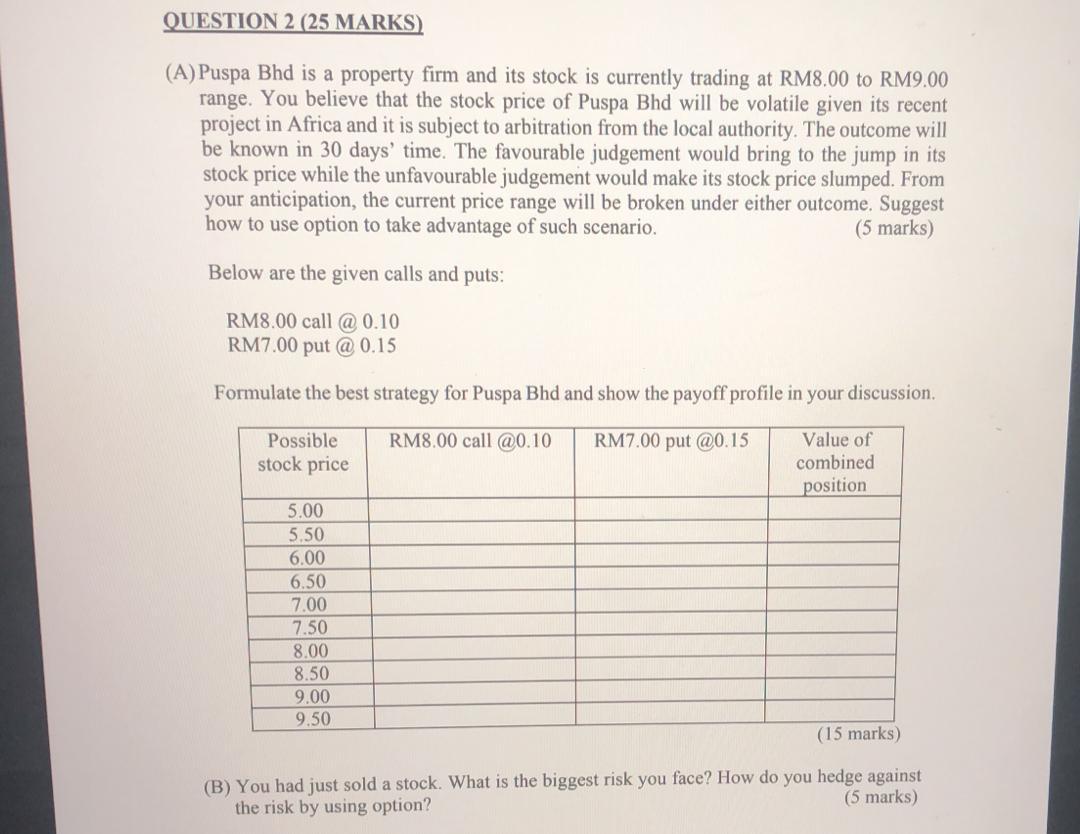

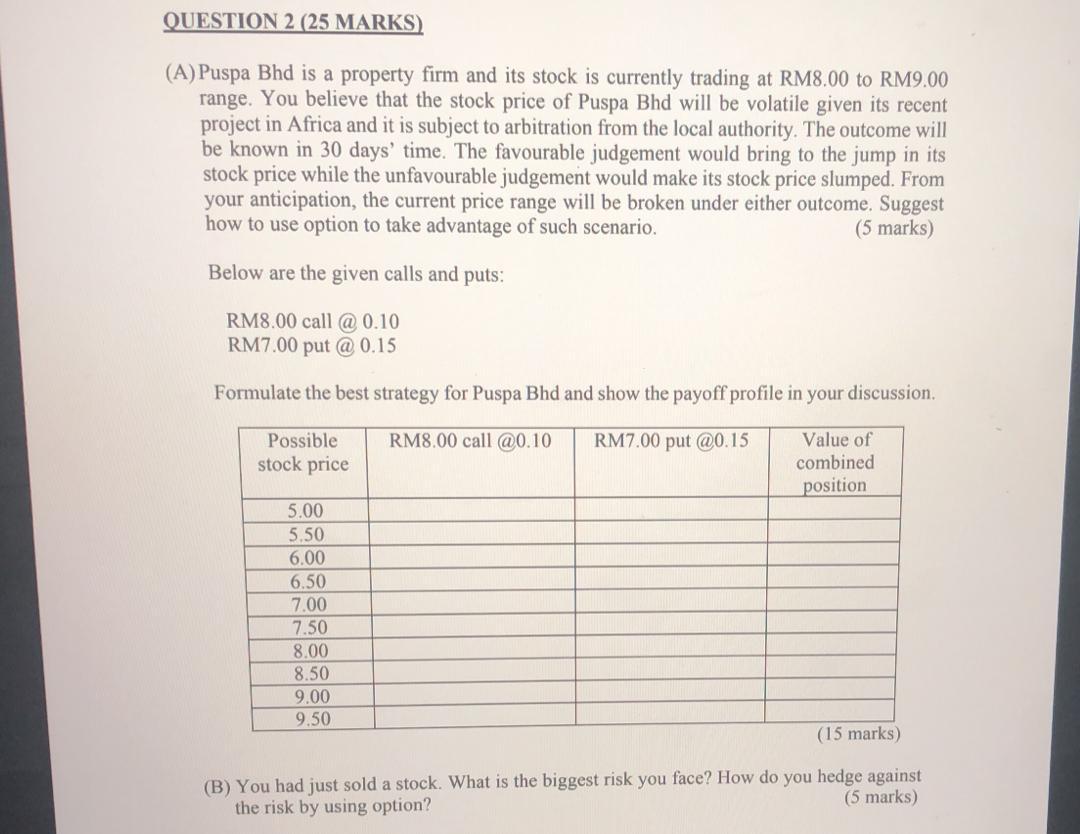

QUESTION 2 (25 MARKS) (A) Puspa Bhd is a property firm and its stock is currently trading at RM8.00 to RM9.00 range. You believe that the stock price of Puspa Bhd will be volatile given its recent project in Africa and it is subject to arbitration from the local authority. The outcome will be known in 30 days' time. The favourable judgement would bring to the jump in its stock price while the unfavourable judgement would make its stock price slumped. From your anticipation, the current price range will be broken under either outcome. Suggest how to use option to take advantage of such scenario. (5 marks) Below are the given calls and puts: RM8.00 call @ 0.10 RM7.00 put @ 0.15 Formulate the best strategy for Puspa Bhd and show the payoff profile in your discussion. Possible RM8.00 call @0.10 RM7.00 put @0.15 Value of combined stock price position 5.00 5.50 6.00 6.50 7.00 7.50 8.00 8.50 9.00 9.50 (15 marks) (B) You had just sold a stock. What is the biggest risk you face? How do you hedge against the risk by using option? (5 marks) QUESTION 2 (25 MARKS) (A) Puspa Bhd is a property firm and its stock is currently trading at RM8.00 to RM9.00 range. You believe that the stock price of Puspa Bhd will be volatile given its recent project in Africa and it is subject to arbitration from the local authority. The outcome will be known in 30 days' time. The favourable judgement would bring to the jump in its stock price while the unfavourable judgement would make its stock price slumped. From your anticipation, the current price range will be broken under either outcome. Suggest how to use option to take advantage of such scenario. (5 marks) Below are the given calls and puts: RM8.00 call @ 0.10 RM7.00 put @ 0.15 Formulate the best strategy for Puspa Bhd and show the payoff profile in your discussion. Possible RM8.00 call @0.10 RM7.00 put @0.15 Value of combined stock price position 5.00 5.50 6.00 6.50 7.00 7.50 8.00 8.50 9.00 9.50 (15 marks) (B) You had just sold a stock. What is the biggest risk you face? How do you hedge against the risk by using option