Question

Question 2: (20 points) Are there specific working capital management suggestions that you can make to the company? (Hint: Use Miller's balance sheet and income

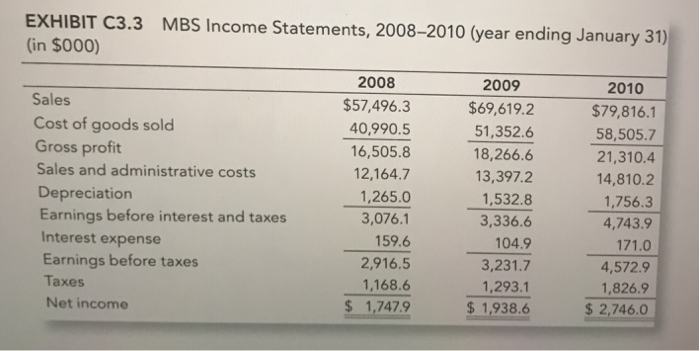

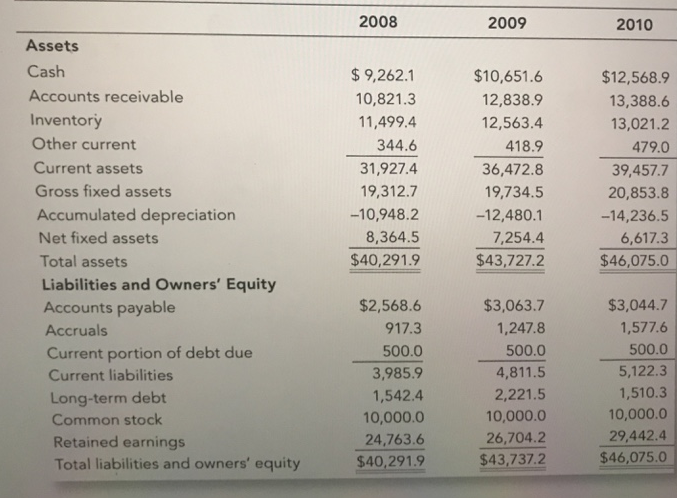

Question 2: (20 points) Are there specific working capital management suggestions that you can make to the company? (Hint: Use Miller's balance sheet and income statement (Exhibits C3.2 and C3.3) to calculate ratios and compare to industry ratios (Exhibits C3.4). Provide suggestions based on this analysis.

Question 3: (15 points) If a line of credit is requested from the Bank, should it be offered? At what interest rate? (Hint: refer back to LOC section in CH4)

Question 4: (65 points) Would a monthly cash budget improve forecasting and provide support for a line of credit? If so, provide a cash budget (to the best of your ability based on the data in the case).

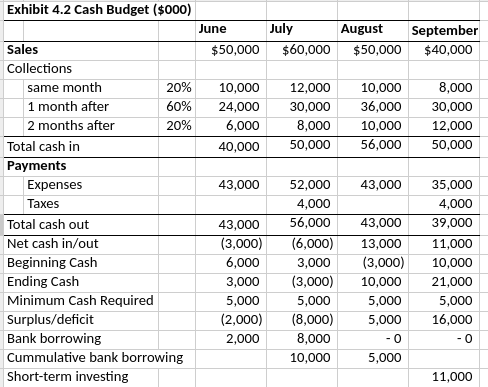

Use format similar to Exhibit 4.2 (see Excel spreadsheet below). For sales, use the information in Exhibit C3.1 and divide each quarter by 3 to get monthly numbers. Since we don't know the minimum cash requirement, you can stop at ending cash.

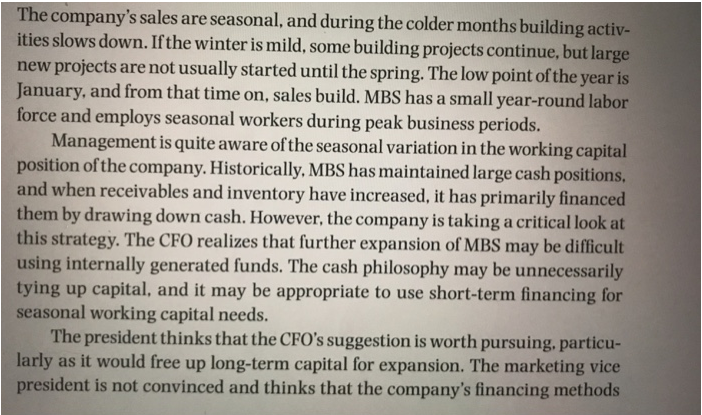

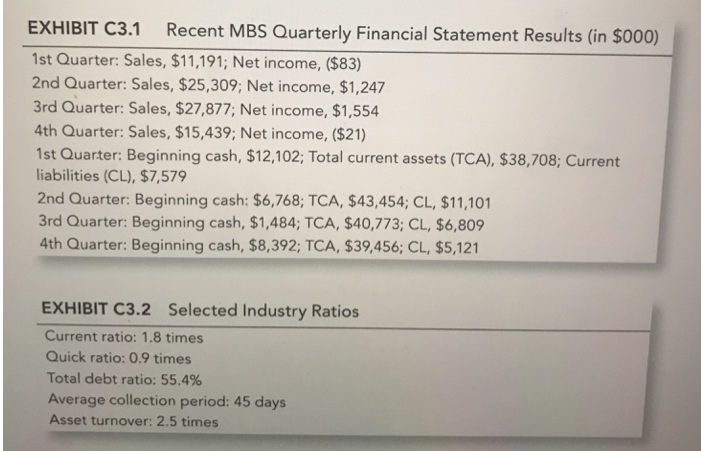

July $60,000 August $50,000 September $40,000 12,000 30,000 8,000 50,000 10,000 36,000 10,000 56,000 8,000 30,000 12,000 50,000 43,000 Exhibit 4.2 Cash Budget ($000) June Sales $50,000 Collections same month 20% 10,000 1 month after 60% 24,000 2 months after 20% 6,000 Total cash in 40,000 Payments Expenses 43,000 Taxes Total cash out 43,000 Net cash in/out (3,000) Beginning Cash 6,000 Ending Cash 3,000 Minimum Cash Required 5,000 Surplus/deficit (2,000) Bank borrowing 2,000 Cummulative bank borrowing Short-term investing 52,000 4,000 56,000 (6,000) 3,000 (3,000) 5,000 (8,000) 8,000 10,000 43,000 13,000 (3,000) 10,000 5,000 5,000 35,000 4,000 39,000 11,000 10,000 21,000 5,000 16,000 -0 -O 5.000 11,000 The company's sales are seasonal, and during the colder months building activ- ities slows down. Ifthe winter is mild, some building projects continue, but large new projects are not usually started until the spring. The low point of the year is January, and from that time on, sales build. MBS has a small year-round labor force and employs seasonal workers during peak business periods. Management is quite aware of the seasonal variation in the working capital position of the company. Historically, MBS has maintained large cash positions, and when receivables and inventory have increased, it has primarily financed them by drawing down cash. However, the company is taking a critical look at this strategy. The CFO realizes that further expansion of MBS may be difficult using internally generated funds. The cash philosophy may be unnecessarily tying up capital, and it may be appropriate to use short-term financing for seasonal working capital needs. The president thinks that the CFO's suggestion is worth pursuing, particu- larly as it would free up long-term capital for expansion. The marketing vice president is not convinced and thinks that the company's financing methods EXHIBIT C3.1 Recent MBS Quarterly Financial Statement Results (in $000) 1st Quarter: Sales, $11,191; Net income, ($83) 2nd Quarter: Sales, $25,309; Net income, $1,247 3rd Quarter: Sales, $27,877; Net income, $1,554 4th Quarter: Sales, $15,439; Net income, ($21) 1st Quarter: Beginning cash, $12,102; Total current assets (TCA), $38,708; Current liabilities (CL), $7,579 2nd Quarter: Beginning cash: $6,768; TCA, $43,454; CL, $11,101 3rd Quarter: Beginning cash, $1,484; TCA, $40,773; CL, $6,809 4th Quarter: Beginning cash, $8,392; TCA, $39,456; CL, $5,121 EXHIBIT C3.2 Selected Industry Ratios Current ratio: 1.8 times Quick ratio: 0.9 times Total debt ratio: 55.4% Average collection period: 45 days Asset turnover: 2.5 times EXHIBIT C3.3 MBS Income Statements, 2008-2010 (year ending January 31) (in $000) Sales Cost of goods sold Gross profit Sales and administrative costs Depreciation Earnings before interest and taxes Interest expense Earnings before taxes Taxes Net income 2008 $57,496.3 40,990.5 16,505.8 12,164.7 1,265.0 3,076.1 159.6 2,916.5 1,168.6 $ 1,747.9 2009 $69,619.2 51,352.6 18,266.6 13,397.2 1,532.8 3,336.6 104.9 3,231.7 1,293.1 $ 1,938.6 2010 $79,816.1 58,505.7 21,310.4 14,810.2 1,756.3 4,743.9 171.0 4,572.9 1,826.9 $ 2,746.0 2008 2009 2010 Assets Cash Accounts receivable Inventory Other current Current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Liabilities and Owners' Equity Accounts payable Accruals Current portion of debt due Current liabilities Long-term debt Common stock Retained earnings Total liabilities and owners' equity $ 9,262.1 10,821.3 11,499.4 344.6 31,927.4 19,312.7 -10,948.2 8,364.5 $40,291.9 $10,651.6 12,838.9 12,563.4 418.9 36,472.8 19,734.5 -12,480.1 7,254.4 $43,727.2 $12,568.9 13,388.6 13,021.2 479.0 39,457.7 20,853.8 -14,236.5 6,617.3 $46,075.0 $2,568.6 917.3 500.0 3,985.9 1,542.4 10,000.0 24,763.6 $40,291.9 $3,063.7 1,247.8 500.0 4,811.5 2,221.5 10,000.0 26,704.2 $43,737.2 $3,044.7 1,577.6 500.0 5,122.3 1,510.3 10,000.0 29,442.4 $46,075.0 July $60,000 August $50,000 September $40,000 12,000 30,000 8,000 50,000 10,000 36,000 10,000 56,000 8,000 30,000 12,000 50,000 43,000 Exhibit 4.2 Cash Budget ($000) June Sales $50,000 Collections same month 20% 10,000 1 month after 60% 24,000 2 months after 20% 6,000 Total cash in 40,000 Payments Expenses 43,000 Taxes Total cash out 43,000 Net cash in/out (3,000) Beginning Cash 6,000 Ending Cash 3,000 Minimum Cash Required 5,000 Surplus/deficit (2,000) Bank borrowing 2,000 Cummulative bank borrowing Short-term investing 52,000 4,000 56,000 (6,000) 3,000 (3,000) 5,000 (8,000) 8,000 10,000 43,000 13,000 (3,000) 10,000 5,000 5,000 35,000 4,000 39,000 11,000 10,000 21,000 5,000 16,000 -0 -O 5.000 11,000 The company's sales are seasonal, and during the colder months building activ- ities slows down. Ifthe winter is mild, some building projects continue, but large new projects are not usually started until the spring. The low point of the year is January, and from that time on, sales build. MBS has a small year-round labor force and employs seasonal workers during peak business periods. Management is quite aware of the seasonal variation in the working capital position of the company. Historically, MBS has maintained large cash positions, and when receivables and inventory have increased, it has primarily financed them by drawing down cash. However, the company is taking a critical look at this strategy. The CFO realizes that further expansion of MBS may be difficult using internally generated funds. The cash philosophy may be unnecessarily tying up capital, and it may be appropriate to use short-term financing for seasonal working capital needs. The president thinks that the CFO's suggestion is worth pursuing, particu- larly as it would free up long-term capital for expansion. The marketing vice president is not convinced and thinks that the company's financing methods EXHIBIT C3.1 Recent MBS Quarterly Financial Statement Results (in $000) 1st Quarter: Sales, $11,191; Net income, ($83) 2nd Quarter: Sales, $25,309; Net income, $1,247 3rd Quarter: Sales, $27,877; Net income, $1,554 4th Quarter: Sales, $15,439; Net income, ($21) 1st Quarter: Beginning cash, $12,102; Total current assets (TCA), $38,708; Current liabilities (CL), $7,579 2nd Quarter: Beginning cash: $6,768; TCA, $43,454; CL, $11,101 3rd Quarter: Beginning cash, $1,484; TCA, $40,773; CL, $6,809 4th Quarter: Beginning cash, $8,392; TCA, $39,456; CL, $5,121 EXHIBIT C3.2 Selected Industry Ratios Current ratio: 1.8 times Quick ratio: 0.9 times Total debt ratio: 55.4% Average collection period: 45 days Asset turnover: 2.5 times EXHIBIT C3.3 MBS Income Statements, 2008-2010 (year ending January 31) (in $000) Sales Cost of goods sold Gross profit Sales and administrative costs Depreciation Earnings before interest and taxes Interest expense Earnings before taxes Taxes Net income 2008 $57,496.3 40,990.5 16,505.8 12,164.7 1,265.0 3,076.1 159.6 2,916.5 1,168.6 $ 1,747.9 2009 $69,619.2 51,352.6 18,266.6 13,397.2 1,532.8 3,336.6 104.9 3,231.7 1,293.1 $ 1,938.6 2010 $79,816.1 58,505.7 21,310.4 14,810.2 1,756.3 4,743.9 171.0 4,572.9 1,826.9 $ 2,746.0 2008 2009 2010 Assets Cash Accounts receivable Inventory Other current Current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Liabilities and Owners' Equity Accounts payable Accruals Current portion of debt due Current liabilities Long-term debt Common stock Retained earnings Total liabilities and owners' equity $ 9,262.1 10,821.3 11,499.4 344.6 31,927.4 19,312.7 -10,948.2 8,364.5 $40,291.9 $10,651.6 12,838.9 12,563.4 418.9 36,472.8 19,734.5 -12,480.1 7,254.4 $43,727.2 $12,568.9 13,388.6 13,021.2 479.0 39,457.7 20,853.8 -14,236.5 6,617.3 $46,075.0 $2,568.6 917.3 500.0 3,985.9 1,542.4 10,000.0 24,763.6 $40,291.9 $3,063.7 1,247.8 500.0 4,811.5 2,221.5 10,000.0 26,704.2 $43,737.2 $3,044.7 1,577.6 500.0 5,122.3 1,510.3 10,000.0 29,442.4 $46,075.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started