Answered step by step

Verified Expert Solution

Question

1 Approved Answer

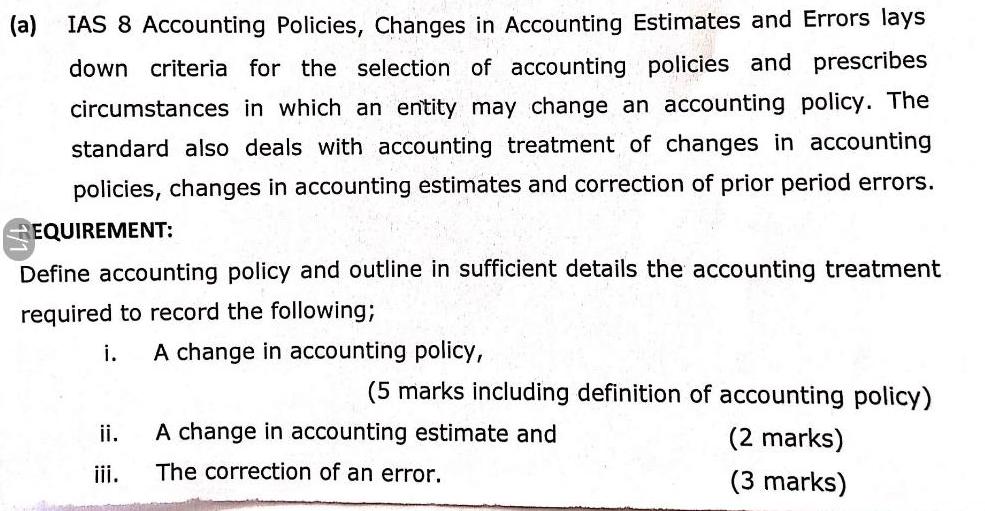

(a) IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors lays down criteria for the selection of accounting policies and prescribes circumstances in

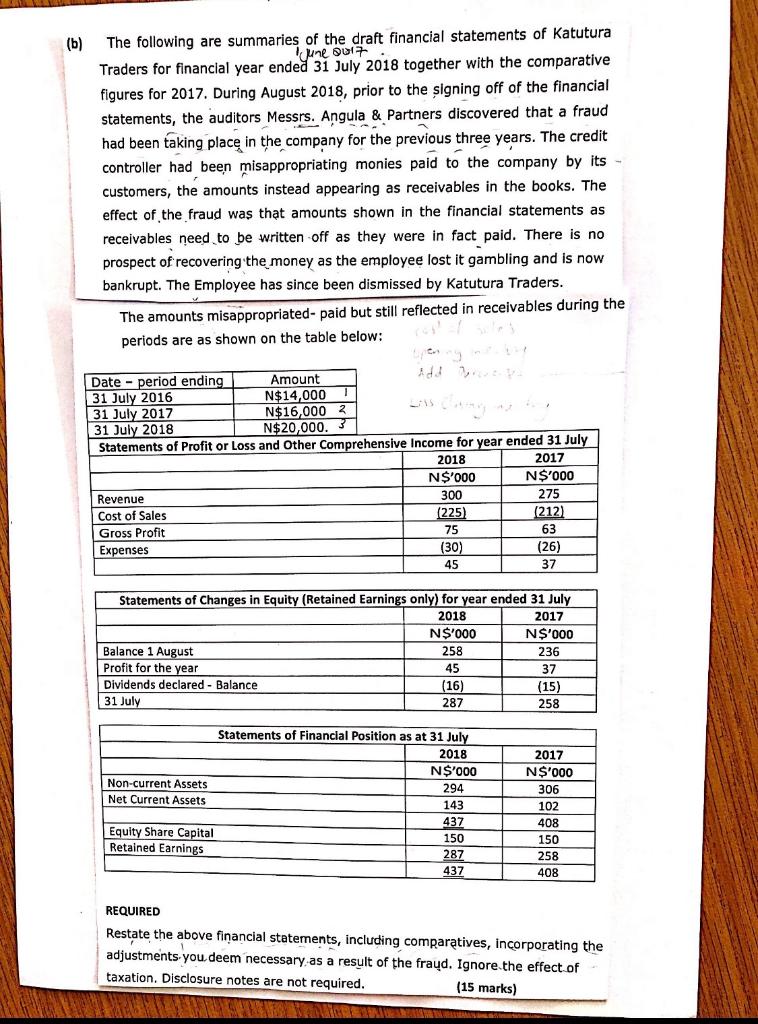

(a) IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors lays down criteria for the selection of accounting policies and prescribes circumstances in which an entity may change an accounting policy. The standard also deals with accounting treatment of changes in accounting policies, changes in accounting estimates and correction of prior period errors. EQUIREMENT: Define accounting policy and outline in sufficient details the accounting treatment required to record the following3B i. A change in accounting policy, (5 marks including definition of accounting policy) ii. A change in accounting estimate and (2 marks) ii. The correction of an error. (3 marks) The following are summaries of the draft financial statements of Katutura une ouI7 (b) Traders for financial year ended 31 July 2018 together with the comparative figures for 2017. During August 2018, prior to the signing off of the financial statements, the auditors Messrs. Angula & Partners discovered that a fraud had been taking place in the company for the previous three years. The credit controller had been misappropriating monies paid to the company by its customers, the amounts instead appearing as receivables in the books. The effect of the fraud was tht amounts shown in the financial statements as receivables need to be written off as they were in fact paid. There is no prospect of recovering the money as the employee lost it gambling and is now bankrupt. The Employee has since been dismissed by Katutura Traders. The amounts misappropriated- paid but still reflected in receivables during the periods are as shown on the table below: Date - period ending 31 July 2016 31 July 2017 31 July 2018 Statements of Profit or Loss and Other Comprehensive Income for year ended 31 July Amount N$14,000 N$16,000 2 N$20,000. 3 2018 2017 N$'000 N$'000 Revenue 300 275 Cost of Sales (225) (212) Gross Profit 75 63 Expenses (30) (26) 45 37 Statements of Changes in Equity (Retained Earnings only) for year ended 31 July 2018 2017 N$'000 NS'000 Balance 1 August Profit for the year 258 236 45 37 Dividends declared - Balance (16) (15) 31 July 287 258 Statements of Financial Position as at 31 July 2018 2017 N$'000 N$'000 Non-current Assets 294 306 Net Current Assets 143 102 437 150 408 Equity Share Capital 150 Retained Earnings 287 258 437 408 REQUIRED Restate the above fiancial statements, including comparatives, incorporating the adjustments-you. deem necessary.as a result of the fraud. Ignore.the effect.of taxation. Disclosure notes are not required. (15 marks)

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a i Change in accounting policy is the change in the general adopted rules principles and practices applicable in the preparation of financial stateme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started