Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (20 points), only need to answer the questions, short sentences are fine: Consider a risk-free investment that costs $10,000 in year 0 and

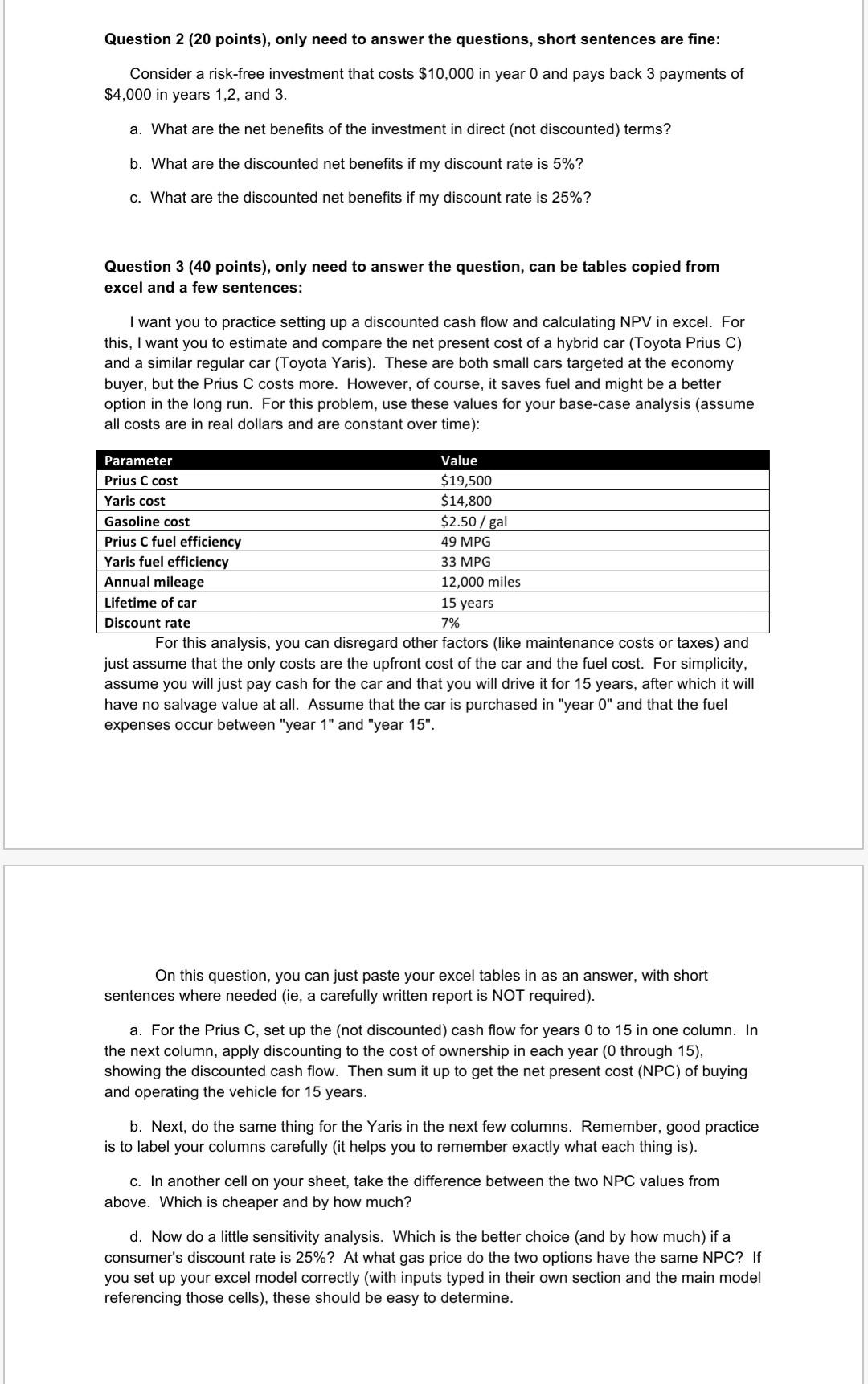

Question 2 (20 points), only need to answer the questions, short sentences are fine: Consider a risk-free investment that costs $10,000 in year 0 and pays back 3 payments of $4,000 in years 1,2, and 3. a. What are the net benefits of the investment in direct (not discounted) terms? b. What are the discounted net benefits if my discount rate is 5%? c. What are the discounted net benefits if my discount rate is 25%? Question 3 (40 points), only need to answer the question, can be tables copied from excel and a few sentences: I want you to practice setting up a discounted cash flow and calculating NPV in excel. For this, I want you to estimate and compare the net present cost of a hybrid car (Toyota Prius C) and a similar regular car (Toyota Yaris). These are both small cars targeted at the economy buyer, but the Prius C costs more. However, of course, it saves fuel and might be a better option in the long run. For this problem, use these values for your base-case analysis (assume all costs are in real dollars and are constant over time): Parameter Value Prius C cost $19,500 Yaris cost $14,800 Gasoline cost $2.50 / gal Prius C fuel efficiency 49 MPG Yaris fuel efficiency 33 MPG Annual mileage 12,000 miles Lifetime of car 15 years Discount rate 7% For this analysis, you can disregard other factors (like maintenance costs or taxes) and just assume that the only costs are the upfront cost of the car and the fuel cost. For simplicity, assume you will just pay cash for the car and that you will drive it for 15 years, after which it will have no salvage value at all. Assume that the car is purchased in "year 0" and that the fuel expenses occur between "year 1" and "year 15". On this question, you can just paste your excel tables in as an answer, with short sentences where needed (ie, a carefully written report is NOT required). a. For the Prius C, set up the (not discounted) cash flow for years 0 to 15 in one column. In the next column, apply discounting to the cost of ownership in each year (0 through 15), showing the discounted cash flow. Then sum it up to get the net present cost (NPC) of buying and operating the vehicle for 15 years. b. Next, do the same thing for the Yaris in the next few columns. Remember, good practice is to label your columns carefully (it helps you to remember exactly what each thing is). c. In another cell on your sheet, take the difference between the two NPC values from above. Which is cheaper and by how much? d. Now do a little sensitivity analysis. Which is the better choice (and by how much) if a consumer's discount rate is 25%? At what gas price do the two options have the same NPC? If you set up your excel model correctly (with inputs typed in their own section and the main model referencing those cells), these should be easy to determine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started