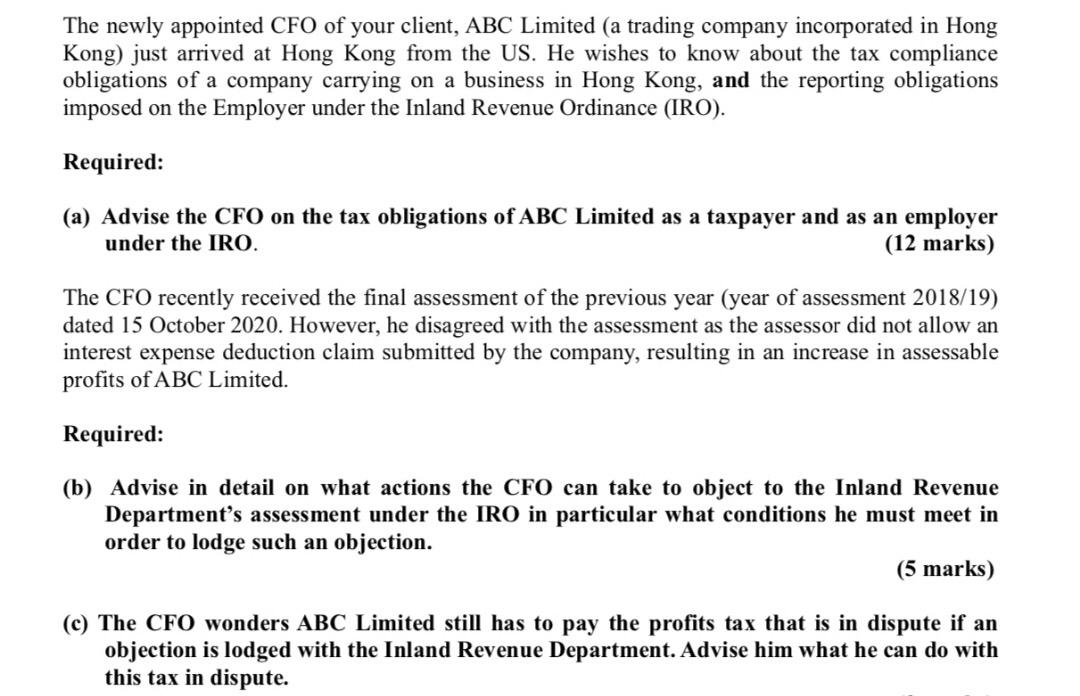

Question 2 (20 marks) Mr Lee is currently employed as the senior accounting manager of City Ltd (City), a company incorporated and carrying on business in Hong Kong. During the year ended 31 March 2020, Mr Lee had following income and expenditure: 1. Annual salary of $800,000, out of which 5% is deducted for MPF contribution. 2. City gave Mr Lee an allowance of $30,000 to spend during his holidays in Australia. He actually spent $25,000 and retained the balance. 3. City provided Mr Lee with a car. The car was leased from a car agency in the name of City, at a monthly rental of $8,000. 4. Mr Lee was provided with a flat by City at a nominal cost of $5,000 per month. The electricity and water bills totalling $ 16,500 were paid by Mr Lee but fully reimbursed by City. 5. On 1 May 2019, Mr Lee was given an option to purchase 20,000 shares at $8 each in City. He paid $1,200 for this option. On 1 July 2019, he exercised the option to acquire 15,000 shares. He sold the 15,000 shares on 31 January 2020. The share market values per share of City were as follows: 1 May 2019 1 July 2019 31 January 2020 $6 $10 $7 6. City paid a tuition fee of $70,000 for Mr Lee's son who is studying in Australia. 7. Mr Lee paid the following annual membership fees: The Association of Chartered Certified Accountants (ACCA) The Hong Kong Jockey Club $2,500 $30,000 8. Mr Lee is married with one child. His wife is a housewife and disabled. She is eligible for the Government Disability Allowance. Their son, aged 16, is studying in Australia. 9. During the year, Mrs Lee made a cash donation of $61,500 to the Red Cross of Hong Kong. 10. Mrs Lee's mother, aged 78, lives in her own flat in Causeway Bay. Mrs Lee paid a total of $48,000 to maintain her mother during the year. Required: Based on the Inland Revenue Ordinance and the prevailing practice, prepare the Hong Kong salaries tax computation for Mr Lee for the year of assessment 2019/20, showing clearly the basis period, assessable income, net assessable income, net chargeable income and the salaries tax payable. Ignore provisional tax and tax concession. (20 marks) The newly appointed CFO of your client, ABC Limited (a trading company incorporated in Hong Kong) just arrived at Hong Kong from the US. He wishes to know about the tax compliance obligations of a company carrying on a business in Hong Kong, and the reporting obligations imposed on the Employer under the Inland Revenue Ordinance (IRO). Required: (a) Advise the CFO on the tax obligations of ABC Limited as a taxpayer and as an employer under the IRO. (12 marks) The CFO recently received the final assessment of the previous year (year of assessment 2018/19) dated 15 October 2020. However, he disagreed with the assessment as the assessor did not allow an interest expense deduction claim submitted by the company, resulting in an increase in assessable profits of ABC Limited. Required: (b) Advise in detail on what actions the CFO can take to object to the Inland Revenue Department's assessment under the IRO in particular what conditions he must meet in order to lodge such an objection. (5 marks) (c) The CFO wonders ABC Limited still has to pay the profits tax that is in dispute if an objection is lodged with the Inland Revenue Department. Advise him what he can do with this tax in dispute. Question 2 (20 marks) Mr Lee is currently employed as the senior accounting manager of City Ltd (City), a company incorporated and carrying on business in Hong Kong. During the year ended 31 March 2020, Mr Lee had following income and expenditure: 1. Annual salary of $800,000, out of which 5% is deducted for MPF contribution. 2. City gave Mr Lee an allowance of $30,000 to spend during his holidays in Australia. He actually spent $25,000 and retained the balance. 3. City provided Mr Lee with a car. The car was leased from a car agency in the name of City, at a monthly rental of $8,000. 4. Mr Lee was provided with a flat by City at a nominal cost of $5,000 per month. The electricity and water bills totalling $ 16,500 were paid by Mr Lee but fully reimbursed by City. 5. On 1 May 2019, Mr Lee was given an option to purchase 20,000 shares at $8 each in City. He paid $1,200 for this option. On 1 July 2019, he exercised the option to acquire 15,000 shares. He sold the 15,000 shares on 31 January 2020. The share market values per share of City were as follows: 1 May 2019 1 July 2019 31 January 2020 $6 $10 $7 6. City paid a tuition fee of $70,000 for Mr Lee's son who is studying in Australia. 7. Mr Lee paid the following annual membership fees: The Association of Chartered Certified Accountants (ACCA) The Hong Kong Jockey Club $2,500 $30,000 8. Mr Lee is married with one child. His wife is a housewife and disabled. She is eligible for the Government Disability Allowance. Their son, aged 16, is studying in Australia. 9. During the year, Mrs Lee made a cash donation of $61,500 to the Red Cross of Hong Kong. 10. Mrs Lee's mother, aged 78, lives in her own flat in Causeway Bay. Mrs Lee paid a total of $48,000 to maintain her mother during the year. Required: Based on the Inland Revenue Ordinance and the prevailing practice, prepare the Hong Kong salaries tax computation for Mr Lee for the year of assessment 2019/20, showing clearly the basis period, assessable income, net assessable income, net chargeable income and the salaries tax payable. Ignore provisional tax and tax concession. (20 marks) The newly appointed CFO of your client, ABC Limited (a trading company incorporated in Hong Kong) just arrived at Hong Kong from the US. He wishes to know about the tax compliance obligations of a company carrying on a business in Hong Kong, and the reporting obligations imposed on the Employer under the Inland Revenue Ordinance (IRO). Required: (a) Advise the CFO on the tax obligations of ABC Limited as a taxpayer and as an employer under the IRO. (12 marks) The CFO recently received the final assessment of the previous year (year of assessment 2018/19) dated 15 October 2020. However, he disagreed with the assessment as the assessor did not allow an interest expense deduction claim submitted by the company, resulting in an increase in assessable profits of ABC Limited. Required: (b) Advise in detail on what actions the CFO can take to object to the Inland Revenue Department's assessment under the IRO in particular what conditions he must meet in order to lodge such an objection. (5 marks) (c) The CFO wonders ABC Limited still has to pay the profits tax that is in dispute if an objection is lodged with the Inland Revenue Department. Advise him what he can do with this tax in dispute