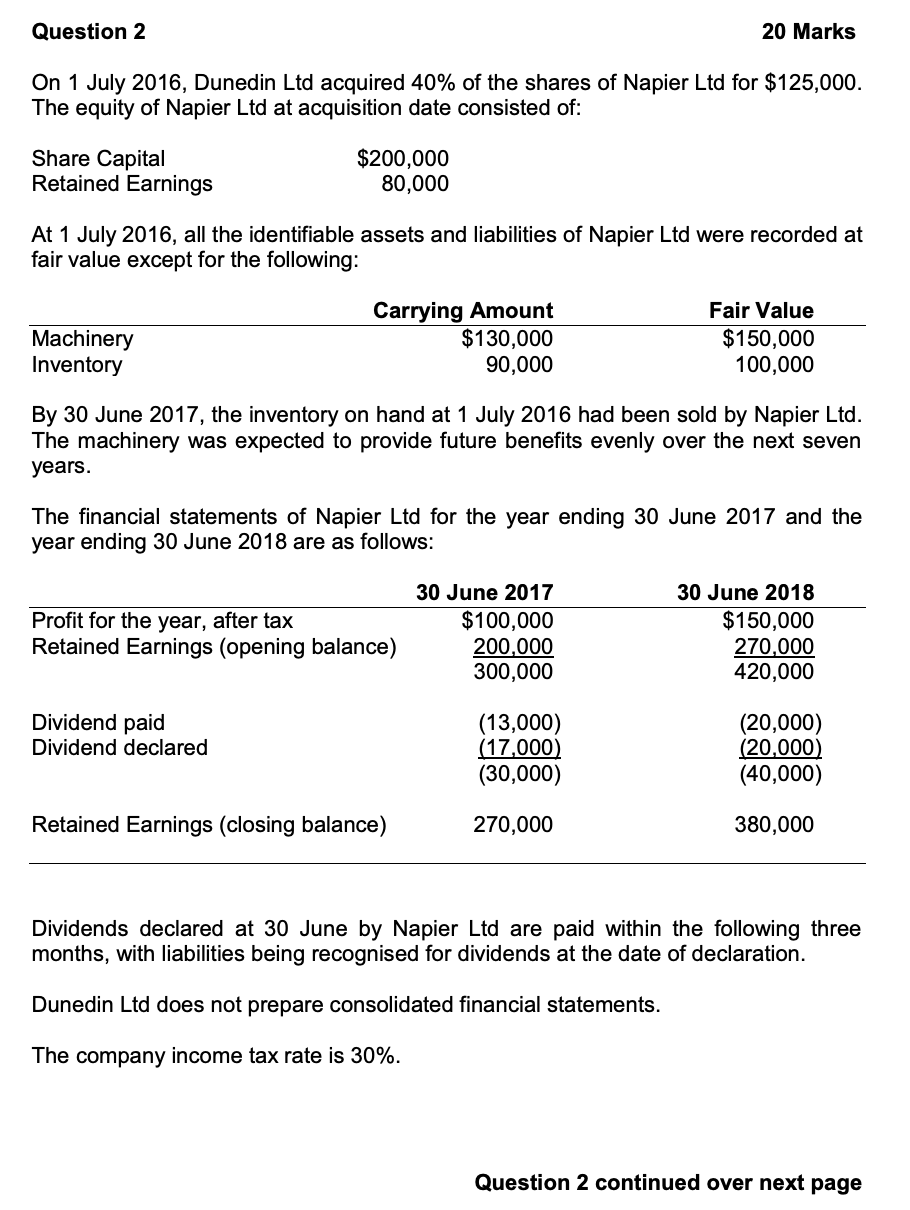

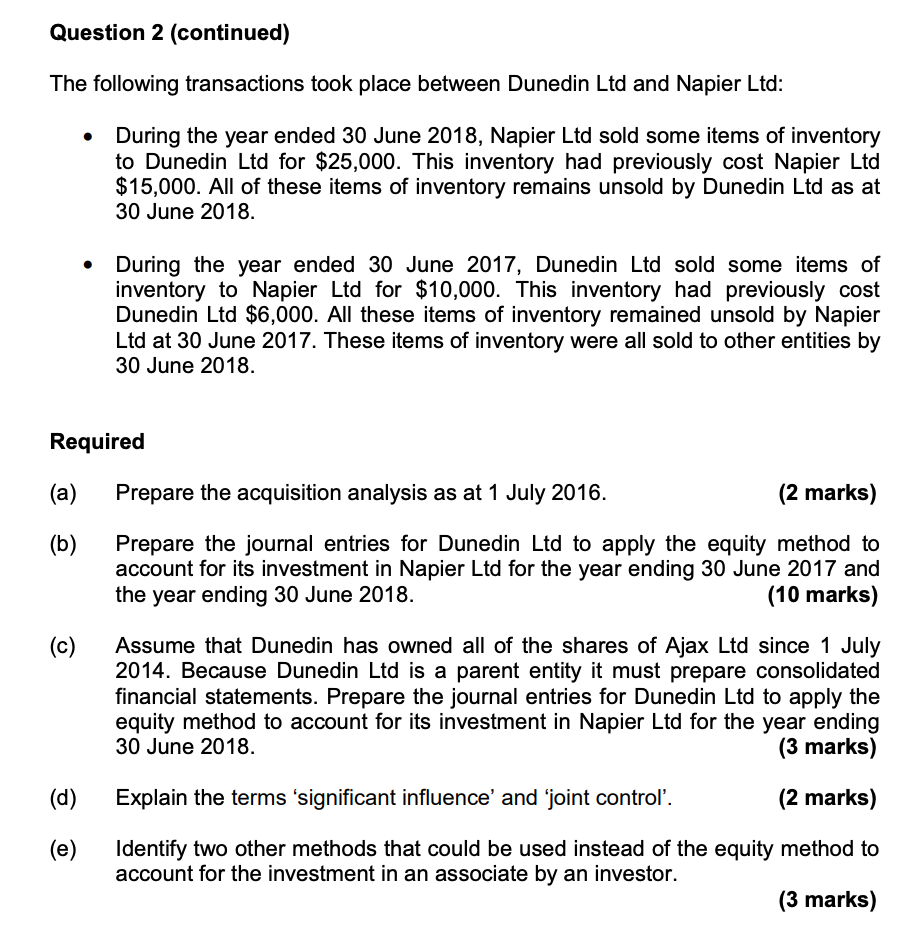

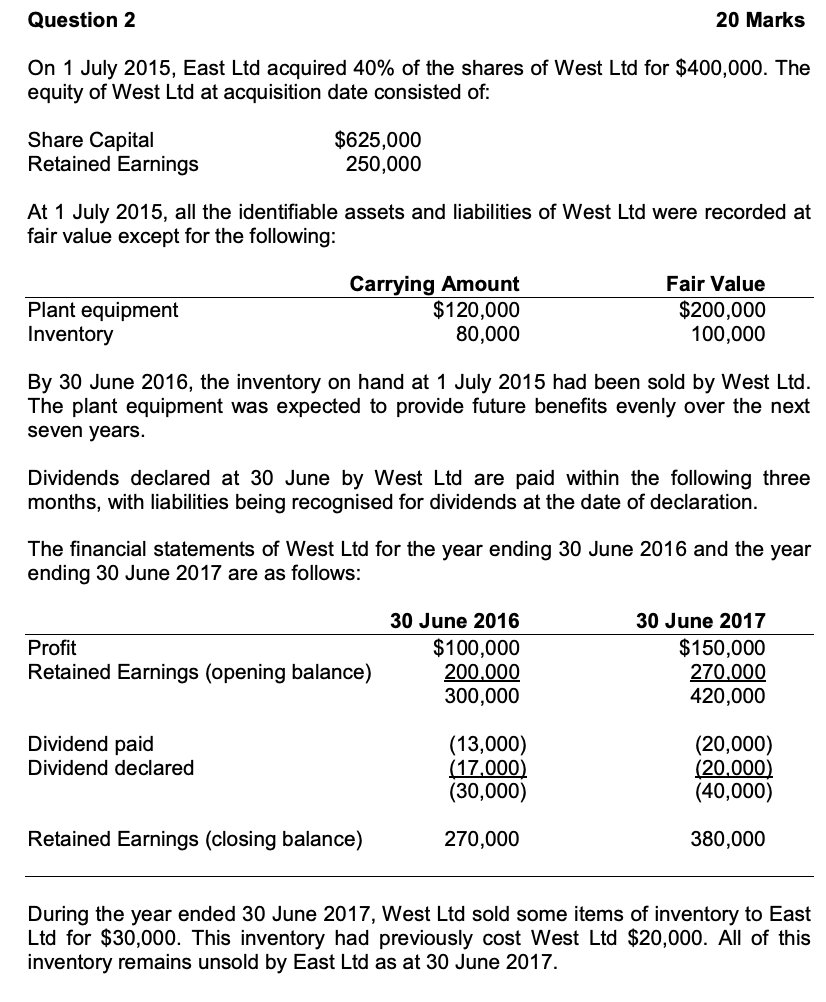

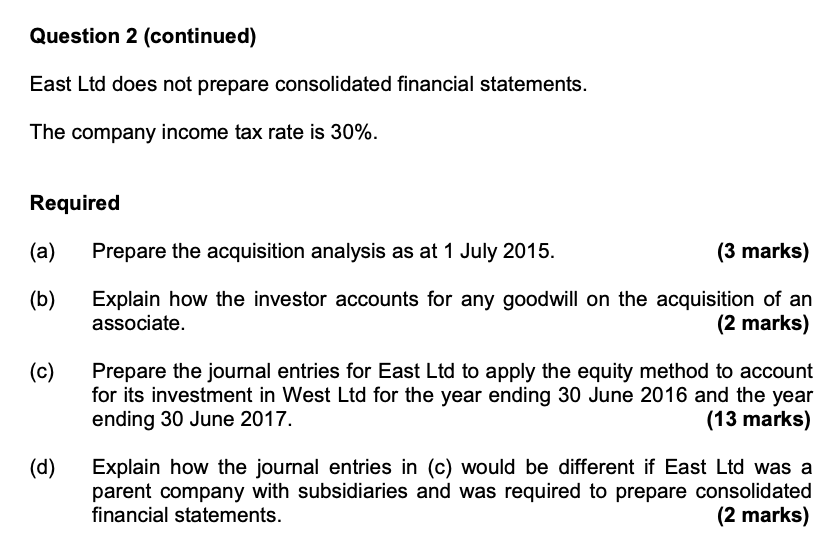

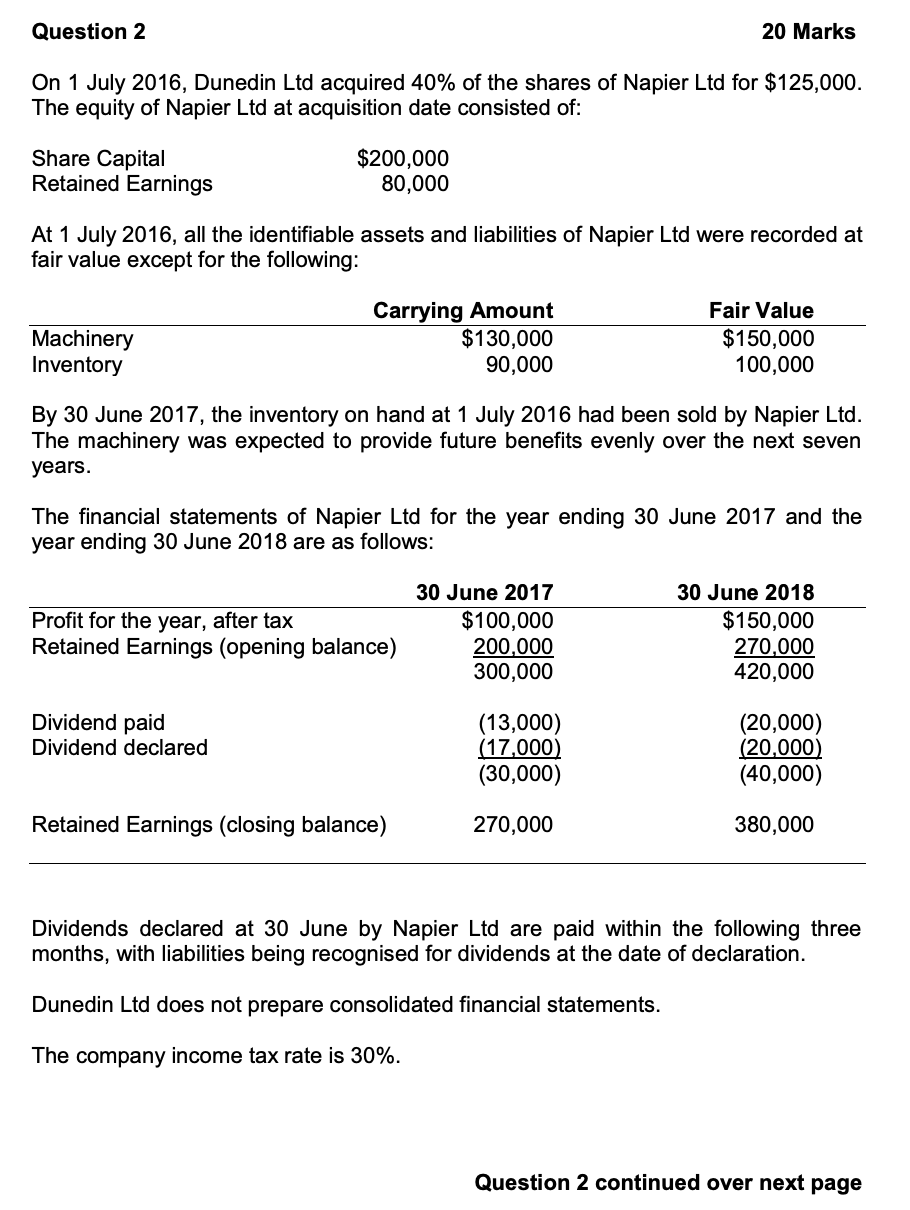

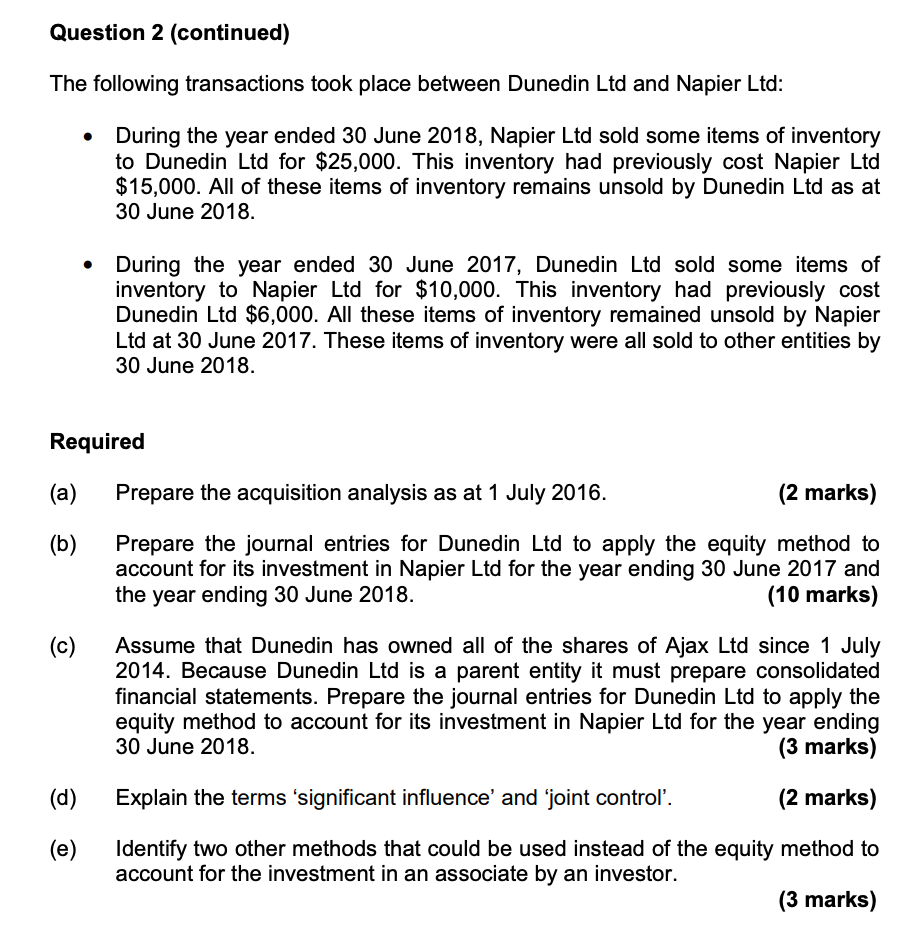

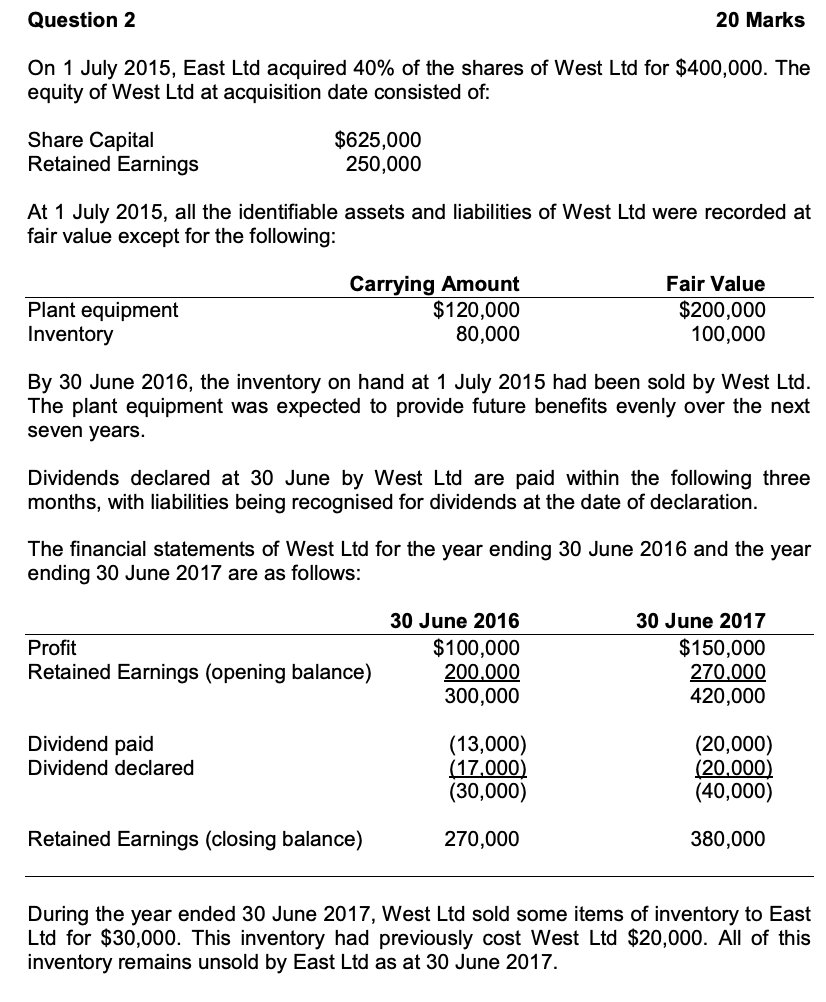

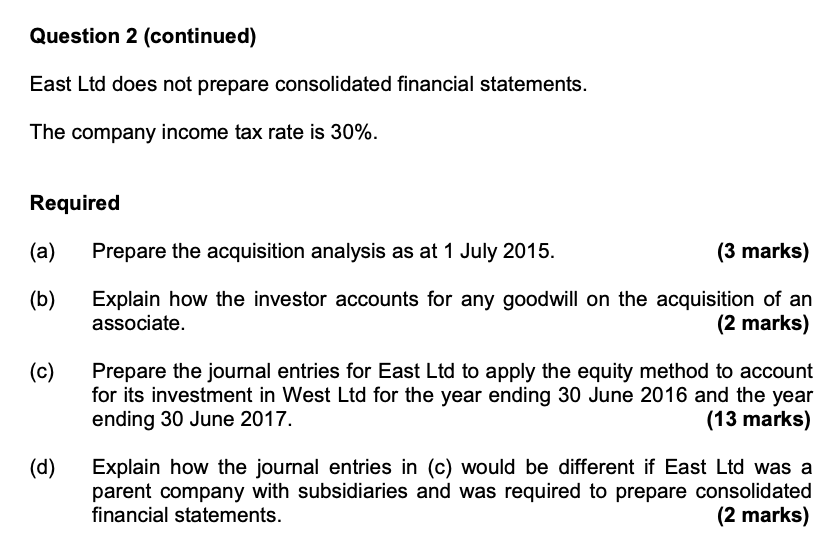

Question 2 20 Marks On 1 July 2016, Dunedin Ltd acquired 40% of the shares of Napier Ltd for $125,000. The equity of Napier Ltd at acquisition date consisted of: Share Capital Retained Earnings $200,000 80,000 At 1 July 2016, all the identifiable assets and liabilities of Napier Ltd were recorded at fair value except for the following: Machinery Inventory Carrying Amount $130,000 90,000 Fair Value $150,000 100,000 By 30 June 2017, the inventory on hand at 1 July 2016 had been sold by Napier Ltd. The machinery was expected to provide future benefits evenly over the next seven years. The financial statements of Napier Ltd for the year ending 30 June 2017 and the year ending 30 June 2018 are as follows: Profit for the year, after tax Retained Earnings (opening balance) 30 June 2017 $100,000 200,000 300,000 30 June 2018 $150,000 270,000 420,000 Dividend paid Dividend declared (13,000) (17,000) (30,000) (20,000) (20,000) (40,000) Retained Earnings (closing balance) 270,000 380,000 Dividends declared at 30 June by Napier Ltd are paid within the following three months, with liabilities being recognised for dividends at the date of declaration. Dunedin Ltd does not prepare consolidated financial statements. The company income tax rate is 30%. Question 2 continued over next page Question 2 (continued) The following transactions took place between Dunedin Ltd and Napier Ltd: During the year ended 30 June 2018, Napier Ltd sold some items of inventory to Dunedin Ltd for $25,000. This inventory had previously cost Napier Ltd $15,000. All of these items of inventory remains unsold by Dunedin Ltd as at 30 June 2018. During the year ended 30 June 2017, Dunedin Ltd sold some items of inventory to Napier Ltd for $10,000. This inventory had previously cost Dunedin Ltd $6,000. All these items of inventory remained unsold by Napier Ltd at 30 June 2017. These items of inventory were all sold to other entities by 30 June 2018. Required (a) Prepare the acquisition analysis as at 1 July 2016. (2 marks) (b) Prepare the journal entries for Dunedin Ltd to apply the equity method to account for its investment in Napier Ltd for the year ending 30 June 2017 and the year ending 30 June 2018. (10 marks) (c) Assume that Dunedin has owned all of the shares of Ajax Ltd since 1 July 2014. Because Dunedin Ltd is a parent entity it must prepare consolidated financial statements. Prepare the journal entries for Dunedin Ltd to apply the equity method to account for its investment in Napier Ltd for the year ending 30 June 2018. (3 marks) (d) Explain the terms 'significant influence' and 'joint control. (2 marks) (e) Identify two other methods that could be used instead of the equity method to account for the investment in an associate by an investor. (3 marks) Question 2 20 Marks On 1 July 2015, East Ltd acquired 40% of the shares of West Ltd for $400,000. The equity of West Ltd at acquisition date consisted of: Share Capital Retained Earnings $625,000 250,000 At 1 July 2015, all the identifiable assets and liabilities of West Ltd were recorded at fair value except for the following: Plant equipment Inventory Carrying Amount $120,000 80,000 Fair Value $200,000 100,000 By 30 June 2016, the inventory on hand at 1 July 2015 had been sold by West Ltd. The plant equipment was expected to provide future benefits evenly over the next seven years. Dividends declared at 30 June by West Ltd are paid within the following three months, with liabilities being recognised for dividends at the date of declaration. The financial statements of West Ltd for the year ending 30 June 2016 and the year ending 30 June 2017 are as follows: Profit Retained Earnings (opening balance) 30 June 2016 $100,000 200.000 300,000 30 June 2017 $150,000 270.000 420,000 Dividend paid Dividend declared (13,000) (17,000) (30,000) (20,000) (20,000) (40,000) Retained Earnings (closing balance) 270,000 380,000 During the year ended 30 June 2017, West Ltd sold some items of inventory to East Ltd for $30,000. This inventory had previously cost West Ltd $20,000. All of this inventory remains unsold by East Ltd as at 30 June 2017. Question 2 (continued) East Ltd does not prepare consolidated financial statements. The company income tax rate is 30%. Required (a) Prepare the acquisition analysis as at 1 July 2015. (3 marks) (b) Explain how the investor accounts for any goodwill on the acquisition of an associate. (2 marks) (c) Prepare the journal entries for East Ltd to apply the equity method to account for its investment in West Ltd for the year ending 30 June 2016 and the year ending 30 June 2017. (13 marks) (d) Explain how the journal entries in (c) would be different if East Ltd was a parent company with subsidiaries and was required to prepare consolidated financial statements. (2 marks) Question 2 20 Marks On 1 July 2016, Dunedin Ltd acquired 40% of the shares of Napier Ltd for $125,000. The equity of Napier Ltd at acquisition date consisted of: Share Capital Retained Earnings $200,000 80,000 At 1 July 2016, all the identifiable assets and liabilities of Napier Ltd were recorded at fair value except for the following: Machinery Inventory Carrying Amount $130,000 90,000 Fair Value $150,000 100,000 By 30 June 2017, the inventory on hand at 1 July 2016 had been sold by Napier Ltd. The machinery was expected to provide future benefits evenly over the next seven years. The financial statements of Napier Ltd for the year ending 30 June 2017 and the year ending 30 June 2018 are as follows: Profit for the year, after tax Retained Earnings (opening balance) 30 June 2017 $100,000 200,000 300,000 30 June 2018 $150,000 270,000 420,000 Dividend paid Dividend declared (13,000) (17,000) (30,000) (20,000) (20,000) (40,000) Retained Earnings (closing balance) 270,000 380,000 Dividends declared at 30 June by Napier Ltd are paid within the following three months, with liabilities being recognised for dividends at the date of declaration. Dunedin Ltd does not prepare consolidated financial statements. The company income tax rate is 30%. Question 2 continued over next page Question 2 (continued) The following transactions took place between Dunedin Ltd and Napier Ltd: During the year ended 30 June 2018, Napier Ltd sold some items of inventory to Dunedin Ltd for $25,000. This inventory had previously cost Napier Ltd $15,000. All of these items of inventory remains unsold by Dunedin Ltd as at 30 June 2018. During the year ended 30 June 2017, Dunedin Ltd sold some items of inventory to Napier Ltd for $10,000. This inventory had previously cost Dunedin Ltd $6,000. All these items of inventory remained unsold by Napier Ltd at 30 June 2017. These items of inventory were all sold to other entities by 30 June 2018. Required (a) Prepare the acquisition analysis as at 1 July 2016. (2 marks) (b) Prepare the journal entries for Dunedin Ltd to apply the equity method to account for its investment in Napier Ltd for the year ending 30 June 2017 and the year ending 30 June 2018. (10 marks) (c) Assume that Dunedin has owned all of the shares of Ajax Ltd since 1 July 2014. Because Dunedin Ltd is a parent entity it must prepare consolidated financial statements. Prepare the journal entries for Dunedin Ltd to apply the equity method to account for its investment in Napier Ltd for the year ending 30 June 2018. (3 marks) (d) Explain the terms 'significant influence' and 'joint control. (2 marks) (e) Identify two other methods that could be used instead of the equity method to account for the investment in an associate by an investor. (3 marks) Question 2 20 Marks On 1 July 2015, East Ltd acquired 40% of the shares of West Ltd for $400,000. The equity of West Ltd at acquisition date consisted of: Share Capital Retained Earnings $625,000 250,000 At 1 July 2015, all the identifiable assets and liabilities of West Ltd were recorded at fair value except for the following: Plant equipment Inventory Carrying Amount $120,000 80,000 Fair Value $200,000 100,000 By 30 June 2016, the inventory on hand at 1 July 2015 had been sold by West Ltd. The plant equipment was expected to provide future benefits evenly over the next seven years. Dividends declared at 30 June by West Ltd are paid within the following three months, with liabilities being recognised for dividends at the date of declaration. The financial statements of West Ltd for the year ending 30 June 2016 and the year ending 30 June 2017 are as follows: Profit Retained Earnings (opening balance) 30 June 2016 $100,000 200.000 300,000 30 June 2017 $150,000 270.000 420,000 Dividend paid Dividend declared (13,000) (17,000) (30,000) (20,000) (20,000) (40,000) Retained Earnings (closing balance) 270,000 380,000 During the year ended 30 June 2017, West Ltd sold some items of inventory to East Ltd for $30,000. This inventory had previously cost West Ltd $20,000. All of this inventory remains unsold by East Ltd as at 30 June 2017. Question 2 (continued) East Ltd does not prepare consolidated financial statements. The company income tax rate is 30%. Required (a) Prepare the acquisition analysis as at 1 July 2015. (3 marks) (b) Explain how the investor accounts for any goodwill on the acquisition of an associate. (2 marks) (c) Prepare the journal entries for East Ltd to apply the equity method to account for its investment in West Ltd for the year ending 30 June 2016 and the year ending 30 June 2017. (13 marks) (d) Explain how the journal entries in (c) would be different if East Ltd was a parent company with subsidiaries and was required to prepare consolidated financial statements. (2 marks)