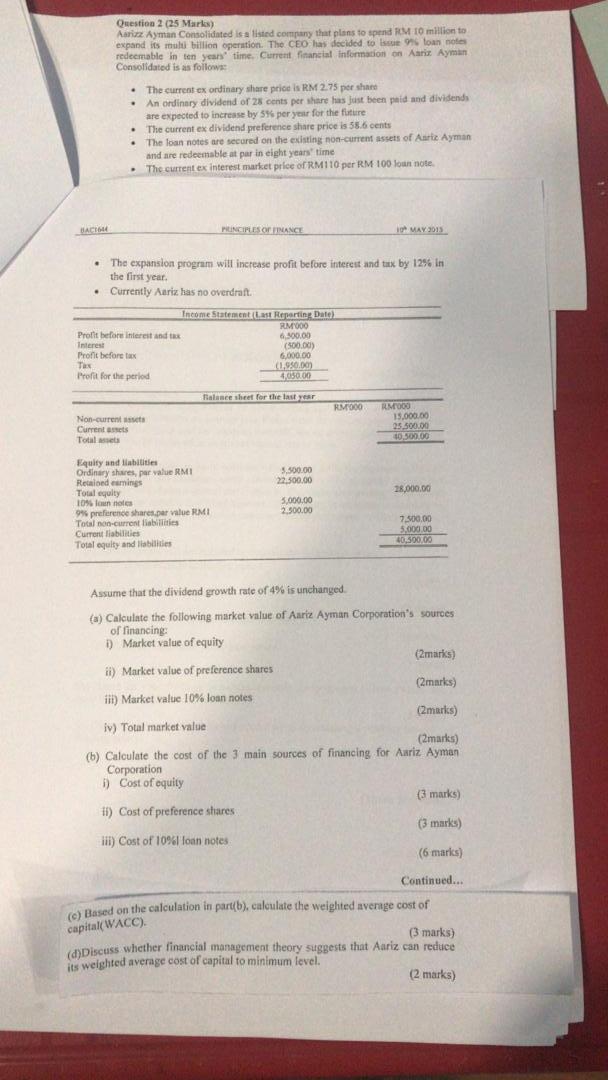

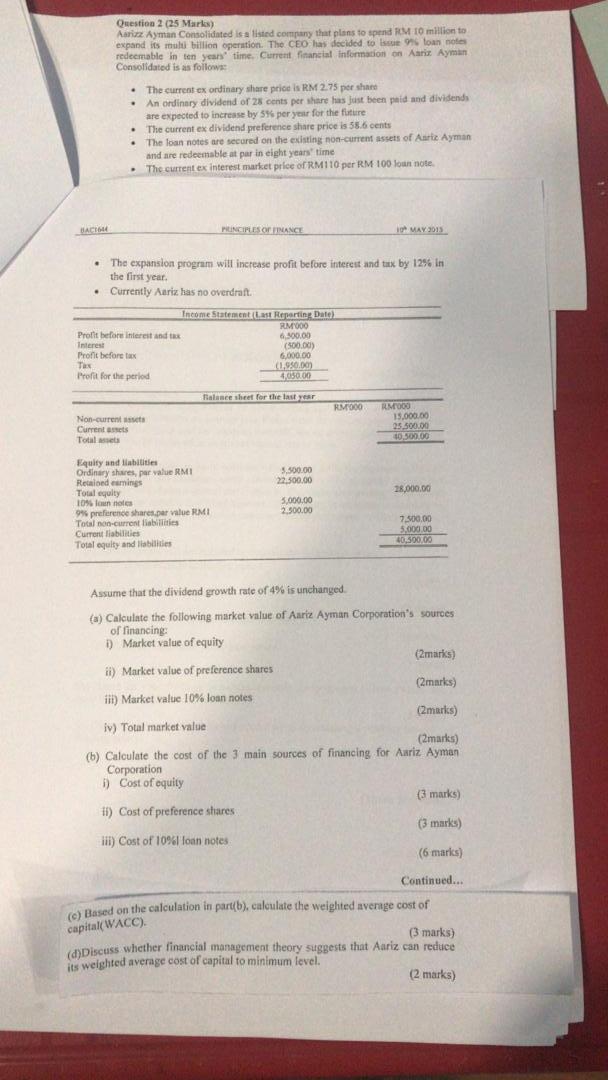

Question 2 (25 Marks) Ariz Ayman Consolidated is a listed company that plans to spend RM 10 million to expand its multi billion operation. The CEO has decided to loan notes redeemable in ton years time. Current financial Information on Ari Ayman Consolidated is as follows: The current ex ordinary share price is RM 2.75 per share An Ordinary dividend of 28 cents per sharehas just been paid and dividends are expected to increase by 5% per year for the future The current ex dividend preference share price is 38.6 cents The loan notes are secured on the existing non-current assets of Art Ayman and are redeemable at par in eight years' time The current ex interest market price of RM110 per RM 100 loan note . . PUINCIPLES OFNANCE 10 MAY 2015 . The expansion program will increase profit before interest and tax by 1296 in the first year. Currently Aariz has no overdraft. Income Statement Last Reporting Date ) RM200 Prolit before interest and 6.300.00 Interest (500.00) Profit before Bax 6,000.00 Tax (1.950.00 Profit for the period 4.050.00 Falance sheet for the last year RM600 RAMOOD 15.000.00 Non-current Current sets Total 25.500.00 10,500.00 3.500.00 22.500,00 28,000.00 Equity and liabilitie Ordinary shares, per value RMI Realondeamings Tool equity 109 laun note 99 preference shares.per value RMI Total non-current liabilities Current liabilities Total equity and liabilities 5,000.00 2.300.00 7.500,00 5,000.00 10,500.00 Assume that the dividend growth rate of 4% is unchanged. (a) Calculate the following market value of Aarie Ayman Corporation's sources of financing D) Market value of equity (2 marks) ii) Market value of preference shares (2 marks) ii) Market value 10% loan notes (2 marks) iv) Total market value (2 marks) (6) Calculate the cost of the 3 main sources of financing for Aariz Ayman Corporation 1) Cost of equity (3 marks) 11) Cost of preference shares (3 marks) iii) Cost of 10% loan notes (6 marks) Continued... (c) Based on the calculation in partb), calculate the weighted average cost of (3 marks) (d) Discuss whether financial management theory suggests that Aariz can reduce its weighted average cost of capital to minimum level. (2 marks) capital WACC). Question 2 (25 Marks) Ariz Ayman Consolidated is a listed company that plans to spend RM 10 million to expand its multi billion operation. The CEO has decided to loan notes redeemable in ton years time. Current financial Information on Ari Ayman Consolidated is as follows: The current ex ordinary share price is RM 2.75 per share An Ordinary dividend of 28 cents per sharehas just been paid and dividends are expected to increase by 5% per year for the future The current ex dividend preference share price is 38.6 cents The loan notes are secured on the existing non-current assets of Art Ayman and are redeemable at par in eight years' time The current ex interest market price of RM110 per RM 100 loan note . . PUINCIPLES OFNANCE 10 MAY 2015 . The expansion program will increase profit before interest and tax by 1296 in the first year. Currently Aariz has no overdraft. Income Statement Last Reporting Date ) RM200 Prolit before interest and 6.300.00 Interest (500.00) Profit before Bax 6,000.00 Tax (1.950.00 Profit for the period 4.050.00 Falance sheet for the last year RM600 RAMOOD 15.000.00 Non-current Current sets Total 25.500.00 10,500.00 3.500.00 22.500,00 28,000.00 Equity and liabilitie Ordinary shares, per value RMI Realondeamings Tool equity 109 laun note 99 preference shares.per value RMI Total non-current liabilities Current liabilities Total equity and liabilities 5,000.00 2.300.00 7.500,00 5,000.00 10,500.00 Assume that the dividend growth rate of 4% is unchanged. (a) Calculate the following market value of Aarie Ayman Corporation's sources of financing D) Market value of equity (2 marks) ii) Market value of preference shares (2 marks) ii) Market value 10% loan notes (2 marks) iv) Total market value (2 marks) (6) Calculate the cost of the 3 main sources of financing for Aariz Ayman Corporation 1) Cost of equity (3 marks) 11) Cost of preference shares (3 marks) iii) Cost of 10% loan notes (6 marks) Continued... (c) Based on the calculation in partb), calculate the weighted average cost of (3 marks) (d) Discuss whether financial management theory suggests that Aariz can reduce its weighted average cost of capital to minimum level. (2 marks) capital WACC)