Answered step by step

Verified Expert Solution

Question

1 Approved Answer

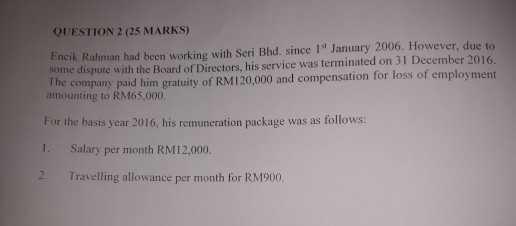

QUESTION 2 (25 MARKS) Encik Rahman had been working with Seri Bhd. since 1st January 2006. However, due to some dispute with the Board of

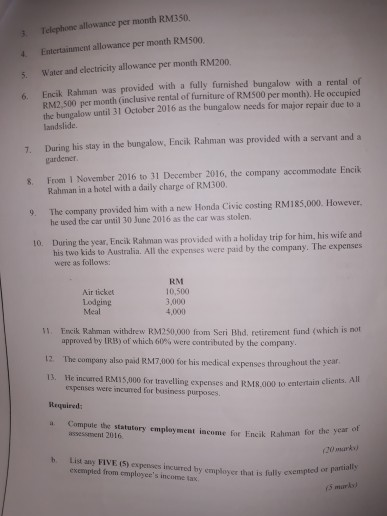

QUESTION 2 (25 MARKS) Encik Rahman had been working with Seri Bhd. since 1st January 2006. However, due to some dispute with the Board of Directors, his service was terminated on 31 December 2016. The company paid him gratuity of RM120,000 and compensation for loss of employment amounting to RM65,000 For the basis year 2016, his remuneration package was as follows: 1. Salary per month RM12,000. 2 Travelling llovance per month for RM900. 3 Telephonc allowance per month RM350. Entertainment allowance per month RM500 5. Water and electricity allowance per month RM200 6. Encik Rahman was provided with a fully furnished bungalow with a rental of RM2,500 per month (inclusive rental of furniture of RM500 per month). He occupied the bungalow until 31 October 2016 as the bungalow needs for major repair due to a landslide. During his stay in the bungalow, Encik Rahman was provided with a servant and a gardener 7. From I November 2016 to 31 December 2016, the company accommodate Encik Rahman in a hotel with a daily charge of RM300 8. The company provided him with a new Honda Civic costing RM185,000. However. 9. he used the car umil 30 June 2016 as the car was stolen. t0. During the year, Encik Rahman was provided with a holiday trip for him, his wife and his two kids to Australia. All the expenses were paid by the company. The expenses were as follows RM Air ticket Lodging Meal 3,000 4,000 W. Encik Rahman withdrew RM250,000 from Seri Bhd, retirement fund (which is not approved by IRB) of which 60% were contributed by the company. 12. The compony also paid RM7,000 for his medical expenses throughout the year 13. He incurod RM15,000 for travelling expenses and RM8.000 to enl Required: a Compule the statutory employ ment iscome for Encik Rahman entertain clients. All expenses were incunred for basiness purposes for the year of assessment 2016 120 marks List any FIVE (5) expenses incurred by employer that is fully exempled from employee's income lax b. 5 mark) QUESTION 2 (25 MARKS) Encik Rahman had been working with Seri Bhd. since 1st January 2006. However, due to some dispute with the Board of Directors, his service was terminated on 31 December 2016. The company paid him gratuity of RM120,000 and compensation for loss of employment amounting to RM65,000 For the basis year 2016, his remuneration package was as follows: 1. Salary per month RM12,000. 2 Travelling llovance per month for RM900. 3 Telephonc allowance per month RM350. Entertainment allowance per month RM500 5. Water and electricity allowance per month RM200 6. Encik Rahman was provided with a fully furnished bungalow with a rental of RM2,500 per month (inclusive rental of furniture of RM500 per month). He occupied the bungalow until 31 October 2016 as the bungalow needs for major repair due to a landslide. During his stay in the bungalow, Encik Rahman was provided with a servant and a gardener 7. From I November 2016 to 31 December 2016, the company accommodate Encik Rahman in a hotel with a daily charge of RM300 8. The company provided him with a new Honda Civic costing RM185,000. However. 9. he used the car umil 30 June 2016 as the car was stolen. t0. During the year, Encik Rahman was provided with a holiday trip for him, his wife and his two kids to Australia. All the expenses were paid by the company. The expenses were as follows RM Air ticket Lodging Meal 3,000 4,000 W. Encik Rahman withdrew RM250,000 from Seri Bhd, retirement fund (which is not approved by IRB) of which 60% were contributed by the company. 12. The compony also paid RM7,000 for his medical expenses throughout the year 13. He incurod RM15,000 for travelling expenses and RM8.000 to enl Required: a Compule the statutory employ ment iscome for Encik Rahman entertain clients. All expenses were incunred for basiness purposes for the year of assessment 2016 120 marks List any FIVE (5) expenses incurred by employer that is fully exempled from employee's income lax b. 5 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started