Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (24 marks) Delco Enterprise currently uses a process costing system to ascertain costs to produce canned soup. At the beginning of the

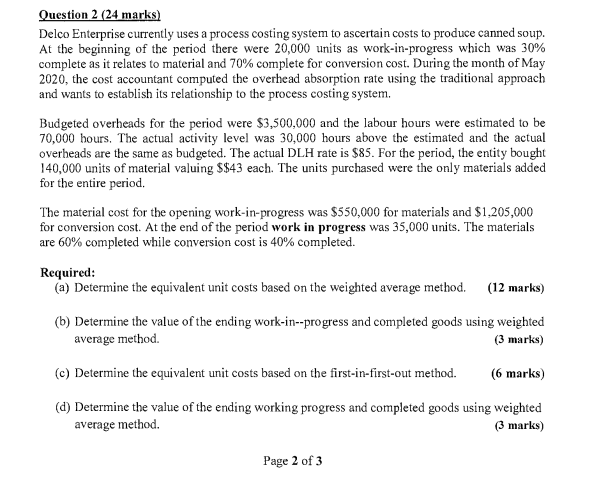

Question 2 (24 marks) Delco Enterprise currently uses a process costing system to ascertain costs to produce canned soup. At the beginning of the period there were 20,000 units as work-in-progress which was 30% complete as it relates to material and 70% complete for conversion cost. During the month of May 2020, the cost accountant computed the overhead absorption rate using the traditional approach and wants to establish its relationship to the process costing system. Budgeted overheads for the period were $3,500,000 and the labour hours were estimated to be 70,000 hours. The actual activity level was 30,000 hours above the estimated and the actual overheads are the same as budgeted. The actual DLH rate is $85. For the period, the entity bought 140,000 units of material valuing $$43 each. The units purchased were the only materials added for the entire period. The material cost for the opening work-in-progress was $550,000 for materials and $1,205,000 for conversion cost. At the end of the period work in progress was 35,000 units. The materials are 60% completed while conversion cost is 40% completed. Required: (a) Determine the equivalent unit costs based on the weighted average method. (12 marks) (b) Determine the value of the ending work-in--progress and completed goods using weighted average method. (3 marks) (c) Determine the equivalent unit costs based on the first-in-first-out method. (6 marks) (d) Determine the value of the ending working progress and completed goods using weighted average method. (3 marks) Page 2 of 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started