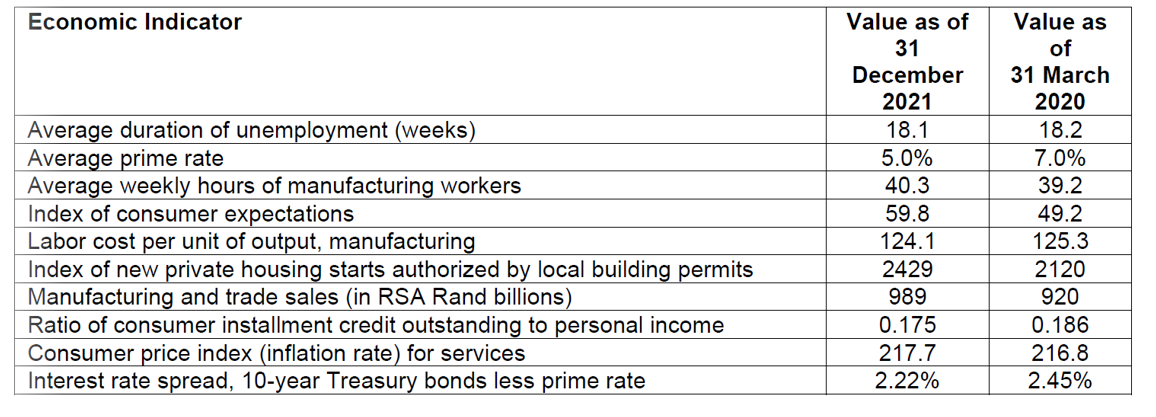

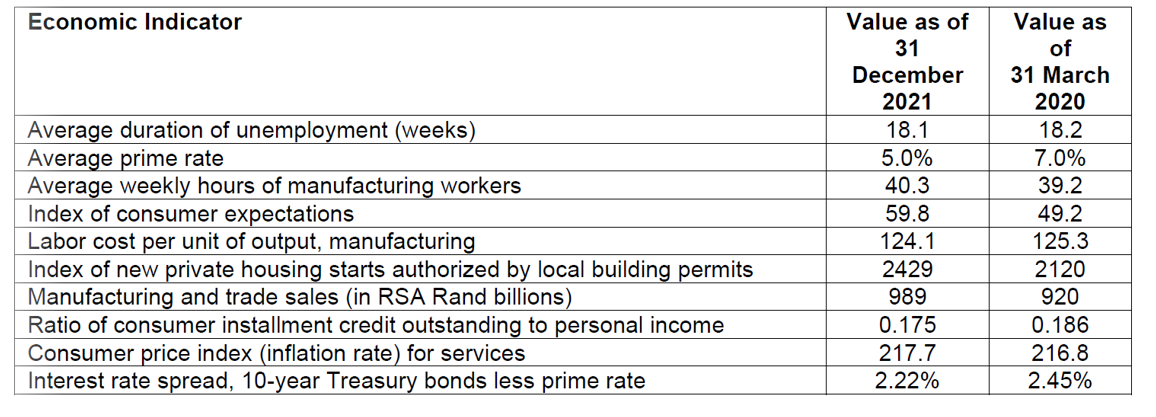

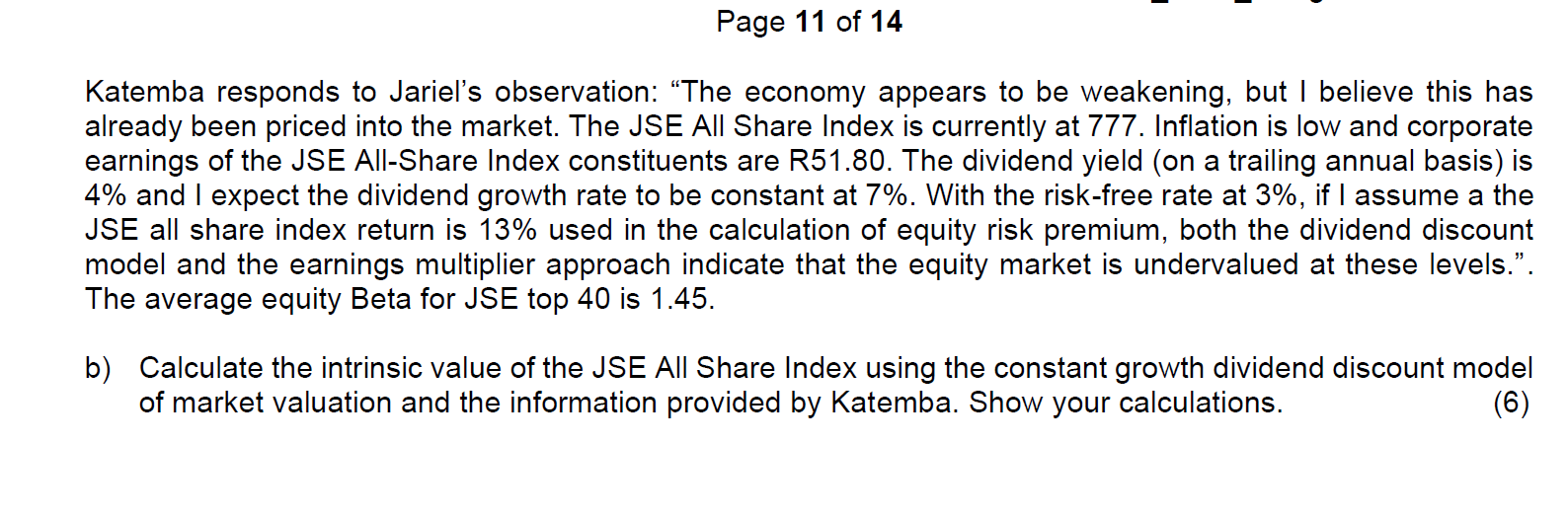

Question 2 [25 marks] Gideon Jariel and Remmy Katemba are analysts at the same firm. Jariel uses the economic indicator approach to formulate his equity market outlook, whereas Katemba uses micro-valuation analysis. Jariel and Katemba have conflicting views on the current outlook for the RSA equity market. Jariel prepares Exhibit 1, a table of recent values of selected RSA economic indicators. He makes the following observation: "Several leading indicators suggest further deterioration in economic conditions. Based on the economic indicator approach, these developments are clearly unfavorable for the RSA equity market. Economic Indicator Average duration of unemployment (weeks) Average prime rate Average weekly hours of manufacturing workers Index of consumer expectations Labor cost per unit of output, manufacturing Index of new private housing starts authorized by local building permits Manufacturing and trade sales (in RSA Rand billions) Ratio of consumer installment credit outstanding to personal income Consumer price index (inflation rate) for services Interest rate spread, 10-year Treasury bonds less prime rate Value as of 31 December 2021 18.1 5.0% 40.3 59.8 124.1 2429 989 0.175 217.7 2.22% Value as of 31 March 2020 18.2 7.0% 39.2 49.2 125.3 2120 920 0.186 216.8 2.45% Page 11 of 14 Katemba responds to Jariel's observation: The economy appears to be weakening, but I believe this has already been priced into the market. The JSE All Share Index is currently at 777. Inflation is low and corporate earnings of the JSE All-Share Index constituents are R51.80. The dividend yield (on a trailing annual basis) is 4% and I expect the dividend growth rate to be constant at 7%. With the risk-free rate at 3%, if I assume a the JSE all share index return is 13% used in the calculation of equity risk premium, both the dividend discount model and the earnings multiplier approach indicate that the equity market is undervalued at these levels.". The average equity Beta for JSE top 40 is 1.45. b) Calculate the intrinsic value of the JSE All Share Index using the constant growth dividend discount model of market valuation and the information provided by Katemba. Show your calculations. (6)