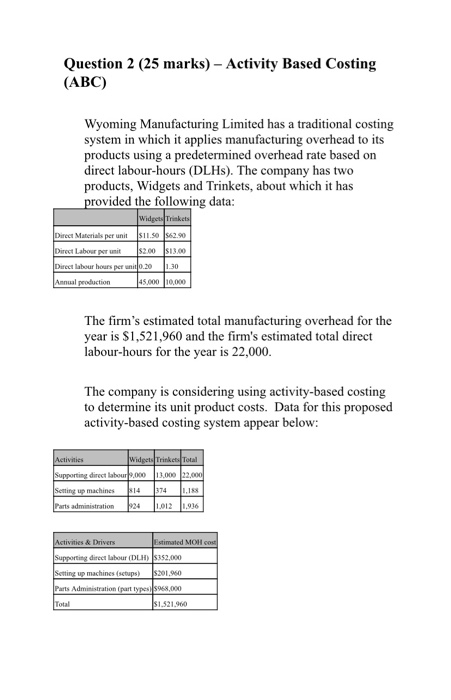

Question 2 (25 marks) - Activity Based Costing (ABC) Wyoming Manufacturing Limited has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labour-hours (DLHS). The company has two products, Widgets and Trinkets, about which it has provided the following data: Widgets Trinkets Direct Materials per unit $11.50 $62.90 Direct Labour per unit Direct labour hours per unit 0.20 1.30 Annual production 45,000 10,000 The firm's estimated total manufacturing overhead for the year is $1,521,960 and the firm's estimated total direct labour-hours for the year is 22,000. The company is considering using activity-based costing to determine its unit product costs. Data for this proposed activity-based costing system appear below: Activities Widgets Trinkets Total Supporting direct labour.000 13.000 22.000 Setting up machines 14 374 Parts administration 1.012 1.936 Activities & Drivers Estimated MOH Supporting direct labour (DLI) 352,000 Setting up machines (setups) 201.960 Parts Administration (part types 5968,000 Total $1.521.960 Required: e. Determine the unit product cost of each of the company's two products under the traditional costing system. f. Determine the unit product cost of each of the company's two products under activity-based costing system. C. What are some of the advantages of the ABC model? Question 2 (25 marks) - Activity Based Costing (ABC) Wyoming Manufacturing Limited has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labour-hours (DLHS). The company has two products, Widgets and Trinkets, about which it has provided the following data: Widgets Trinkets Direct Materials per unit $11.50 $62.90 Direct Labour per unit Direct labour hours per unit 0.20 1.30 Annual production 45,000 10,000 The firm's estimated total manufacturing overhead for the year is $1,521,960 and the firm's estimated total direct labour-hours for the year is 22,000. The company is considering using activity-based costing to determine its unit product costs. Data for this proposed activity-based costing system appear below: Activities Widgets Trinkets Total Supporting direct labour.000 13.000 22.000 Setting up machines 14 374 Parts administration 1.012 1.936 Activities & Drivers Estimated MOH Supporting direct labour (DLI) 352,000 Setting up machines (setups) 201.960 Parts Administration (part types 5968,000 Total $1.521.960 Required: e. Determine the unit product cost of each of the company's two products under the traditional costing system. f. Determine the unit product cost of each of the company's two products under activity-based costing system. C. What are some of the advantages of the ABC model