Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 [20 marks] Wagon Ltd produces bespoke horse-drawn wagons for parks and operates in the leisure sector. The company is in the process

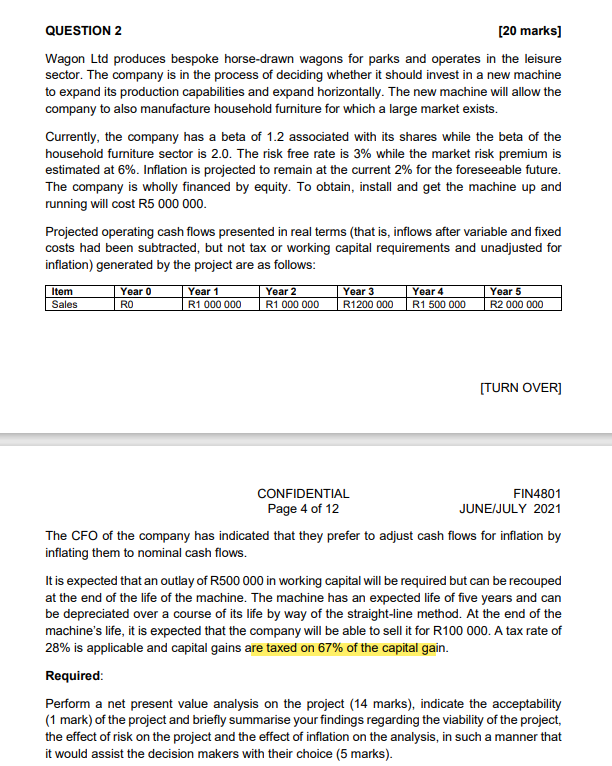

QUESTION 2 [20 marks] Wagon Ltd produces bespoke horse-drawn wagons for parks and operates in the leisure sector. The company is in the process of deciding whether it should invest in a new machine to expand its production capabilities and expand horizontally. The new machine will allow the company to also manufacture household furniture for which a large market exists. Currently, the company has a beta of 1.2 associated with its shares while the beta of the household furniture sector is 2.0. The risk free rate is 3% while the market risk premium is estimated at 6%. Inflation is projected to remain at the current 2% for the foreseeable future. The company is wholly financed by equity. To obtain, install and get the machine up and running will cost R5 000 000. Projected operating cash flows presented in real terms (that is, inflows after variable and fixed costs had been subtracted, but not tax or working capital requirements and unadjusted for inflation) generated by the project are as follows: Item Sales Year 0 RO Year 1 R1 000 000 Year 2 R1 000 000 Year 3 R1200 000 CONFIDENTIAL Page 4 of 12 Year 4 R1 500 000 Year 5 R2 000 000 [TURN OVER] FIN4801 JUNE/JULY 2021 The CFO of the company has indicated that they prefer to adjust cash flows for inflation by inflating them to nominal cash flows. It is expected that an outlay of R500 000 in working capital will be required but can be recouped at the end of the life of the machine. The machine has an expected life of five years and can be depreciated over a course of its life by way of the straight-line method. At the end of the machine's life, it is expected that the company will be able to sell it for R100 000. A tax rate of 28% is applicable and capital gains are taxed on 67% of the capital gain. Required: Perform a net present value analysis on the project (14 marks), indicate the acceptability (1 mark) of the project and briefly summarise your findings regarding the viability of the project, the effect of risk on the project and the effect of inflation on the analysis, in such a manner that it would assist the decision makers with their choice (5 marks).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To perform a net present value NPV analysis on the project we need to calculate the present value of the projected cash flows and compare it to the initial investment cost Lets calculate the NPV step ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started