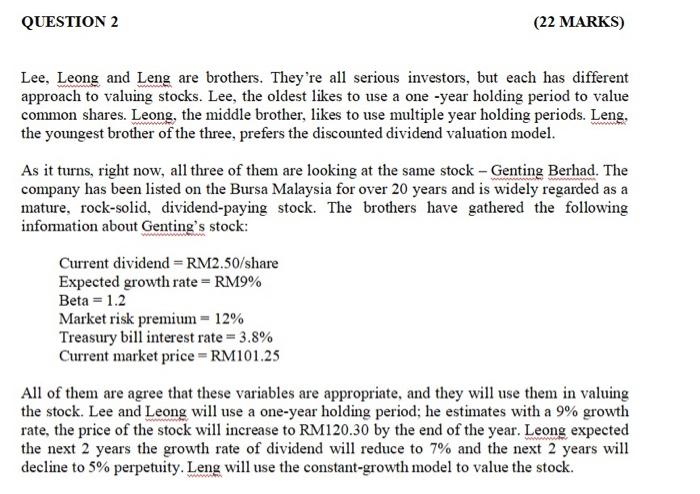

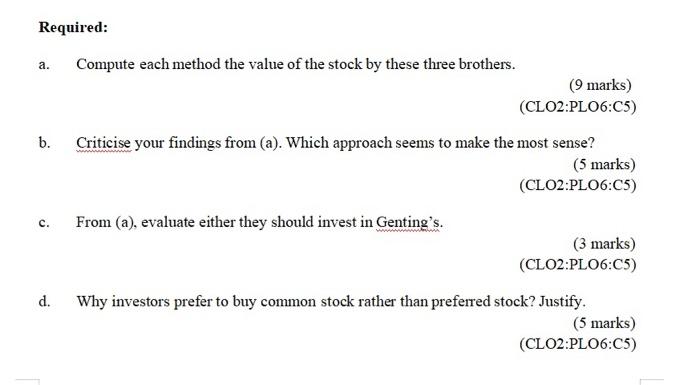

QUESTION 2 (22 MARKS) Lee, Leong and Leng are brothers. They're all serious investors, but each has different approach to valuing stocks. Lee, the oldest likes to use a one -year holding period to value common shares. Leong, the middle brother, likes to use multiple year holding periods. Leng, the youngest brother of the three, prefers the discounted dividend valuation model. As it turns, right now, all three of them are looking at the same stock - Genting Berhad. The company has been listed on the Bursa Malaysia for over 20 years and is widely regarded as a mature, rock-solid, dividend-paying stock. The brothers have gathered the following information about Genting's stock: Current dividend = RM2.50/share Expected growth rate = RM9% Beta = 1.2 Market risk premium = 12% Treasury bill interest rate = 3.8% Current market price=RM101.25 All of them are agree that these variables are appropriate, and they will use them in valuing the stock. Lee and Leong will use a one-year holding period; he estimates with a 9% growth rate, the price of the stock will increase to RM120.30 by the end of the year. Leong expected the next 2 years the growth rate of dividend will reduce to 7% and the next 2 years will decline to 5% perpetuity. Leng will use the constant-growth model to value the stock. Required: a. Compute each method the value of the stock by these three brothers. (9 marks) (CLO2:PL06:05) b. Criticise your findings from (a). Which approach seems to make the most sense? (5 marks) (CLO2:PL06:05) c. From (a), evaluate either they should invest in Genting's. (3 marks) (CLO2:PLO6:05) d. Why investors prefer to buy common stock rather than preferred stock? Justify. (5 marks) (CLO2:PLO6:05) QUESTION 2 (22 MARKS) Lee, Leong and Leng are brothers. They're all serious investors, but each has different approach to valuing stocks. Lee, the oldest likes to use a one -year holding period to value common shares. Leong, the middle brother, likes to use multiple year holding periods. Leng, the youngest brother of the three, prefers the discounted dividend valuation model. As it turns, right now, all three of them are looking at the same stock - Genting Berhad. The company has been listed on the Bursa Malaysia for over 20 years and is widely regarded as a mature, rock-solid, dividend-paying stock. The brothers have gathered the following information about Genting's stock: Current dividend = RM2.50/share Expected growth rate = RM9% Beta = 1.2 Market risk premium = 12% Treasury bill interest rate = 3.8% Current market price=RM101.25 All of them are agree that these variables are appropriate, and they will use them in valuing the stock. Lee and Leong will use a one-year holding period; he estimates with a 9% growth rate, the price of the stock will increase to RM120.30 by the end of the year. Leong expected the next 2 years the growth rate of dividend will reduce to 7% and the next 2 years will decline to 5% perpetuity. Leng will use the constant-growth model to value the stock. Required: a. Compute each method the value of the stock by these three brothers. (9 marks) (CLO2:PL06:05) b. Criticise your findings from (a). Which approach seems to make the most sense? (5 marks) (CLO2:PL06:05) c. From (a), evaluate either they should invest in Genting's. (3 marks) (CLO2:PLO6:05) d. Why investors prefer to buy common stock rather than preferred stock? Justify. (5 marks) (CLO2:PLO6:05)