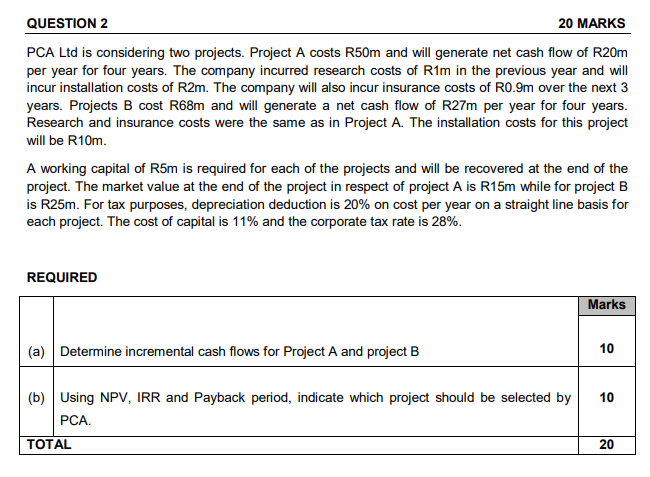

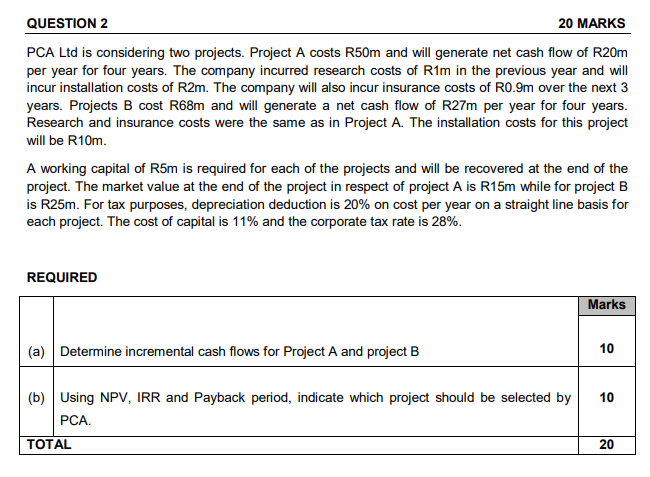

QUESTION 2 20 MARKS PCA Ltd is considering two projects. Project A costs R50m and will generate net cash flow of R20m per year for four years. The company incurred research costs of R1m in the previous year and will incur installation costs of R2m. The company will also incur insurance costs of R0.9m over the next 3 years. Projects B cost R68m and will generate a net cash flow of R27m per year for four years. Research and insurance costs were the same as in Project A. The installation costs for this project will be R10m. A working capital of R5m is required for each of the projects and will be recovered at the end of the project. The market value at the end of the project in respect of project A is R15m while for project B is R25m. For tax purposes, depreciation deduction is 20% on cost per year on a straight line basis for each project. The cost of capital is 11% and the corporate tax rate is 28%. REQUIRED Marks (a) Determine incremental cash flows for Project A and project B 10 10 (b) Using NPV, IRR and Payback period, indicate which project should be selected by PCA. TOTAL 20 QUESTION 2 20 MARKS PCA Ltd is considering two projects. Project A costs R50m and will generate net cash flow of R20m per year for four years. The company incurred research costs of R1m in the previous year and will incur installation costs of R2m. The company will also incur insurance costs of R0.9m over the next 3 years. Projects B cost R68m and will generate a net cash flow of R27m per year for four years. Research and insurance costs were the same as in Project A. The installation costs for this project will be R10m. A working capital of R5m is required for each of the projects and will be recovered at the end of the project. The market value at the end of the project in respect of project A is R15m while for project B is R25m. For tax purposes, depreciation deduction is 20% on cost per year on a straight line basis for each project. The cost of capital is 11% and the corporate tax rate is 28%. REQUIRED Marks (a) Determine incremental cash flows for Project A and project B 10 10 (b) Using NPV, IRR and Payback period, indicate which project should be selected by PCA. TOTAL 20