Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (25 Marks) a) Powell Industries Ltd (PIL), based in St. Andrew, has secured a new contract making them the sole supplier of commercial

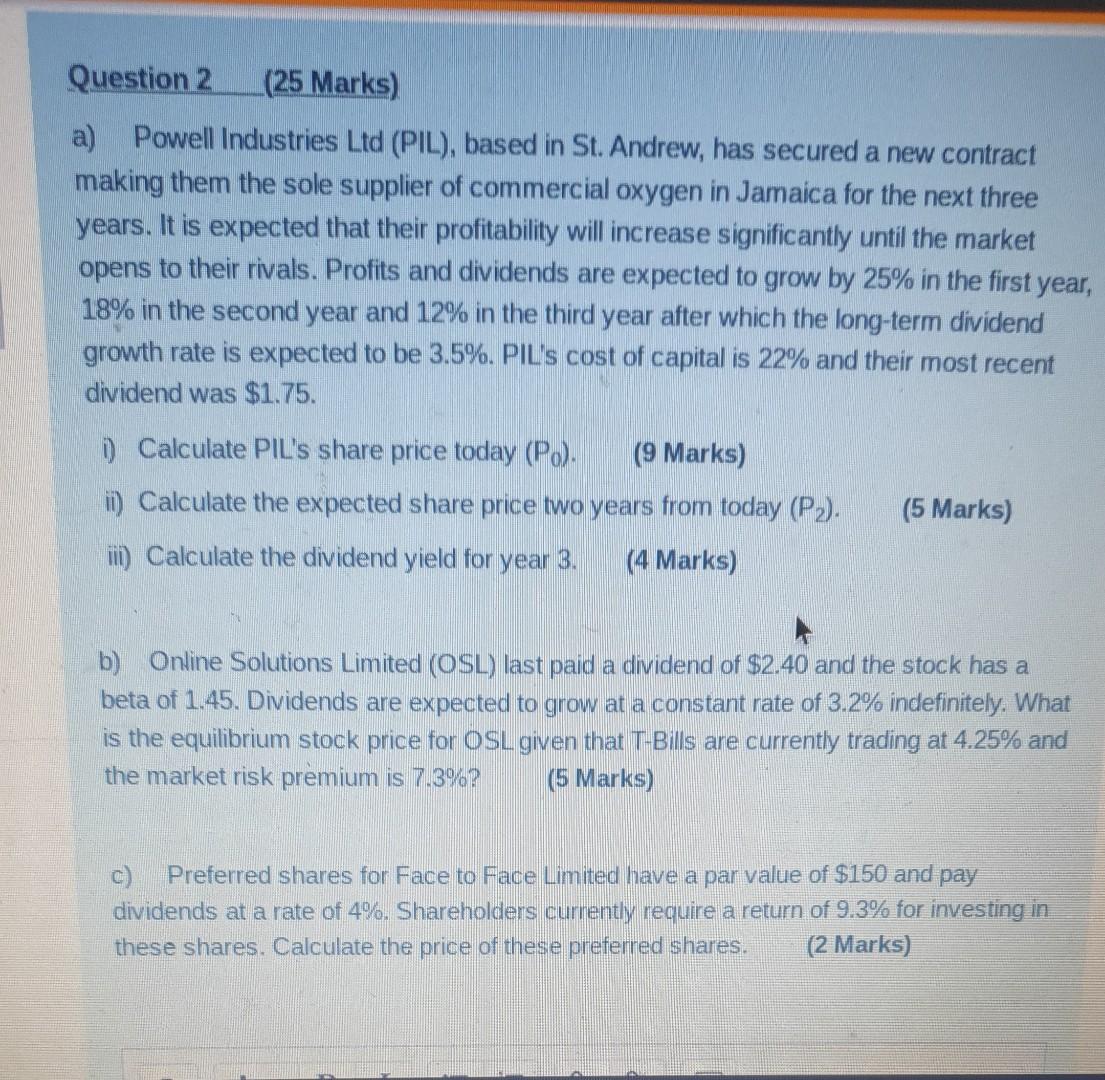

Question 2 (25 Marks) a) Powell Industries Ltd (PIL), based in St. Andrew, has secured a new contract making them the sole supplier of commercial oxygen in Jamaica for the next three years. It is expected that their profitability will increase significantly until the market opens to their rivals. Profits and dividends are expected to grow by 25% in the first year, 18% in the second year and 12% in the third year after which the long-term dividend growth rate is expected to be 3.5%. PIL's cost of capital is 22% and their most recent dividend was $1.75. i) Calculate PIL's share price today (Po). (9 Marks) ii) Calculate the expected share price two years from today (P2). (5 Marks) ii) Calculate the dividend yield for year 3. (4 Marks) b) Online Solutions Limited (OSL) last paid a dividend of $2.40 and the stock has a beta of 1.45. Dividends are expected to grow at a constant rate of 3.2% indefinitely. What is the equilibrium stock price for OSL given that T-Bills are currently trading at 4.25% and the market risk premium is 7.3%? (5 Marks) c) P err shares for Face to Face Limited have a par value of $150 and pay dividends at a rate of 4%. Shareholders currently require a return of 9.3% for investing in these shares. Calculate the price of these preferred shares. (2 Marks) Question 2 (25 Marks) a) Powell Industries Ltd (PIL), based in St. Andrew, has secured a new contract making them the sole supplier of commercial oxygen in Jamaica for the next three years. It is expected that their profitability will increase significantly until the market opens to their rivals. Profits and dividends are expected to grow by 25% in the first year, 18% in the second year and 12% in the third year after which the long-term dividend growth rate is expected to be 3.5%. PIL's cost of capital is 22% and their most recent dividend was $1.75. i) Calculate PIL's share price today (Po). (9 Marks) ii) Calculate the expected share price two years from today (P2). (5 Marks) ii) Calculate the dividend yield for year 3. (4 Marks) b) Online Solutions Limited (OSL) last paid a dividend of $2.40 and the stock has a beta of 1.45. Dividends are expected to grow at a constant rate of 3.2% indefinitely. What is the equilibrium stock price for OSL given that T-Bills are currently trading at 4.25% and the market risk premium is 7.3%? (5 Marks) c) P err shares for Face to Face Limited have a par value of $150 and pay dividends at a rate of 4%. Shareholders currently require a return of 9.3% for investing in these shares. Calculate the price of these preferred shares. (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started